Question: Could you please help me with question 80 and 81 please. TOU 80. Manuel and Jackie purchased health insurance through the LUIU that they had

Could you please help me with question 80 and 81 please.

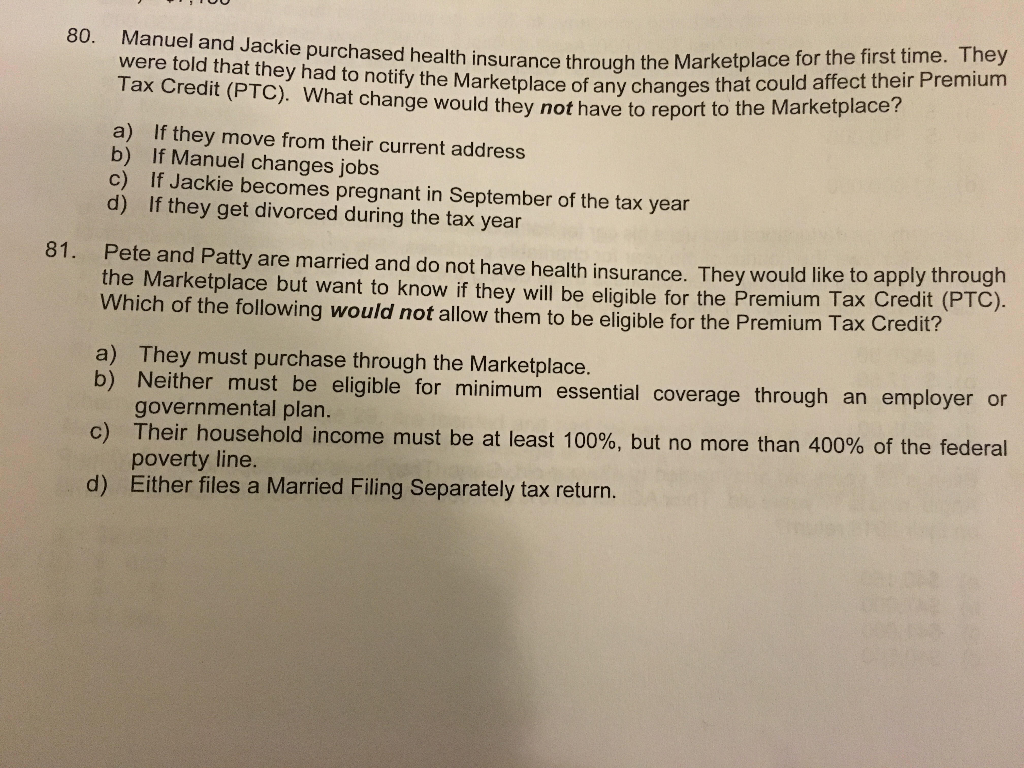

TOU 80. Manuel and Jackie purchased health insurance through the LUIU that they had to notify the Marketplace of any changes that could Tax Credit (PTC). What change would they not have to report to ith insurance through the Marketplace for the first time. They ketplace of any changes that could affect their Premium la they not have to report to the Marketplace? a) If they move from their current address b) If Manuel changes jobs c) If Jackie becomes pregnant in September of the tax year d) If they get divorced during the tax year 81. Pete and Patty are married and do not have health insurance. They would like to apply through the Marketplace but want to know if they will be eligible for the Premium Tax Credit (PIO). Which of the following would not allow them to be eligible for the Premium Tax Credit? a) They must purchase through the Marketplace. b) Neither must be eligible for minimum essential coverage through an employer or governmental plan. Their household income must be at least 100%, but no more than 400% of the federal poverty line. ) Either files a Married Filing Separately tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts