Question: Could you please explain how did they come up with the numbers in the adjustment column and Elimination column Lecture example 3 (built on Week

Could you please explain how did they come up with the numbers in the adjustment column and Elimination column

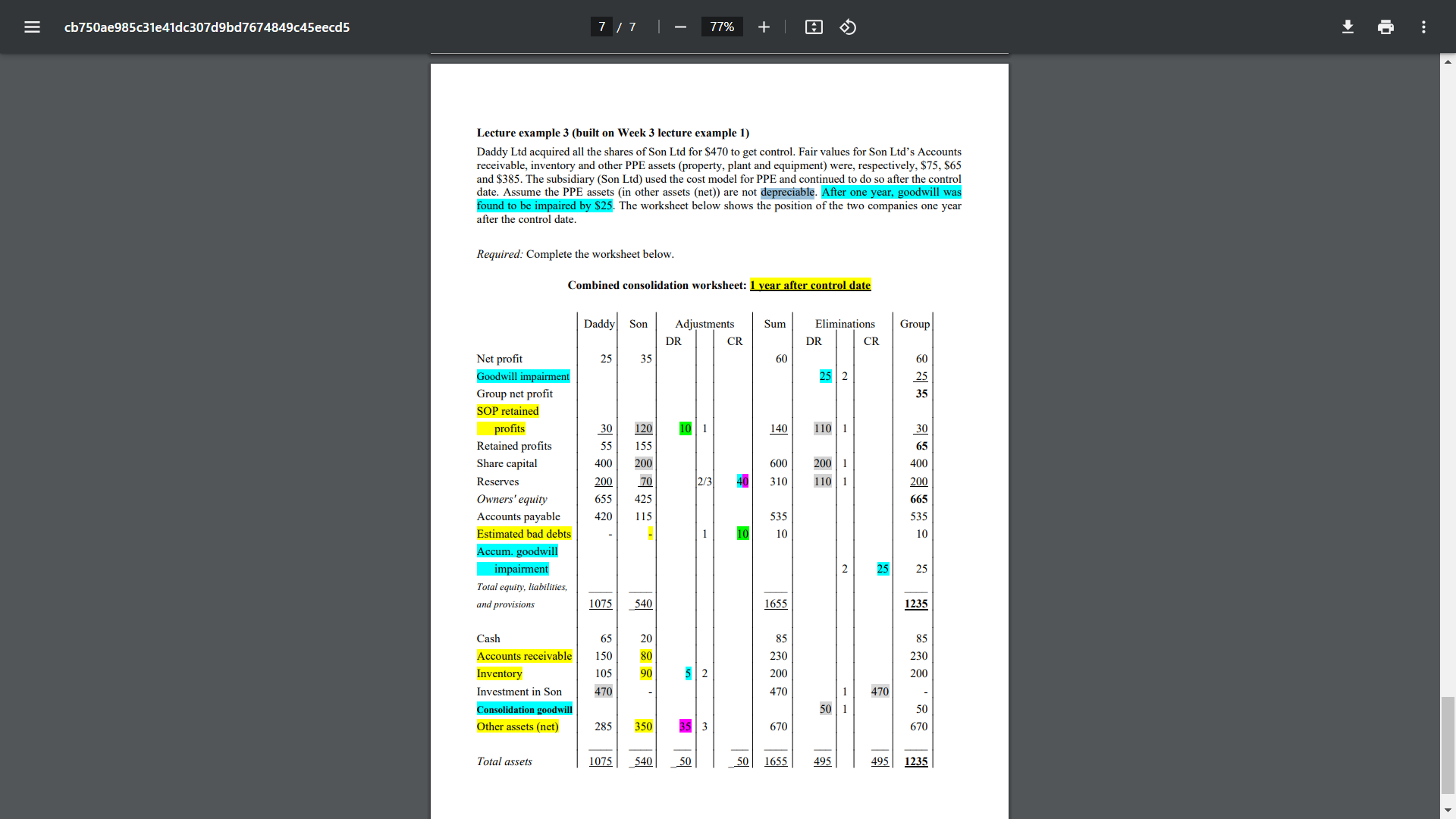

Lecture example 3 (built on Week 3 lecture example 1) Daddy Ltd acquired all the shares of Son Ltd for \\( \\$ 470 \\) to get control. Fair values for Son Ltd's Accounts receivable, inventory and other PPE assets (property, plant and equipment) were, respectively, \\( \\$ 75, \\$ 65 \\) and \\( \\$ 385 \\). The subsidiary (Son Ltd) used the cost model for PPE and continued to do so after the control date. Assume the PPE assets (in other assets (net)) are not depreciable. After one year, goodwill was found to be impaired by \\( \\$ 25 \\). The worksheet below shows the position of the two companies one year after the control date. Lecture example 3 (built on Week 3 lecture example 1) Daddy Ltd acquired all the shares of Son Ltd for \\( \\$ 470 \\) to get control. Fair values for Son Ltd's Accounts receivable, inventory and other PPE assets (property, plant and equipment) were, respectively, \\( \\$ 75, \\$ 65 \\) and \\( \\$ 385 \\). The subsidiary (Son Ltd) used the cost model for PPE and continued to do so after the control date. Assume the PPE assets (in other assets (net)) are not depreciable. After one year, goodwill was found to be impaired by \\( \\$ 25 \\). The worksheet below shows the position of the two companies one year after the control date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts