Question: Could you please help me to write Explanation regarding THIS QUESTION :- Since this is Emmy's first year claiming the childcare expense deduction is wondering

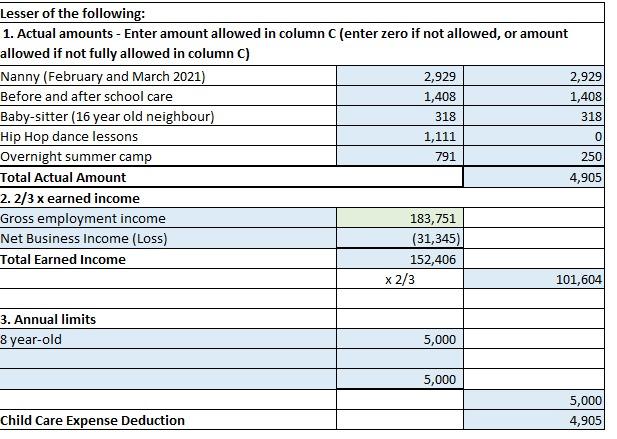

Could you please help me to write Explanation regarding THIS QUESTION :- Since this is Emmy's first year claiming the childcare expense deduction is wondering if you can explain the amount of deducted ??? Calculation Given Below :-

Thanks!

Lesser of the following: 1. Actual amounts - Enter amount allowed in column C (enter zero if not allowed, or amount allowed if not fully allowed in column C) Nanny (February and March 2021) Before and after school care Baby-sitter (16 year old neighbour) Hip Hop dance lessons Overnight summer camp Total Actual Amount 2. 2/3 x earned income Gross employment income Net Business Income (Loss) Total Earned Income 3. Annual limits 8 year-old Child Care Expense Deduction 2,929 1,408 318 1,111 791 183,751 (31,345) 152,406 x 2/3 5,000 5,000 2,929 1,408 318 0 250 4,905 101,604 5,000 4,905

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts