Question: Could you please answer this question in details and clear writing? Thanks uld vanc do? 4. capitalize on consumers' concerns about healt ing a new

Could you please answer this question in details and clear writing? Thanks

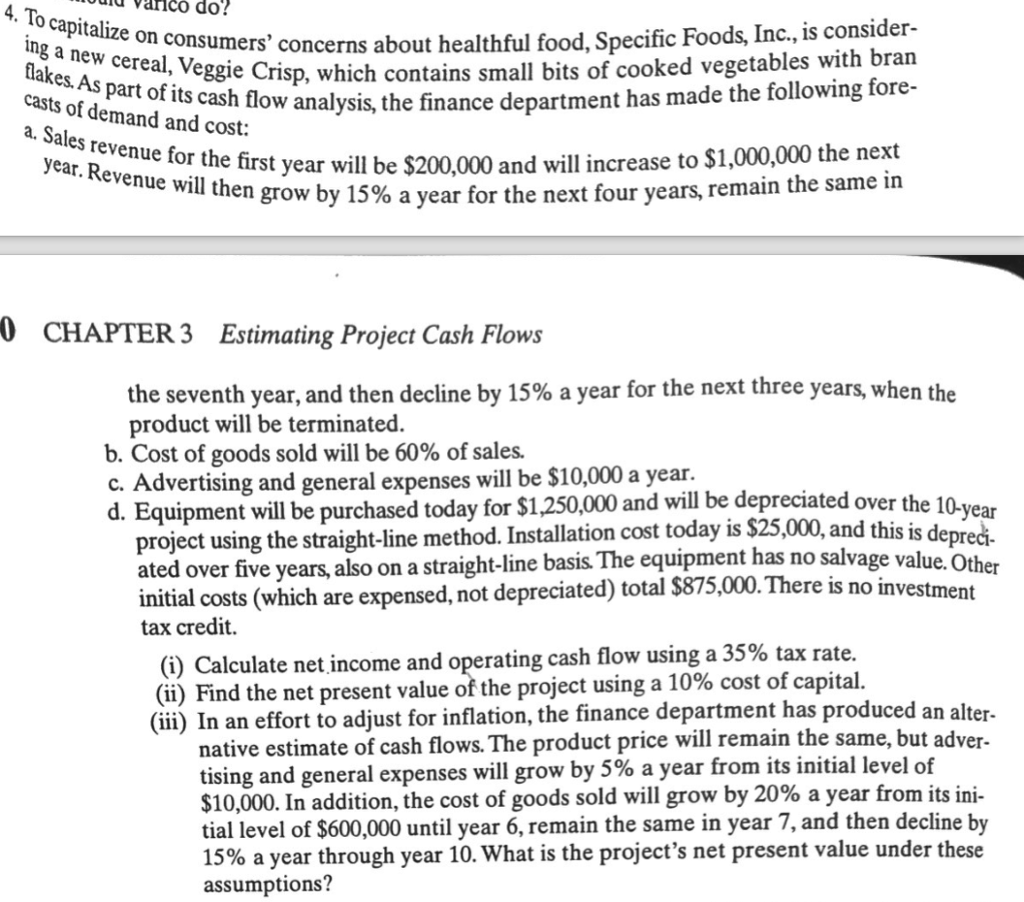

uld vanc do? 4. capitalize on consumers' concerns about healt ing a new cereal, Veggie con Makes. As part of its cash flow fin casts of demand and cost: hful food, Specific Foods, Inc., is consider- isp, which contains small bits of cooked vegetables with bran analysis, the finance department has made the following fore- first year will be $200,000 and will increase to $1,000,000 the next by 15% a year for the next four years, remain the same in 0 CHAPTER 3 Estimating Project Cash Flows the seventh year, and then decline by 15% a year for the next three years, when the product will be terminated b. Cost of goods sold will be 60% of sales. c. Advertising and general expenses will be $10,000 a year d. Equipment will be project using the straight-line method. Installation cost today is $25,000, and this ated over five years, also on a straight-line basis The equipment has no salvag initial costs (which are expensed, not depreciated) total $875,000.Th tax credit. and will be depreciated over the 10-year is depreci e value. Other ere is no investment (i) Calculate net income and operating cash flow using a 35% tax rate. (ii) Find the net present value of the project using a 10% cost of capital (ii) In an effort to adjust for inflation, the finance department has produced an alter- native estimate of cash flows. The product price will remain the same, but adver- tising and general expenses will grow by 5% a year from its initial level of $10,000. In addition, the cost of goods sold will grow by 20% a year from its ini- tial level of $600,000 until year 6, remain the same in year 7, and then decline by 15% a year through year 10.What is the project's net present value under these assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts