Question: Could you please assist me with solving this problem, please show formulas/ work excel file , thank you. NAME: PROBLEM SET 6 Chapter 13 --

Could you please assist me with solving this problem, please show formulas/ work excel file , thank you.

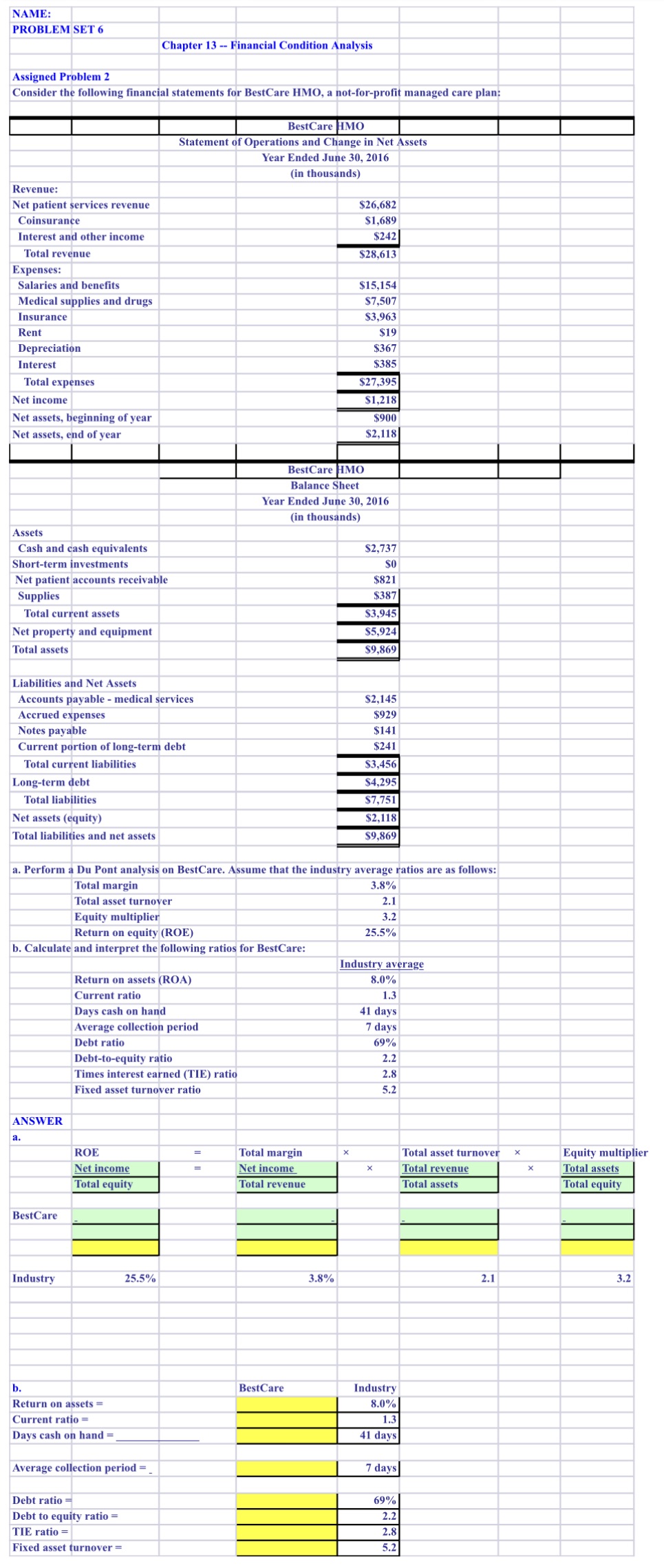

NAME: PROBLEM SET 6 Chapter 13 -- Financial Condition Analysis Assigned Problem 2 Consider the following financial statements for BestCare HMO, a not-for-profit managed care plan; BestCare HMO Statement of Operations and Change in Net Assets Year Ended June 30, 2016 (in thousands) Revenue: Net patient services revenue $26,682 Coinsurance $1,689 Interest and other income $242 Total revenue $28,613 Expenses: Salaries and benefits $15,154 Medical supplies and drugs $7,507 Insurance $3,963 Rent $19 Depreciation $367 Interest $385 Total expenses $27,395 Net income $1,218 Net assets, beginning of year $900 Net assets, end of year $2,118 BestCare HMO Balance Sheet Year Ended June 30, 2016 (in thousands) Assets Cash and cash equivalents $2,737 Short-term investments S Net patient accounts receivable $821 Supplies $387 Total current assets $3,945 Net property and equipment $5,924 Total assets $9,869 Liabilities and Net Assets Accounts payable - medical services $2,145 Accrued expenses $929 Notes payable $141 Current portion of long-term debt $241 Total current liabilities $3,456 Long-term debt $4,295 Total liabilities $7,751 Net assets (equity) $2,118 Total liabilities and net assets $9,869 a. Perform a Du Pont analysis on BestCare. Assume that the industry average ratios are as follows: Total margin 3.8% Total asset turnover 2.1 Equity multiplier 3.2 Return on equity (ROE) 25.5% b. Calculate and interpret the following ratios for BestCare: Industry average Return on assets (ROA) 8.0% Current ratio 1.3 Days cash on hand 41 days Average collection period 7 days Debt ratio 69% Debt-to-equity ratio 2.2 Times interest earned (TIE) ratio 2.8 Fixed asset turnover ratio 5.2 ANSWER a. ROE Total margin Total asset turnover x Equity multiplier Net income Net income X Total revenue Total assets Total equity Total revenue Total assets Total equity BestCare Industry 25.5% 3.8% 2.1 3.2 b. BestCare Industry Return on assets = 8.0% Current ratio = 1.3 Days cash on hand = 41 days Average collection period = 7 days Debt ratio = 69% Debt to equity ratio = 2.2 TIE ratio = 2.8 Fixed asset turnover = 5.2