Question: could you please show me how to solve it on excel and also the formula used ? thank you ! Suppose you purchase $1000 face-value

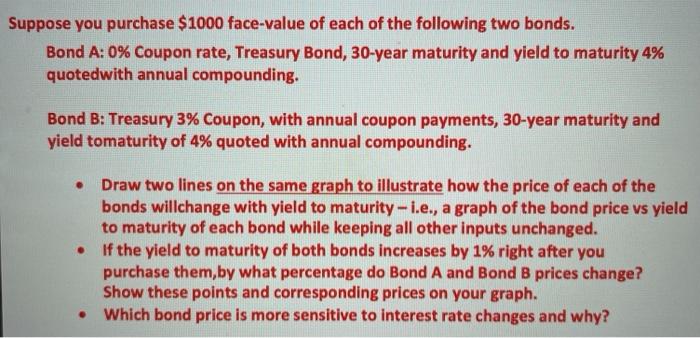

Suppose you purchase $1000 face-value of each of the following two bonds. Bond A: 0% Coupon rate, Treasury Bond, 30-year maturity and yield to maturity 4% quotedwith annual compounding. Bond B: Treasury 3% Coupon, with annual coupon payments, 30-year maturity and yield tomaturity of 4% quoted with annual compounding. Draw two lines on the same graph to illustrate how the price of each of the bonds willchange with yield to maturity - i.e., a graph of the bond price vs yield to maturity of each bond while keeping all other inputs unchanged. If the yield to maturity of both bonds increases by 1% right after you purchase them, by what percentage do Bond A and Bond B prices change? Show these points and corresponding prices on your graph. Which bond price is more sensitive to interest rate changes and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts