Question: could you please show the formulation for each step in excel? thank you Summer Tyme, Inc. has cash available and is considering a new three-year

could you please show the formulation for each step in excel? thank you

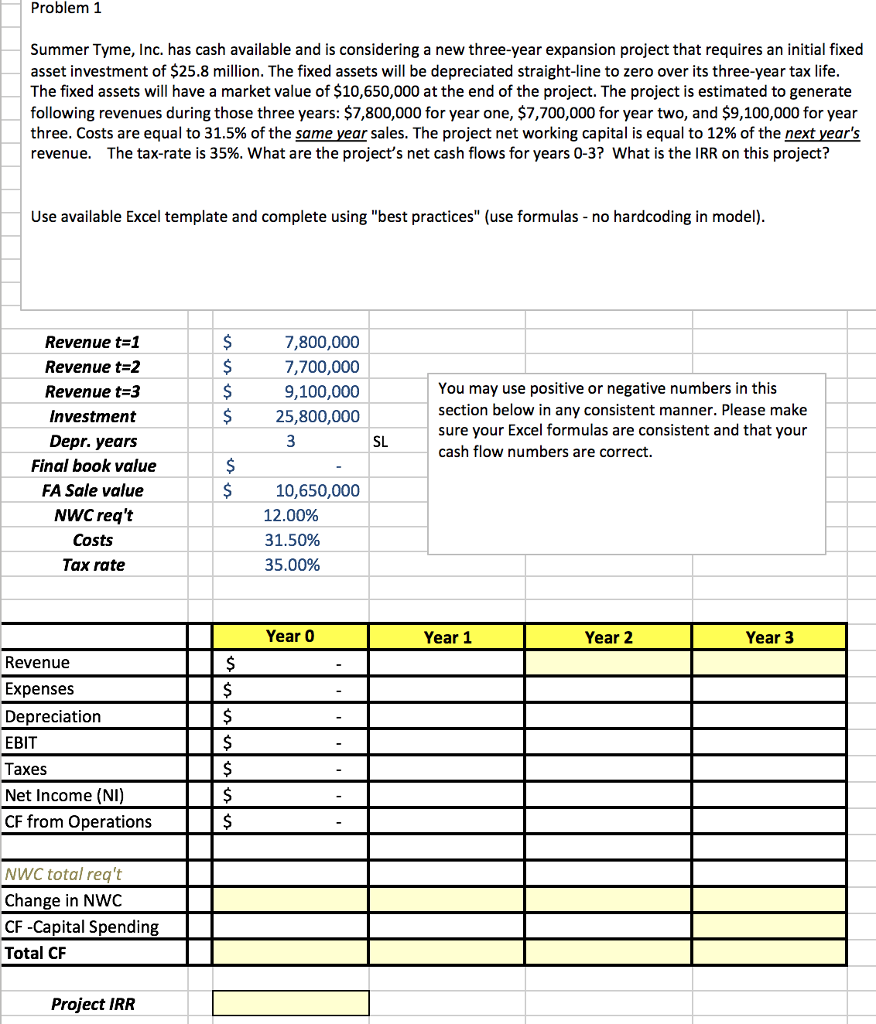

Summer Tyme, Inc. has cash available and is considering a new three-year expansion project that requires an initial fixed asset investment of $25.8 million. The fixed assets will be depreciated straight-line to zero over its three-year tax life. The fixed assets will have a market value of $10, 650,000 at the end of the project. The project is estimated to generate following revenues during those three years: $7, 800,000 for year one, $7, 700,000 for year two, and $9, 100,000 for year three. Costs are equal to 31.5% of the same year sales. The project net working capital is equal to 12% of the next year's revenue. The tax-rate is 35%. What are the project's net cash flows for years 0-3? What is the IRR on this project? Use available Excel template and complete using "best practices" (use formulas - no hardcoding in model)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts