Question: Could you please explain logic behind the following problems (please not just excel calculations). Thank you very much Convert 9.9% APR compounded daily into an

Could you please explain logic behind the following problems (please not just excel calculations). Thank you very much

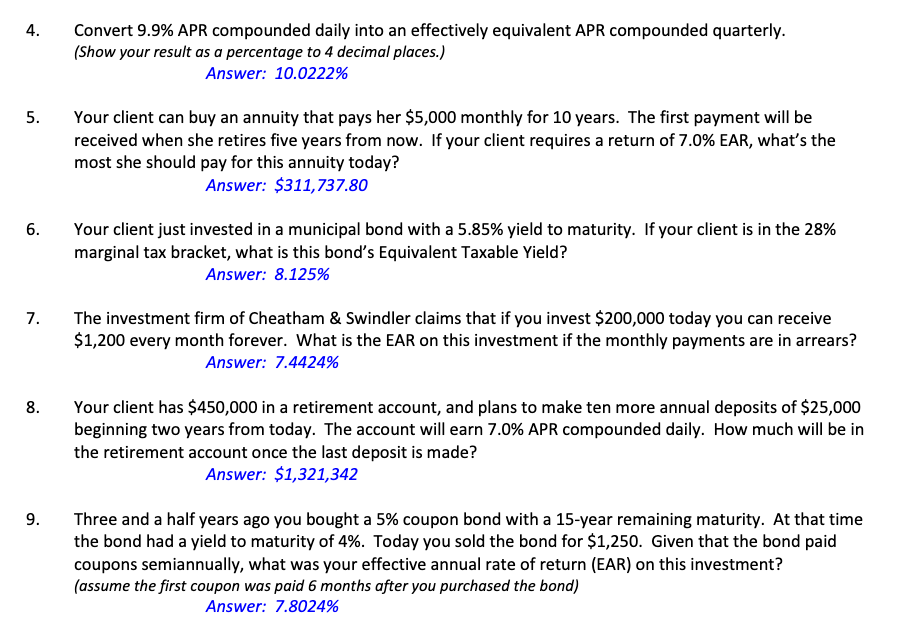

Convert 9.9% APR compounded daily into an effectively equivalent APR compounded quarterly. (Show your result as a percentage to 4 decimal places.) Answer: 10.0222% 5. Your client can buy an annuity that pays her $5,000 monthly for 10 years. The first payment will be received when she retires five years from now. If your client requires a return of 7.0% EAR, what's the most she should pay for this annuity today? Answer: $311,737.80 6. Your client just invested in a municipal bond with a 5.85% yield to maturity. If your client is in the 28% marginal tax bracket, what is this bond's Equivalent Taxable Yield? Answer: 8.125% 7. The investment firm of Cheatham & Swindler claims that if you invest $200,000 today you can receive $1,200 every month forever. What is the EAR on this investment if the monthly payments are in arrears? Answer: 7.4424% 8. Your client has $450,000 in a retirement account, and plans to make ten more annual deposits of $25,000 beginning two years from today. The account will earn 7.0% APR compounded daily. How much will be in the retirement account once the last deposit is made? Answer: $1,321,342 9. Three and a half years ago you bought a 5% coupon bond with a 15-year remaining maturity. At that time the bond had a yield to maturity of 4%. Today you sold the bond for $1,250. Given that the bond paid coupons semiannually, what was your effective annual rate of return (EAR) on this investment? (assume the first coupon was paid 6 months after you purchased the bond) Answer: 7.8024%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts