Question: COULD YOU PLEASE HELP ME ANSWER CASE 13 TOPEKA ADHESIVE (II) FINANCIAL FORECASTING QUESTION 1-7 CASE 1 3 TOPEKA ADHESIVES (II) FINANCIAL FORECASTING 8 Karen

COULD YOU PLEASE HELP ME ANSWER CASE 13 TOPEKA ADHESIVE (II) FINANCIAL FORECASTING QUESTION 1-7

COULD YOU PLEASE HELP ME ANSWER CASE 13 TOPEKA ADHESIVE (II) FINANCIAL FORECASTING QUESTION 1-7

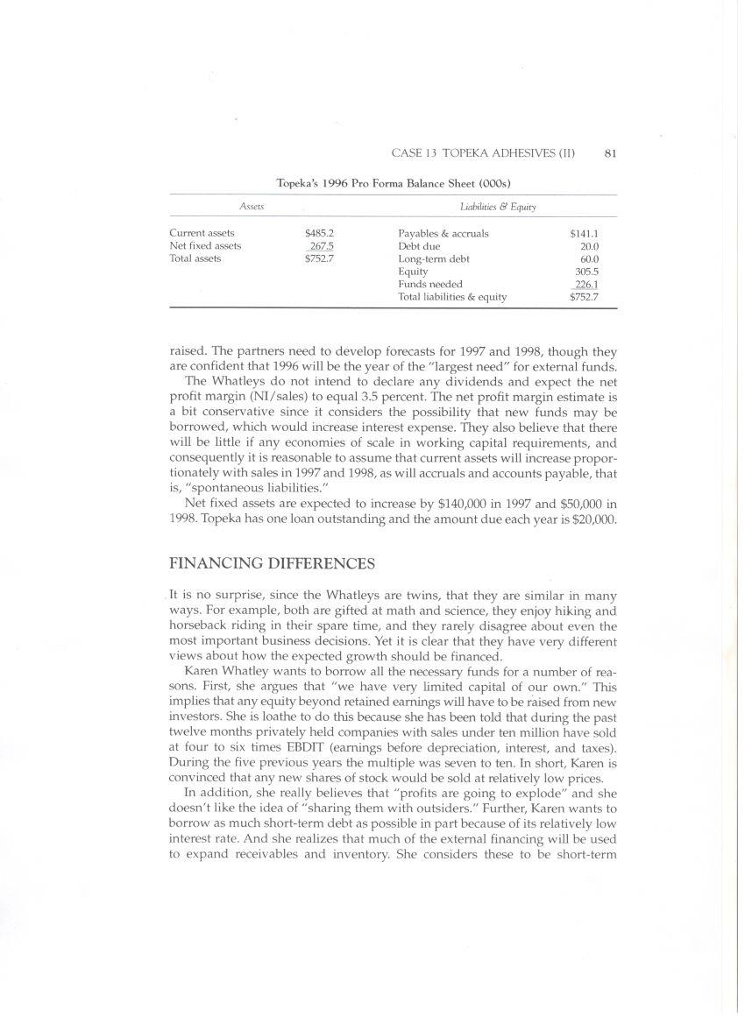

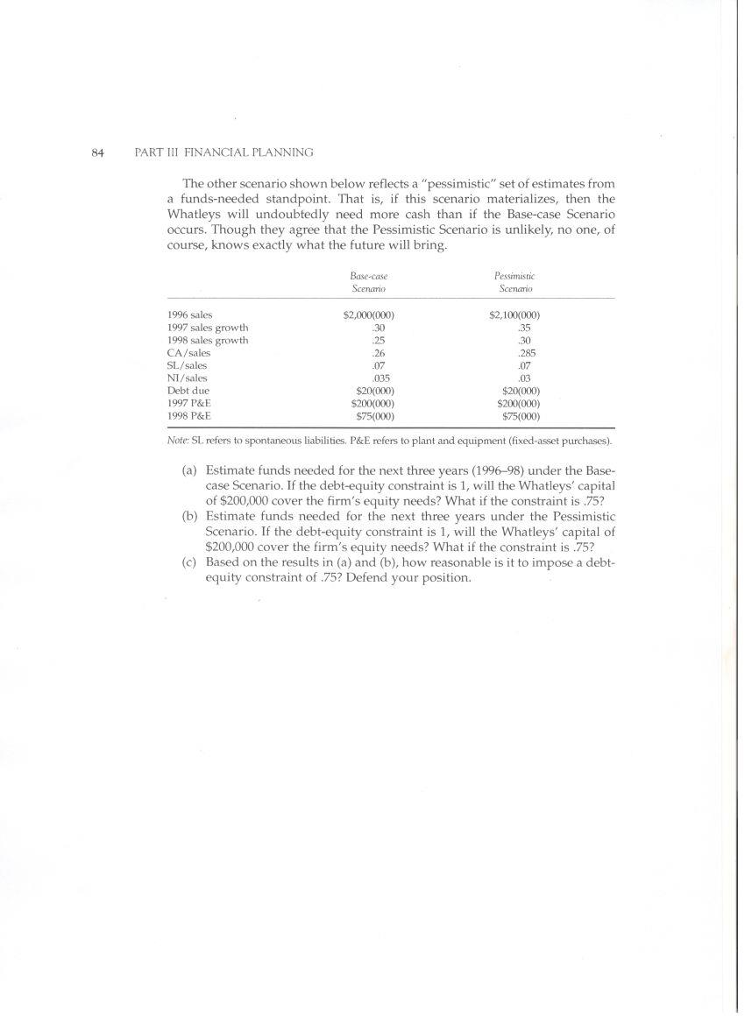

CASE 1 3 TOPEKA ADHESIVES (II) FINANCIAL FORECASTING 8 Karen and Elizabeth Whatley are twins and the owners of Topeka Adhesives, a company they started seven years ago. The technical expertise of the firm is unsur- passed, and Topeka has developed a number of adhesives like tapes and glues that are popular with industrial users as well as home supply and hardware stores, About twelve months ago the partners concluded that Topeka's products were "underappreciated" and that "sales could -and should- be substantiall higher." They fired an unproductive salesperson and, more importantly, made a key marketing decision. They decided to reduce advertising in trade journals and increase the funds spent on attending trade shows. The marketing change worked. The firm's exhibits were impressive, and the Whatleys made impor- tant contacts with some major industrial users and even one large retailer, Spears. The sisters are in the process of negotiating a number of large contracts for the coming year (1996) and product inquiries are markedly higher As a result of all this, Topeka's sales are expected to increase sharply in the next three years, more than doubling by the end of 1998. The partners estimate sales of $1,933,100 in 1996, $2,609,700 in 1997, and $3,131,600 in 1998. On one hand the twins are extremely pleased with the forecast because it is evidence of what they have long believed: The company manufactures quality products at a reasonable price. The downside is that such large growth will undoubtedly require external financing and could cause managerial difficulties. FORECASTING CONSIDERATIONS The partners have met with Fred Lanzi, Topeka's accountant, and Karl Shatner, the firm's general manager, in order to compile a forecast for 1996-1998 and to discuss the financing options. The table below shows the 1996 pro forma balance sheet resulting from the meetings, and indicates that $226,100 needs to be CASE 13 TOPEKA ADHESIVES(I 81 Topeka's 1996 Pro Forma Balance Sheet (000s) Assets Liabilaties& Equity Current assets Net fixed assets Total assets $485.2 267.5 S752.7 Payables & accruals Debt due Long-term debt Equity Funds needed Total liabilities & equity $141.1 20.0 600 305.5 226.1 $752.7 raised. The partners need to develop forecasts for 1997 and 1998, though they are confident that 1996 will be the year of the "largest need" for external funds. The Whatleys do not intend to declare any dividends and expect the net profit margin (NI/sales) to equal 3.5 percent. The net profit margin estimate is a bit conservative since it considers the possibility that new funds may be borrowed, which would increase interest expense. They also believe that there will be little if any economies of scale in working capital requirements, and consequently it is reasonable to assume that current assets will increase propor- tionately with sales in 1997 and 1998, as will accruals and accounts payable, that is, "spontaneous liabilities." Net fixed assets are expected to increase by $140,000 in 1997 and $50,000 in 1998. Topeka has one loan outstanding and the amount due each year is $20,000. FINANCING DIFFERENCES It is no surprise, since the Whatleys are twins, that they are similar in many ways. For example, both are gifted at math and science, they enjoy hiking and horseback riding in their spare time, and they rarely disagree about even the most important business decisions. Yet it is clear that they have very different views about how the expected growth should be financed Karen Whatley wants to borrow all the necessary funds for a number of rea- we have very limited capital of our own." This implies that any equity beyond retained earnings will have to be raised from new investors. She is loathe to do this because she has been told that during the past twelve months privately held companies with sales under ten million have sold at four to six times EBDIT (earnings before depreciation, interest, and taxes). During the five previous years the multiple was seven to ten. In short, Karen is sons, First, sh e argues that " convinced that any new shares of stock would be sold at relatively low prices. In addition, she really believes that "profits are going to explode" and she doesn't like the idea of "sharing them with outsiders." Further, Karen wants to borrow as much short-term debt as possible in part because of its relatively low interest rate. And she realizes that much of the external financing will be used to expand receivables and inventory. She considers these to be short-term 84 PARTII FINANCIAL PLANNING The other scenario shown below reflects a " a funds-needed standpoint. That is, if this scenario materializes, then the Whatleys will undoubtedly need more cash than if the Base-case Scenario occurs. Though they agree that the Pessimistic Scenario is unlikely, no one, of course, knows exactly what the future will bring. "pessimistic" set of estimates from Scenanio 1996 sales 1997 sales growth 1998 sales growth CA/sales SL/sales NI/sales Debt due 1997 P&E 1998 P&E $2,000(000) $2. 100(000) 30 .25 35 30 285 .07 03 .07 035 $200000) $2000000) $2000000) S75(000) Note: SL. refers to spontaneous liabilities. P&E refers to plant and equipment (fixed-asset purchases) (a) Estimate funds needed for the next three years (1996-98) under the Base- (b) Estimate funds needed for the next three years under the Pessimistic (c) Based on the results in (a) and (b), how reasonable is it to impose a debt case Scenario. If the debt-equity constraint is 1, will the Whatleys' capital of $200,000 cover the firm's equity needs? What if the constraint is 75? Scenario. If the debt-equity constraint is 1, will the Whatleys' capital of $200,000 cover the firm's equity needs? What if the constraint is .75? equity constraint of .75? Defend your position CASE 13 TOPEKA ADHESIVES( 83 3. How much of the funds needed in 1996-1998 can be borrowed each year as short-term debt without violating the current ratio constraint given in the case? 4. Carefully evaluate Karen Whatley's arguments for using short-term debt 5. How do you recommend the partners procede? Defend your advice 6. Consider the following formula for estimating the maximum annual sales growth rate, g, that can be financed out of retained earnings. where b retained earnings ratio, ROA NI/S] >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts