Question: could you please solve case problem 6.1 parts a,b, and c blem 6.1 Wally Wonders Whether There's a Place for Dividends high quality prowth rocks

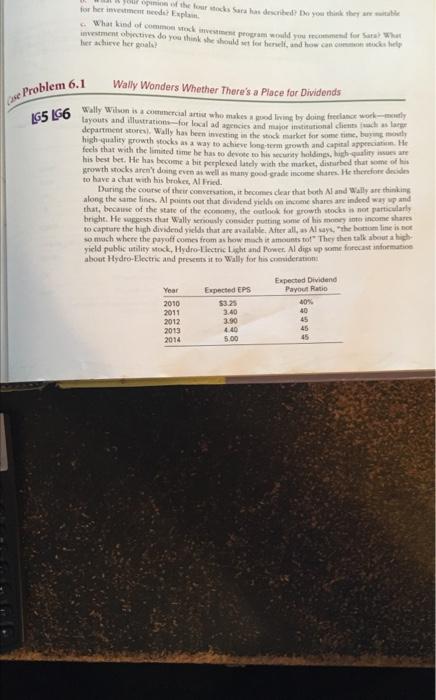

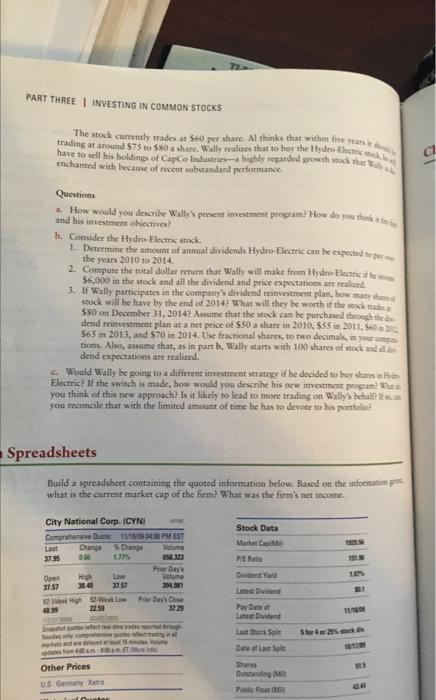

blem 6.1 Wally Wonders Whether There's a Place for Dividends high quality prowth rocks at a way to achirve longrerm wrowth and cypiral appecciation. He feels that with the limited ume be has to devole to his wecuiny haldings, hyph-qualing issues ane his bet bet. He has becoene at bie perplesed litedy with the market, sisturbed that wome of hit growith stocks aren't doing even an wril as many good grade income sharm. He therefote decides to bave a chat with his brokes, Al firied. During the course of their coeversation, it becomes char that both Nl and wally are thinking aloes the aine lines. Al points oet that dividend yieldw on income shares ane indred way wp and that, becaus of the state of the pooneney, the oathook for yowth stocks in not particularly to capeare the high dividend yiclds that are available, Niter all, as Al ayst, "The bonum line is not so mosh where the puyotf coene from as how moch it amoues sot" They shen talk abeut a hiph yield public utility sock, Hydro-Llectric Light and Poner. Al digs sp wome fertecast infoematioe abont Hydro-Electric and presents it to Wally fot his cnavideration: ART THAEE I INVESTING IN COMMON STOCKS The rock currently trades ar S60 prr share Al thinks that within five yran e is. have to sell his boldings of CapCo Industries 2 highly regaeded erowith wask ehis enchanted with hecause of recent substandard pertorimance. Questions a. How would you describe Wally's peenent investment program? How do you thek is to he and his investment obiectives? b. Consider the Hydro: Electric pook. 1. Determine the amount of annual dividendx Hydru-Electric can be capected to por are the years 2010 to 2014. 2. Compute the fotal dollar return that Wally will make from Hydeo-Electric it he ions. 56,000 in the stock and all the dividend and prise expectations are realued. 3. If Wally particrpates in the company' 3 dividend trinvestment plan, how muny shas it stock will he have by the end of 2014 ? What will they he woith if the seck tradey 580 on December 31. 2014? Assume that the stock can be purchased through ste (i. dend reinvestment plan at a net price of 550 a share in 2010, 555 in 2011, 501 in 1 hit 565 in 2013 , and 570 in 2014. Use fractional shares, to two decimals, in yoer ceng 5. dend expectations are realized. c. Would Wally be going to a differeat anvectment strategy if he decided to buy shure in thit Electric? If the swirch is made, how would you describe his new investment proeant that bl you think of this new approoch? Is it likely to lead to more trading on Wallys brhalp lf es at you reconcile that with the limited amount of time he has to devote to his portfolin? eadsheets Build a specadsheer containing the quoted information below. Based on the informasief what is the current market cap of the firm? What was the firm's net income. blem 6.1 Wally Wonders Whether There's a Place for Dividends high quality prowth rocks at a way to achirve longrerm wrowth and cypiral appecciation. He feels that with the limited ume be has to devole to his wecuiny haldings, hyph-qualing issues ane his bet bet. He has becoene at bie perplesed litedy with the market, sisturbed that wome of hit growith stocks aren't doing even an wril as many good grade income sharm. He therefote decides to bave a chat with his brokes, Al firied. During the course of their coeversation, it becomes char that both Nl and wally are thinking aloes the aine lines. Al points oet that dividend yieldw on income shares ane indred way wp and that, becaus of the state of the pooneney, the oathook for yowth stocks in not particularly to capeare the high dividend yiclds that are available, Niter all, as Al ayst, "The bonum line is not so mosh where the puyotf coene from as how moch it amoues sot" They shen talk abeut a hiph yield public utility sock, Hydro-Llectric Light and Poner. Al digs sp wome fertecast infoematioe abont Hydro-Electric and presents it to Wally fot his cnavideration: ART THAEE I INVESTING IN COMMON STOCKS The rock currently trades ar S60 prr share Al thinks that within five yran e is. have to sell his boldings of CapCo Industries 2 highly regaeded erowith wask ehis enchanted with hecause of recent substandard pertorimance. Questions a. How would you describe Wally's peenent investment program? How do you thek is to he and his investment obiectives? b. Consider the Hydro: Electric pook. 1. Determine the amount of annual dividendx Hydru-Electric can be capected to por are the years 2010 to 2014. 2. Compute the fotal dollar return that Wally will make from Hydeo-Electric it he ions. 56,000 in the stock and all the dividend and prise expectations are realued. 3. If Wally particrpates in the company' 3 dividend trinvestment plan, how muny shas it stock will he have by the end of 2014 ? What will they he woith if the seck tradey 580 on December 31. 2014? Assume that the stock can be purchased through ste (i. dend reinvestment plan at a net price of 550 a share in 2010, 555 in 2011, 501 in 1 hit 565 in 2013 , and 570 in 2014. Use fractional shares, to two decimals, in yoer ceng 5. dend expectations are realized. c. Would Wally be going to a differeat anvectment strategy if he decided to buy shure in thit Electric? If the swirch is made, how would you describe his new investment proeant that bl you think of this new approoch? Is it likely to lead to more trading on Wallys brhalp lf es at you reconcile that with the limited amount of time he has to devote to his portfolin? eadsheets Build a specadsheer containing the quoted information below. Based on the informasief what is the current market cap of the firm? What was the firm's net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts