Question: Could you please solve problem 4. I want to compare my answer. 4. Your purchase a PC for $2000 (5 year asset) and 'you are

Could you please solve problem 4. I want to compare my answer.

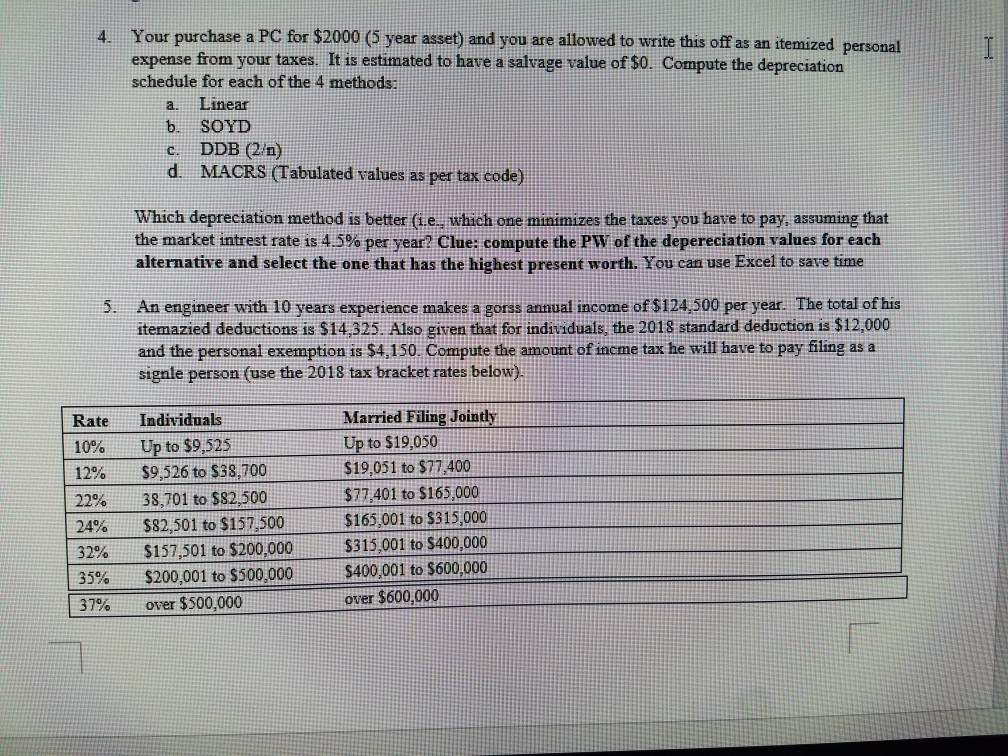

4. Your purchase a PC for $2000 (5 year asset) and 'you are allowed to write this off as an itemized personal expense from your taxes. It is estimated to have a salvage value of S0. Compute the depreciation schedule for each of the 4 methods: a Linear b. SOYD c. DDB (2) d MACRS Tabulated values as per tax code) Which depreciation method is better (ie. which one minimizes the taxes you have to pay, assuming that the market intrest rate is 45% per year? Clue: compute the PW of the depereciation values for each alternative and select the one that has the highest present worth. You can use Excel to save time 5. An engineer with 10 years experience makes a gorss annual income of $124,500 per year The total of his itemazied deductions is $14:325. Also given that for individuals, the 2018 standard deduction is $12,000 and the personal exemption is $4,150 Compute the amount of incme tax he will have to pay filing as a signle person (use the 2018 tax bracket rates below Rate 10% 12% 22% 24% 32% 35% 37% Individuals Up to $9,525 $9,526 to $38,700 38,701 to $82,500 $82,501 to $157,500 $157,501 to $200,000 S200,001 to$500,000 over $500,000 Married Filing Jointly Up to $19,050 $19,051 to $77,400 $77 401 to $165,000 $165,001 to $315,000 $315,001 to $400,000 $400,001 to $600,000 over $600,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts