Question: could you please provide perhaps some entries for these amortization transactions Create your own spreadsheet file to show the calculations for all of the following.

could you please provide perhaps some entries for these amortization transactions

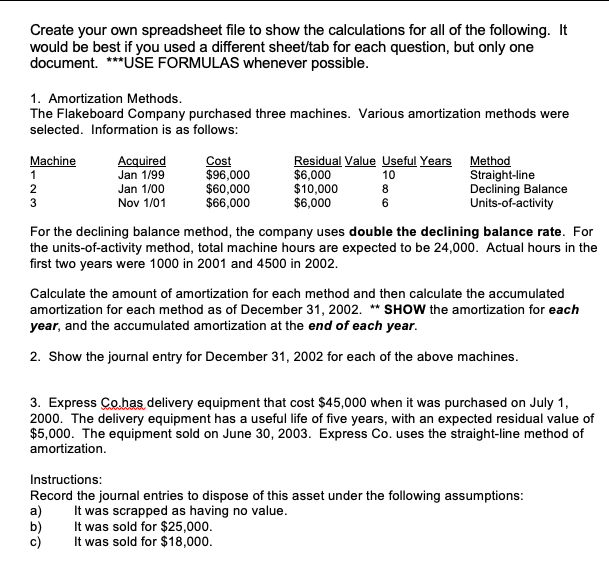

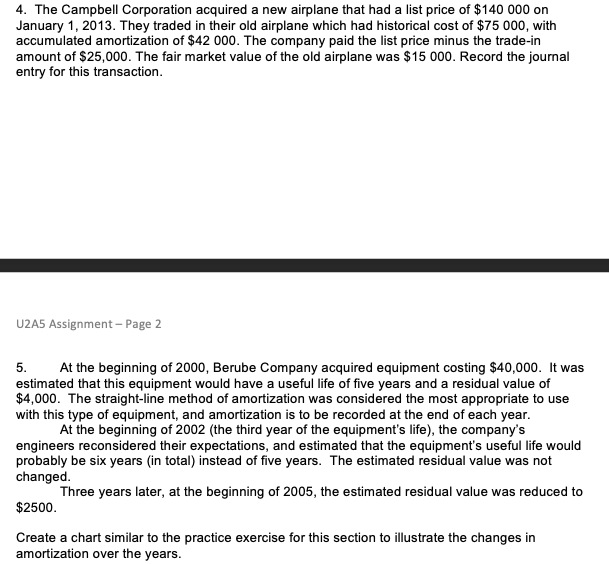

Create your own spreadsheet file to show the calculations for all of the following. It would be best if you used a different sheet/tab for each question, but only one document. USE FORMULAS whenever possible. 1. Amortization Methods. The Flakeboard Company purchased three machines. Various amortization methods were selected. Information is as follows: For the declining balance method, the company uses double the declining balance rate. For the units-of-activity method, total machine hours are expected to be 24,000. Actual hours in the first two years were 1000 in 2001 and 4500 in 2002. Calculate the amount of amortization for each method and then calculate the accumulated amortization for each method as of December 31, 2002. ** SHOW the amortization for each year, and the accumulated amortization at the end of each year. 2. Show the journal entry for December 31,2002 for each of the above machines. 3. Express Co.has delivery equipment that cost $45,000 when it was purchased on July 1 , 2000. The delivery equipment has a useful life of five years, with an expected residual value of $5,000. The equipment sold on June 30,2003 . Express Co. uses the straight-line method of amortization. Instructions: Record the journal entries to dispose of this asset under the following assumptions: a) It was scrapped as having no value. b) It was sold for $25,000. c) It was sold for $18,000. 4. The Campbell Corporation acquired a new airplane that had a list price of $140000 on January 1, 2013. They traded in their old airplane which had historical cost of $75000, with accumulated amortization of $42000. The company paid the list price minus the trade-in amount of $25,000. The fair market value of the old airplane was $15000. Record the journal entry for this transaction. U2A5 Assignment - Page 2 5. At the beginning of 2000 , Berube Company acquired equipment costing $40,000. It was estimated that this equipment would have a useful life of five years and a residual value of $4,000. The straight-line method of amortization was considered the most appropriate to use with this type of equipment, and amortization is to be recorded at the end of each year. At the beginning of 2002 (the third year of the equipment's life), the company's engineers reconsidered their expectations, and estimated that the equipment's useful life would probably be six years (in total) instead of five years. The estimated residual value was not changed. Three years later, at the beginning of 2005 , the estimated residual value was reduced to $2500. Create a chart similar to the practice exercise for this section to illustrate the changes in amortization over the years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts