Question: Could you please help me solve this? I ve attached the Excel sheet from Part 3 , and now I need help with Part 4

Could you please help me solve this? Ive attached the Excel sheet from Part and now I need help with Part

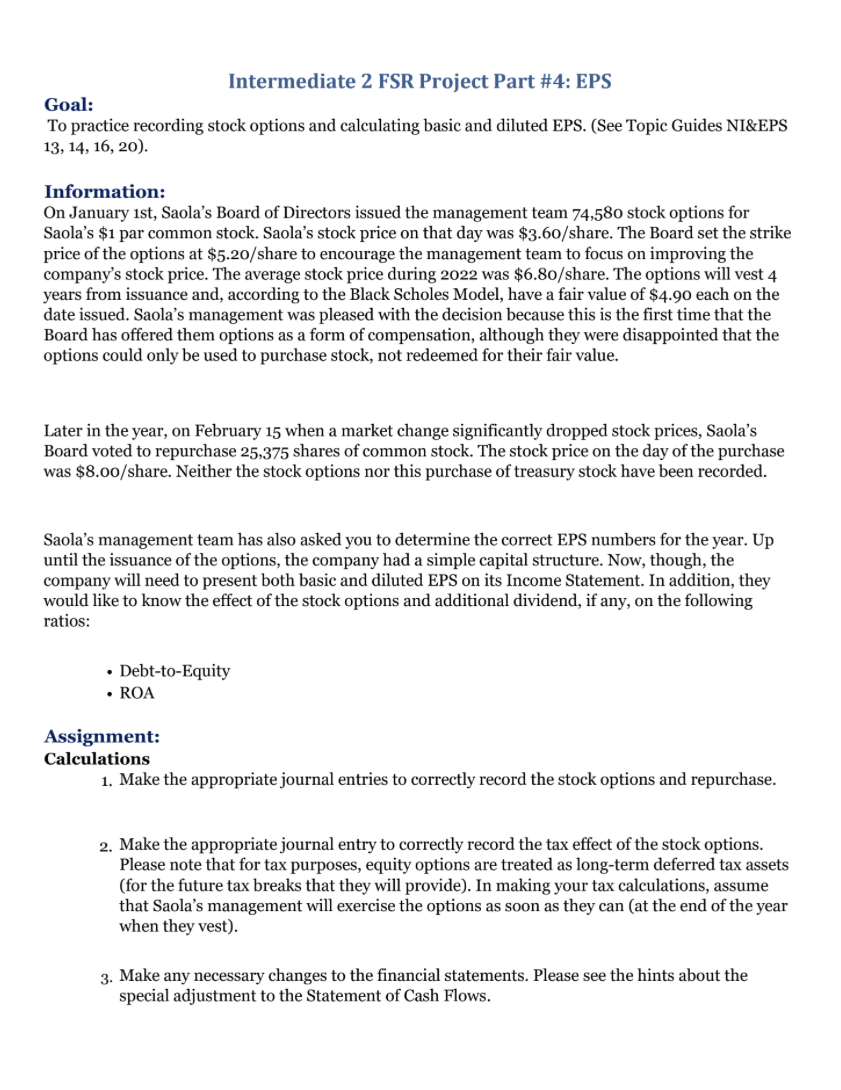

Intermediate FSR Project Part #: EPS

Goal:

To practice recording stock options and calculating basic and diluted EPS. See Topic Guides NI&EPS

Information:

On January st Saola's Board of Directors issued the management team o stock options for

Saola's $ par common stock. Saola's stock price on that day was $ share. The Board set the strike

price of the options at $share to encourage the management team to focus on improving the

company's stock price. The average stock price during was $ share. The options will vest

years from issuance and, according to the Black Scholes Model, have a fair value of $ each on the

date issued. Saola's management was pleased with the decision because this is the first time that the

Board has offered them options as a form of compensation, although they were disappointed that the

options could only be used to purchase stock, not redeemed for their fair value.

Later in the year, on February when a market change significantly dropped stock prices, Saola's

Board voted to repurchase shares of common stock. The stock price on the day of the purchase

was $ share. Neither the stock options nor this purchase of treasury stock have been recorded.

Saola's management team has also asked you to determine the correct EPS numbers for the year. Up

until the issuance of the options, the company had a simple capital structure. Now, though, the

company will need to present both basic and diluted EPS on its Income Statement. In addition, they

would like to know the effect of the stock options and additional dividend, if any, on the following

ratios:

DebttoEquity

ROA

Assignment:

Calculations

Make the appropriate journal entries to correctly record the stock options and repurchase.

Make the appropriate journal entry to correctly record the tax effect of the stock options.

Please note that for tax purposes, equity options are treated as longterm deferred tax assets

for the future tax breaks that they will provide In making your tax calculations, assume

that Saola's management will exercise the options as soon as they can at the end of the year

when they vest

Make any necessary changes to the financial statements. Please see the hints about the

special adjustment to the Statement of Cash Flows.

Critical Thinking

Calculate each of the required ratios using the original values before any changes and the

updated values after your changes Also, calculate the new Basic and Diluted EPS values

and report them in your Income Statement.

Which of type of options do you think will provide the better motivation to Saola's

management team: equity or liability? Defend your answer.

After looking back over the company's book, Saola's controller has become concerned that

management purposely provided negative financial information to the market in the weeks

before the strike price was set on their new options. What options are available to the

controller now that she has discovered this information? Provide at least two

consequences for each option.

Hints:

Saola uses 'Executive Salaries Expense' to record all of the compensation for the

management team. Do NOT create a new account for this new compensation.

While Saola does keep separate accounts for all of their Additional Paidin Capital, they

combine all of these amounts on the balance sheet, so you should not add a new account to

the BS for the stock option PIC.

You will need to change the note under the Common Stock line in the Balance Sheet to

include both the and end of year shares outstanding.

Don't forget to adjust your Statement of Cash Flows for the purchase of the treasury stock.

As with pensions, you have to make a special adjustment in the CFO section of the

Statement of Cash Flows; you can't just record the change in Additional PIC since those are

equity accounts In this case, you can record a Stock Option Compensation line that equals

the total change in Executive Salary Expense for these stock options.

Don't forget to calculate the weighted average common stock shares outstanding before you

calculate the new basic EPS. Also, under GAAP ASC A employee stock

options are included in the diluted EPS calculation, even if they haven't yet vested. You treat

them just like any other outstanding stock option, only weighting them if they were awarded

in the middle of the year.

While there is a tax effect from issuing stock options, please ignore the effects of deferred

taxes for this problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock