Question: Could you please help me solve this problem? There are practice problems for my exam, but I don't know how they are done, and I

Could you please help me solve this problem? There are practice problems for my exam, but I don't know how they are done, and I want to have the answer so I can practice them.

Thank you for your help.

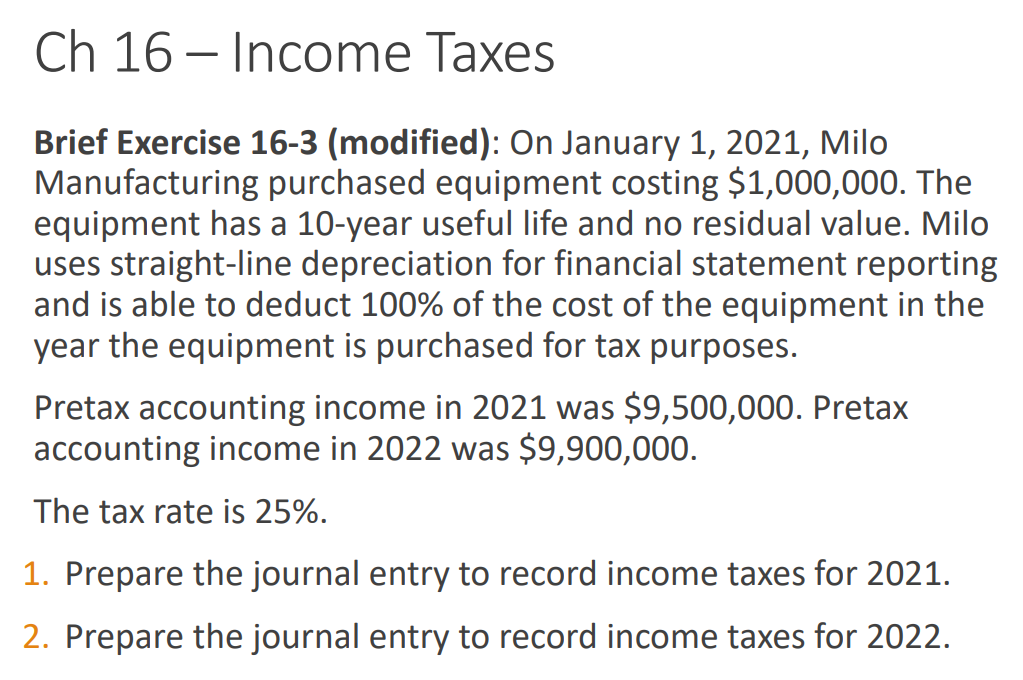

Brief Exercise 16-3 (modified): On January 1, 2021, Milo Manufacturing purchased equipment costing $1,000,000. The equipment has a 10-year useful life and no residual value. Milo uses straight-line depreciation for financial statement reporting and is able to deduct 100% of the cost of the equipment in the year the equipment is purchased for tax purposes. Pretax accounting income in 2021 was $9,500,000. Pretax accounting income in 2022 was $9,900,000. The tax rate is 25%. 1. Prepare the journal entry to record income taxes for 2021. 2. Prepare the journal entry to record income taxes for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts