Question: could you please help walk me through with numbers 3 and 4. i have compleated and provided answers for numbers 1 and need help to

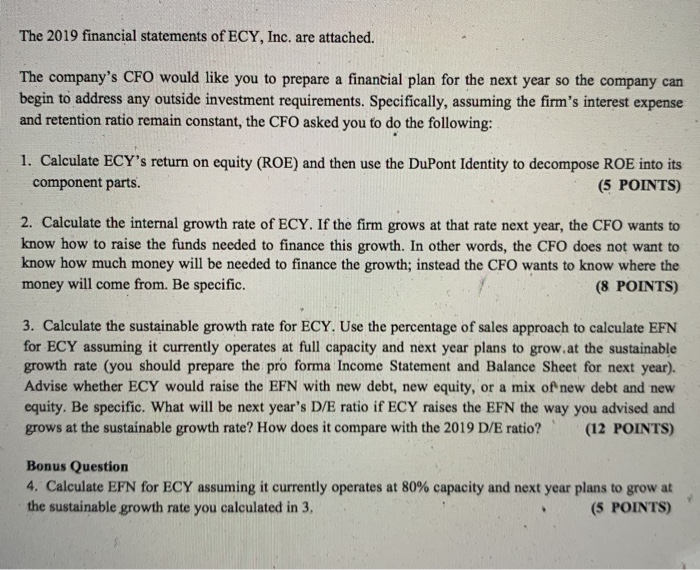

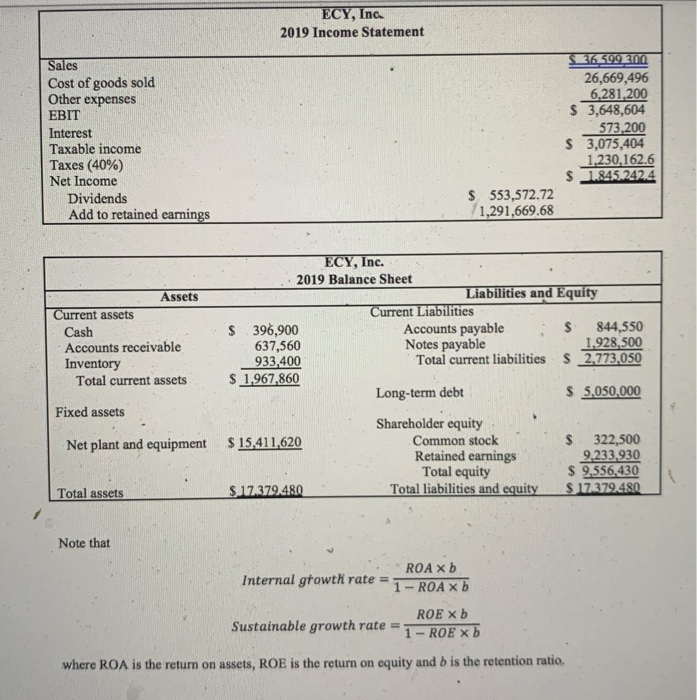

The 2019 financial statements of ECY, Inc. are attached. The company's CFO would like you to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. Specifically, assuming the firm's interest expense and retention ratio remain constant, the CFO asked you to do the following: 1. Calculate ECY's return on equity (ROE) and then use the DuPont Identity to decompose ROE into its component parts. (5 POINTS) 2. Calculate the internal growth rate of ECY. If the firm grows at that rate next year, the CFO wants to know how to raise the funds needed to finance this growth. In other words, the CFO does not want to know how much money will be needed to finance the growth; instead the CFO wants to know where the money will come from. Be specific. (8 POINTS) 3. Calculate the sustainable growth rate for ECY. Use the percentage of sales approach to calculate EFN for ECY assuming it currently operates at full capacity and next year plans to grow at the sustainable growth rate (you should prepare the pro forma Income Statement and Balance Sheet for next year). Advise whether ECY would raise the EFN with new debt, new equity, or a mix of new debt and new equity. Be specific. What will be next year's D/E ratio if ECY raises the EFN the way you advised and grows at the sustainable growth rate? How does it compare with the 2019 D/E ratio? (12 POINTS) Bonus Question 4. Calculate EFN for ECY assuming it currently operates at 80% capacity and next year plans to grow at the sustainable growth rate you calculated in 3, (5 POINTS) ECY, Inc 2019 Income Statement Sales Cost of goods sold Other expenses EBIT Interest Taxable income Taxes (40%) Net Income Dividends Add to retained earnings 36 399200 26,669,496 6,281,200 $ 3,648,604 573,200 $ 3,075,404 1,230,162.6 $ 1.845.2424 $ 553,572.72 1,291,669.68 Asser Current assets Cash Accounts receivable Inventory Total current assets ECY, Inc. 2019 Balance Sheet Liabilities and Equity Current Liabilities $ 396,900 Accounts payable $ 844,550 637,560 Notes payable 1,928,500 933,400 Total current liabilities $2,773,050 $ 1,967,860 Long-term debt $ 5,050,000 Fixed assets Net plant and equipment $15,411,620 Shareholder equity Common stock Retained earnings Total equity Total liabilities and equity $ 322,500 9,233,930 $ 9,556,430 S17379480 Total assets $17.379.480 Note that ROA X b Internal growth rate = 1 -ROA Xb ROE Xb Sustainable growth rate - 1 - ROE Xb where ROA is the return on assets, ROE is the return on equity and b is the retention ratio. The 2019 financial statements of ECY, Inc. are attached. The company's CFO would like you to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. Specifically, assuming the firm's interest expense and retention ratio remain constant, the CFO asked you to do the following: 1. Calculate ECY's return on equity (ROE) and then use the DuPont Identity to decompose ROE into its component parts. (5 POINTS) 2. Calculate the internal growth rate of ECY. If the firm grows at that rate next year, the CFO wants to know how to raise the funds needed to finance this growth. In other words, the CFO does not want to know how much money will be needed to finance the growth; instead the CFO wants to know where the money will come from. Be specific. (8 POINTS) 3. Calculate the sustainable growth rate for ECY. Use the percentage of sales approach to calculate EFN for ECY assuming it currently operates at full capacity and next year plans to grow at the sustainable growth rate (you should prepare the pro forma Income Statement and Balance Sheet for next year). Advise whether ECY would raise the EFN with new debt, new equity, or a mix of new debt and new equity. Be specific. What will be next year's D/E ratio if ECY raises the EFN the way you advised and grows at the sustainable growth rate? How does it compare with the 2019 D/E ratio? (12 POINTS) Bonus Question 4. Calculate EFN for ECY assuming it currently operates at 80% capacity and next year plans to grow at the sustainable growth rate you calculated in 3, (5 POINTS) ECY, Inc 2019 Income Statement Sales Cost of goods sold Other expenses EBIT Interest Taxable income Taxes (40%) Net Income Dividends Add to retained earnings 36 399200 26,669,496 6,281,200 $ 3,648,604 573,200 $ 3,075,404 1,230,162.6 $ 1.845.2424 $ 553,572.72 1,291,669.68 Asser Current assets Cash Accounts receivable Inventory Total current assets ECY, Inc. 2019 Balance Sheet Liabilities and Equity Current Liabilities $ 396,900 Accounts payable $ 844,550 637,560 Notes payable 1,928,500 933,400 Total current liabilities $2,773,050 $ 1,967,860 Long-term debt $ 5,050,000 Fixed assets Net plant and equipment $15,411,620 Shareholder equity Common stock Retained earnings Total equity Total liabilities and equity $ 322,500 9,233,930 $ 9,556,430 S17379480 Total assets $17.379.480 Note that ROA X b Internal growth rate = 1 -ROA Xb ROE Xb Sustainable growth rate - 1 - ROE Xb where ROA is the return on assets, ROE is the return on equity and b is the retention ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts