Question: Could you please solve only question e and f? Darcy is considering investing in two risky portfolios- an international equity fund and an Australian bond

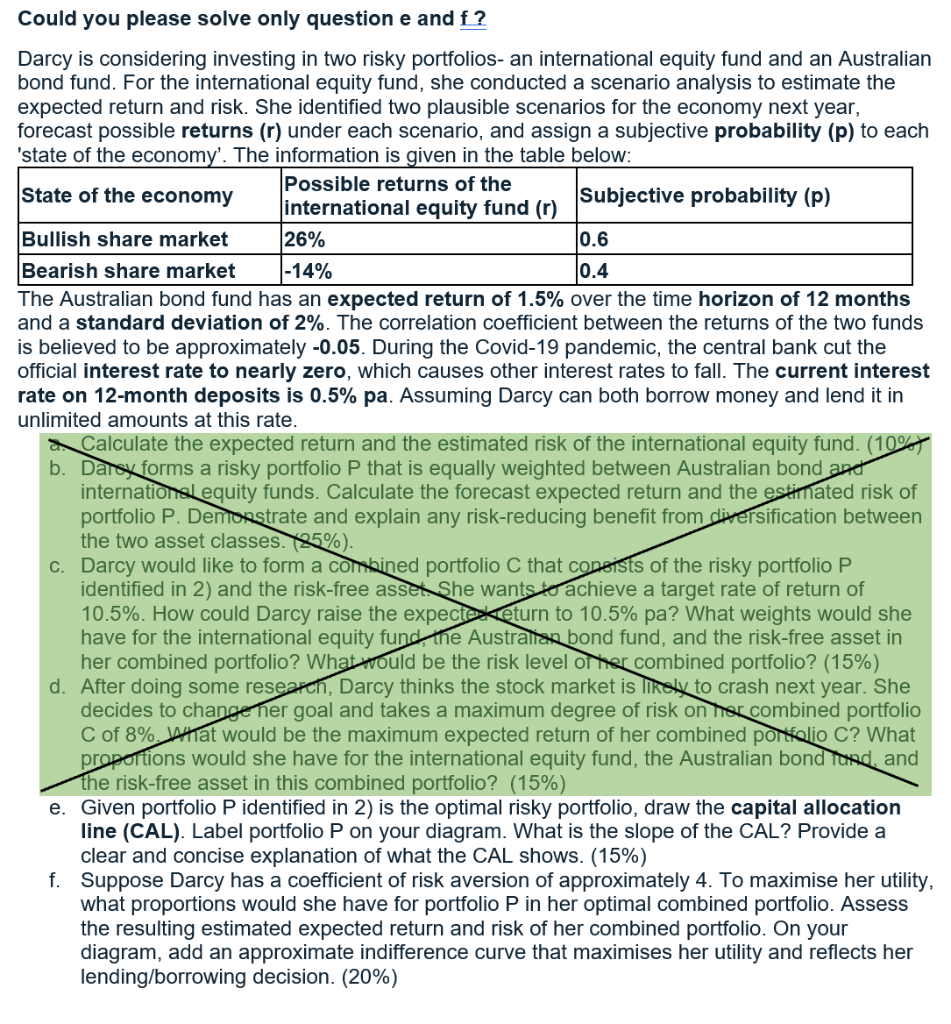

Could you please solve only question e and f? Darcy is considering investing in two risky portfolios- an international equity fund and an Australian bond fund. For the international equity fund, she conducted a scenario analysis to estimate the expected return and risk. She identified two plausible scenarios for the economy next year, forecast possible returns (r) under each scenario, and assign a subjective probability (p) to each 'state of the economy'. The information is given in the table below: State of the economy Possible returns of the Subjective probability (p) international equity fund (c) Bullish share market 26% 0.6 Bearish share market -14% 0.4 The Australian bond fund has an expected return of 1.5% over the time horizon of 12 months and a standard deviation of 2%. The correlation coefficient between the returns of the two funds is believed to be approximately -0.05. During the Covid-19 pandemic, the central bank cut the official interest rate to nearly zero, which causes other interest rates to fall. The current interest rate on 12-month deposits is 0.5% pa. Assuming Darcy can both borrow money and lend it in unlimited amounts at this rate. Calculate the expected return and the estimated risk of the international equity fund. (10%) b. Daisy forms a risky portfolio P that is equally weighted between Australian bond art international equity funds. Calculate the forecast expected return and the estimated risk of portfolio P. Demonstrate and explain any risk-reducing benefit from diversification between the two asset classes. (25%). C. Darcy would like to form a combined portfolio C that consists of the risky portfolio P identified in 2) and the risk-free assed She wants to achieve a target rate of return of 10.5%. How could Darcy raise the expectexeturn to 10.5% pa? What weights would she have for the international equity fund, the Australian bond fund, and the risk-free asset in her combined portfolio? What would be the risk level of her combined portfolio? (15%) d. After doing some research, Darcy thinks the stock market is likely to crash next year. She decides to change her goal and takes a maximum degree of risk on her combined portfolio C of 8% what would be the maximum expected return of her combined porfolio C? What proportions would she have for the international equity fund, the Australian bond tored and the risk-free asset in this combined portfolio? (15%) e. Given portfolio P identified in 2) is the optimal risky portfolio, draw the capital allocation line (CAL). Label portfolio P on your diagram. What is the slope of the CAL? Provide a clear and concise explanation of what the CAL shows. (15%) f. Suppose Darcy has a coefficient of risk aversion of approximately 4. To maximise her utility, what proportions would she have for portfolio P in her optimal combined portfolio. Assess the resulting estimated expected return and risk of her combined portfolio. On your diagram, add an approximate indifference curve that maximises her utility and reflects her lending/borrowing decision. (20%) Could you please solve only question e and f? Darcy is considering investing in two risky portfolios- an international equity fund and an Australian bond fund. For the international equity fund, she conducted a scenario analysis to estimate the expected return and risk. She identified two plausible scenarios for the economy next year, forecast possible returns (r) under each scenario, and assign a subjective probability (p) to each 'state of the economy'. The information is given in the table below: State of the economy Possible returns of the Subjective probability (p) international equity fund (c) Bullish share market 26% 0.6 Bearish share market -14% 0.4 The Australian bond fund has an expected return of 1.5% over the time horizon of 12 months and a standard deviation of 2%. The correlation coefficient between the returns of the two funds is believed to be approximately -0.05. During the Covid-19 pandemic, the central bank cut the official interest rate to nearly zero, which causes other interest rates to fall. The current interest rate on 12-month deposits is 0.5% pa. Assuming Darcy can both borrow money and lend it in unlimited amounts at this rate. Calculate the expected return and the estimated risk of the international equity fund. (10%) b. Daisy forms a risky portfolio P that is equally weighted between Australian bond art international equity funds. Calculate the forecast expected return and the estimated risk of portfolio P. Demonstrate and explain any risk-reducing benefit from diversification between the two asset classes. (25%). C. Darcy would like to form a combined portfolio C that consists of the risky portfolio P identified in 2) and the risk-free assed She wants to achieve a target rate of return of 10.5%. How could Darcy raise the expectexeturn to 10.5% pa? What weights would she have for the international equity fund, the Australian bond fund, and the risk-free asset in her combined portfolio? What would be the risk level of her combined portfolio? (15%) d. After doing some research, Darcy thinks the stock market is likely to crash next year. She decides to change her goal and takes a maximum degree of risk on her combined portfolio C of 8% what would be the maximum expected return of her combined porfolio C? What proportions would she have for the international equity fund, the Australian bond tored and the risk-free asset in this combined portfolio? (15%) e. Given portfolio P identified in 2) is the optimal risky portfolio, draw the capital allocation line (CAL). Label portfolio P on your diagram. What is the slope of the CAL? Provide a clear and concise explanation of what the CAL shows. (15%) f. Suppose Darcy has a coefficient of risk aversion of approximately 4. To maximise her utility, what proportions would she have for portfolio P in her optimal combined portfolio. Assess the resulting estimated expected return and risk of her combined portfolio. On your diagram, add an approximate indifference curve that maximises her utility and reflects her lending/borrowing decision. (20%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts