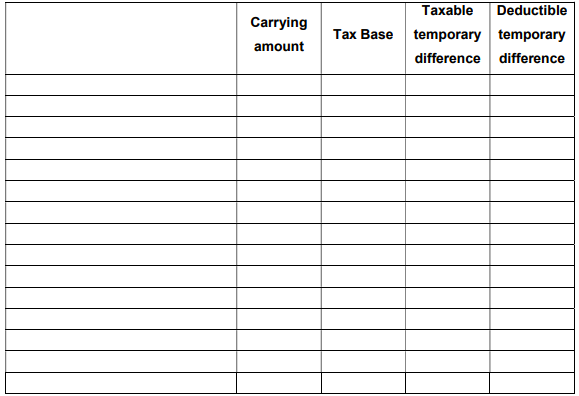

Question: Could you please prepare the deferred tax worksheet for below information?(worksheet template attached after the information) The statement of financial position of a company 2019

Could you please prepare the deferred tax worksheet for below information?(worksheet template attached after the information)

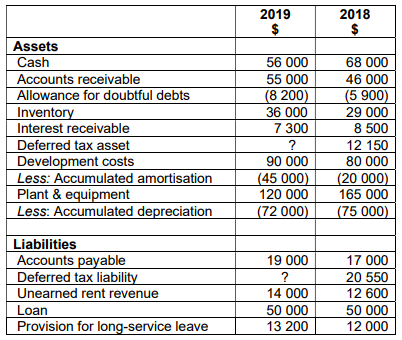

The statement of financial position of a company

2019 2018 $ $ Assets Cash 56 000 68 000 Accounts receivable 55 000 46 000 Allowance for doubtful debts (8 200) (5 900) Inventory 36 000 29 000 Interest receivable 7 300 8 500 Deferred tax asset ? 12 150 Development costs 90 000 80 000 Less: Accumulated amortisation (45 000) (20 000) Plant & equipment 120 000 165 000 Less: Accumulated depreciation (72 000 (75 000) Liabilities Accounts payable 19 000 17 000 Deferred tax liability ? 20 550 Unearned rent revenue 14 000 12 600 Loan 50 000 50 000 Provision for long-service leave 13 200 12 000\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts