Question: Could you please show me the step to solve this question? . The Parent has an 70% interest in its Sub. On Jan.1, 20X1, the

Could you please show me the step to solve this question?

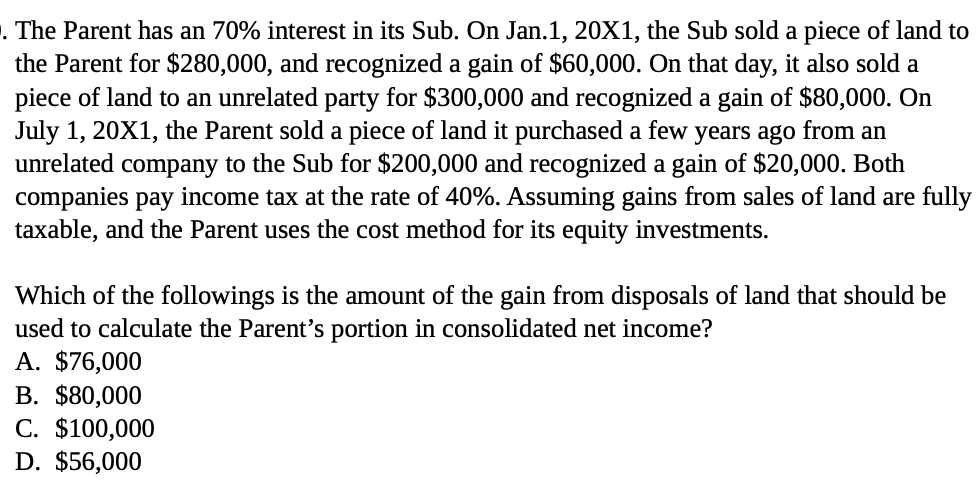

. The Parent has an 70% interest in its Sub. On Jan.1, 20X1, the Sub sold a piece of land to the Parent for $280,000, and recognized a gain of $60,000. On that day, it also sold a piece of land to an unrelated party for $300,000 and recognized a gain of $80,000. On July 1, 20X1, the Parent sold a piece of land it purchased a few years ago from an unrelated company to the Sub for $200,000 and recognized a gain of $20,000. Both companies pay income tax at the rate of 40%. Assuming gains from sales of land are fully taxable, and the Parent uses the cost method for its equity investments. Which of the followings is the amount of the gain from disposals of land that should be used to calculate the Parent's portion in consolidated net income? A. $76,000 B. $80,000 C. $100,000 D. $56,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts