Question: Could you please show me the formulas needed for each method as well? Thank you! PR 10-3A Depreciation by three methods; partial years Perdue Company

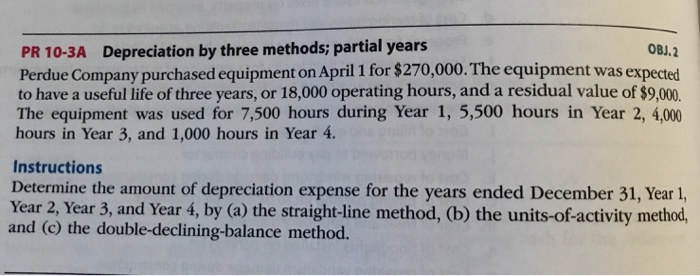

PR 10-3A Depreciation by three methods; partial years Perdue Company purchased equipment on April 1 for $270,000. The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $9,000 The equipment was used for 7,500 hours during Year 1, 5,500 hours in Year 2, 4,000 hours in Year 3, and 1,000 hours in Year 4. OBJ.2 Instructions Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method and (c) the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts