Question: could you please hellppp True/False Questions (10 Points) 1. Debt markets are often referred to generically as the bond market. 2. A bond is a

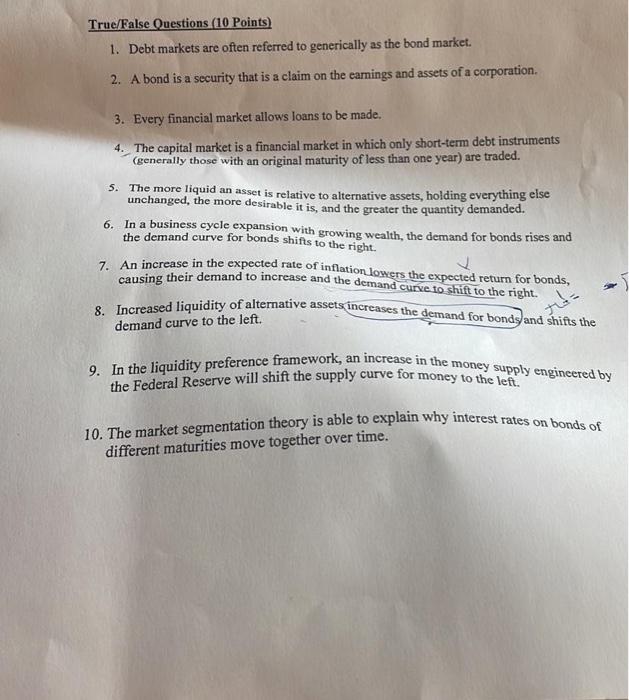

True/False Questions (10 Points) 1. Debt markets are often referred to generically as the bond market. 2. A bond is a security that is a claim on the earnings and assets of a corporation. 3. Every financial market allows loans to be made. 4. The capital market is a financial market in which only short-term debt instruments (generally those with an original maturity of less than one year) are traded. 5. The more liquid an asset is relative to alternative assets, holding everything else unchanged, the more desirable it is, and the greater the quantity demanded. 6. In a business cycle expansion with growing wealth, the demand for bonds rises and the demand curve for bonds shifts to the right. 7. An increase in the expected rate of inflation lowers the expected return for bonds, causing their demand to increase and the demand curve to shift to the right. 8. Increased liquidity of alternative assets increases the demand for bonds and shifts the demand curve to the left. tu 9. In the liquidity preference framework, an increase in the money supply engineered by the Federal Reserve will shift the supply curve for money to the le 10. The market segmentation theory is able to explain why interest rates on bonds of different maturities move together over time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts