Question: could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it? A company has some

could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it?

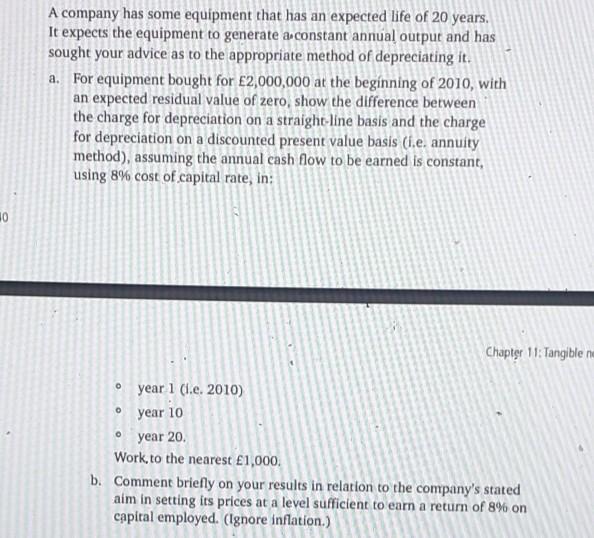

A company has some equipment that has an expected life of 20 years. It expects the equipment to generate a constant annual output and has sought your advice as to the appropriate method of depreciating it. a. For equipment bought for 2,000,000 at the beginning of 2010, with an expected residual value of zero, show the difference between the charge for depreciation on a straight-line basis and the charge for depreciation on a discounted present value basis (1.e. annuity method), assuming the annual cash flow to be earned is constant, using 8% cost of capital rate, in: 30 Chapter 11: Tangible o o year 1 (1.e. 2010) year 10 year 20. Work, to the nearest 1,000 b. Comment briefly on your results in relation to the company's stated aim in setting its prices at a level sufficient to earn a return of 8% on capital employed. (Ignore inflation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts