Question: Could you please help me with this question. I am not sure how to answer it. A B C D E F G H K

Could you please help me with this question. I am not sure how to answer it.

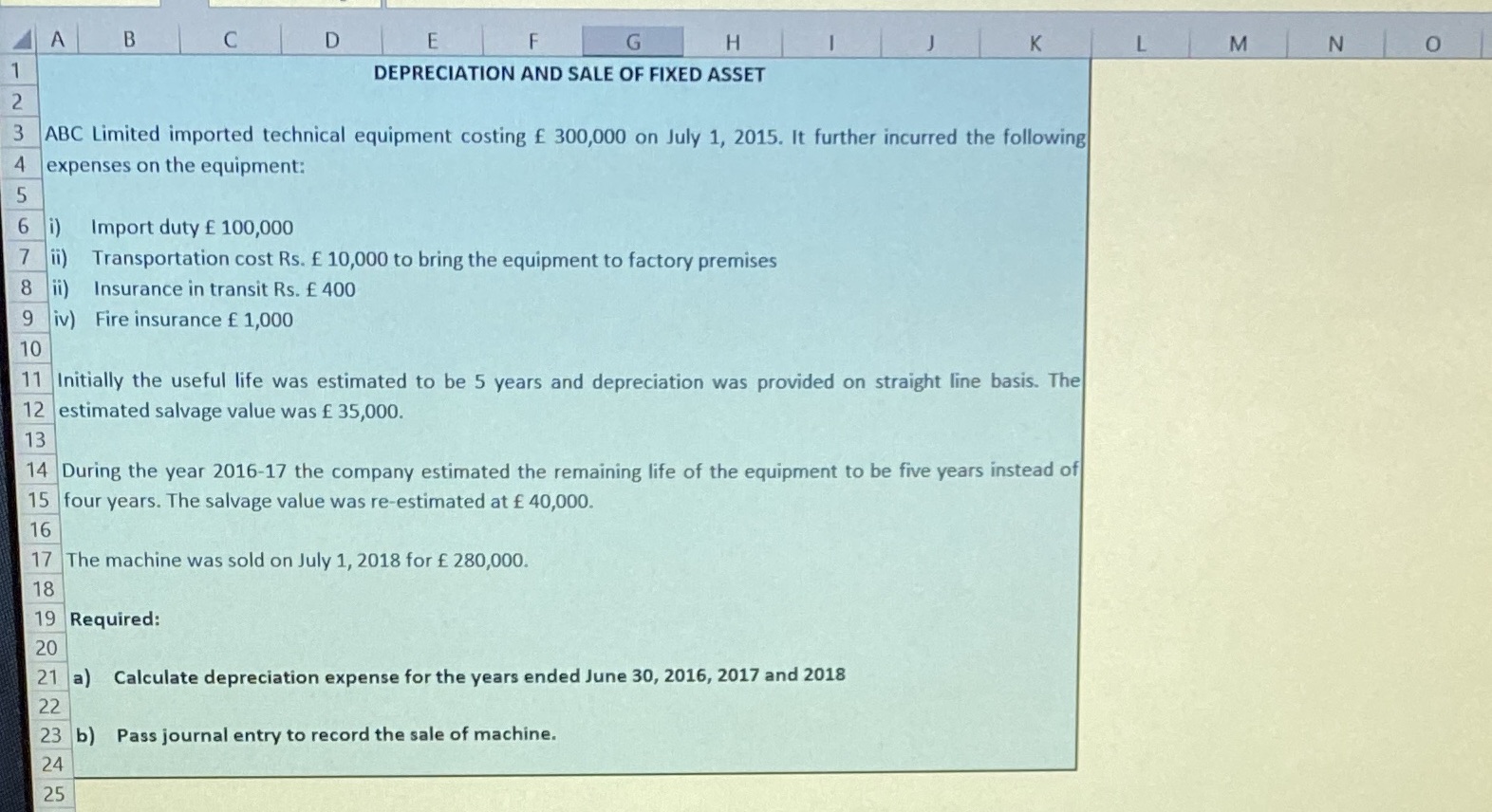

A B C D E F G H K L M N O DEPRECIATION AND SALE OF FIXED ASSET 2 ABC Limited imported technical equipment costing f 300,000 on July 1, 2015. It further incurred the following 4 expenses on the equipment: 5 6 i) Import duty f 100,000 7 ii) Transportation cost Rs. f 10,000 to bring the equipment to factory premises 8 ii) Insurance in transit Rs. E 400 9 iv) Fire insurance f 1,000 10 11 Initially the useful life was estimated to be 5 years and depreciation was provided on straight line basis. The 12 estimated salvage value was f 35,000. 13 14 During the year 2016-17 the company estimated the remaining life of the equipment to be five years instead of 15 four years. The salvage value was re-estimated at f 40,000. 16 17 The machine was sold on July 1, 2018 for f 280,000. 18 19 Required: 20 21 a) Calculate depreciation expense for the years ended June 30, 2016, 2017 and 2018 22 23 b) Pass journal entry to record the sale of machine. 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts