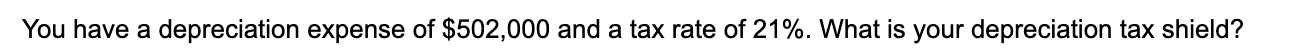

Question: could you please show how you got to the answer please You have a depreciation expense of $502,000 and a tax rate of 21%. What

could you please show how you got to the answer please

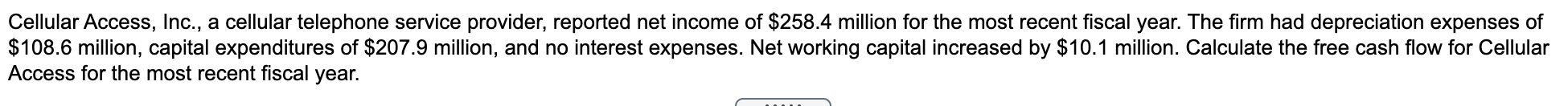

You have a depreciation expense of $502,000 and a tax rate of 21%. What is your depreciation tax shield? Cellular Access, Inc., a cellular telephone service provider, reported net income of $258.4 million for the most recent fiscal year. The firm had depreciation expenses of $108.6 million, capital expenditures of $207.9 million, and no interest expenses. Net working capital increased by $10.1 million. Calculate the free cash flow for Cellular Access for the most recent fiscal year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock