Question: Could you please help me with this question and explain in details? Thank you Computing Taxable income A-1 Company had pretax GAAP income of $100,000

Could you please help me with this question and explain in details? Thank you

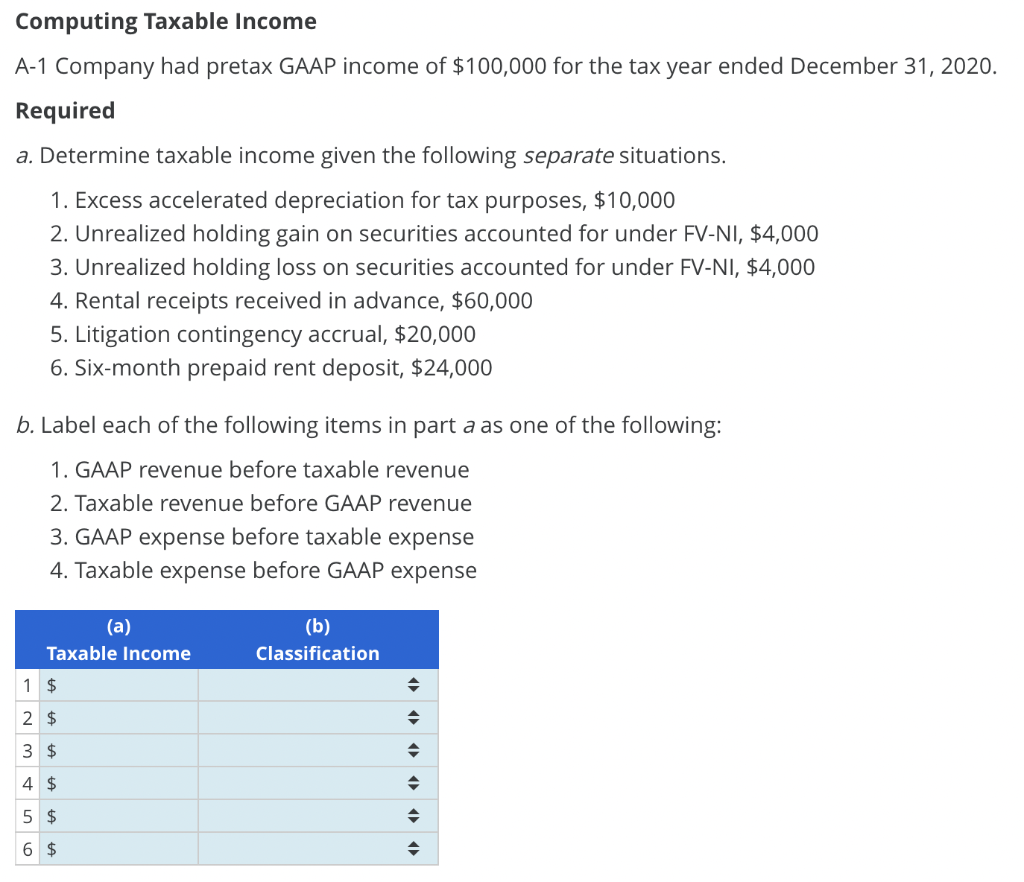

Computing Taxable income A-1 Company had pretax GAAP income of $100,000 for the tax year ended December 31, 2020. Required a. Determine taxable income given the following separate situations. 1. Excess accelerated depreciation for tax purposes, $10,000 2. Unrealized holding gain on securities accounted for under FV-NI, $4,000 3. Unrealized holding loss on securities accounted for under FV-NI, $4,000 4. Rental receipts received in advance, $60,000 5. Litigation contingency accrual, $20,000 6. Six-month prepaid rent deposit, $24,000 b. Label each of the following items in part a as one of the following: 1. GAAP revenue before taxable revenue 2. Taxable revenue before GAAP revenue 3. GAAP expense before taxable expense 4. Taxable expense before GAAP expense (a) Taxable Income (b) Classification 1 $ 2 $ . 3 $ 4 $ 5 $ . 6 $ Computing Taxable income A-1 Company had pretax GAAP income of $100,000 for the tax year ended December 31, 2020. Required a. Determine taxable income given the following separate situations. 1. Excess accelerated depreciation for tax purposes, $10,000 2. Unrealized holding gain on securities accounted for under FV-NI, $4,000 3. Unrealized holding loss on securities accounted for under FV-NI, $4,000 4. Rental receipts received in advance, $60,000 5. Litigation contingency accrual, $20,000 6. Six-month prepaid rent deposit, $24,000 b. Label each of the following items in part a as one of the following: 1. GAAP revenue before taxable revenue 2. Taxable revenue before GAAP revenue 3. GAAP expense before taxable expense 4. Taxable expense before GAAP expense (a) Taxable Income (b) Classification 1 $ 2 $ . 3 $ 4 $ 5 $ . 6 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts