Question: Could you please solve this question? Thank you! Consider a one-period model with N = {1,2,3} and two risky assets S1, S2 whose with current

Could you please solve this question? Thank you!

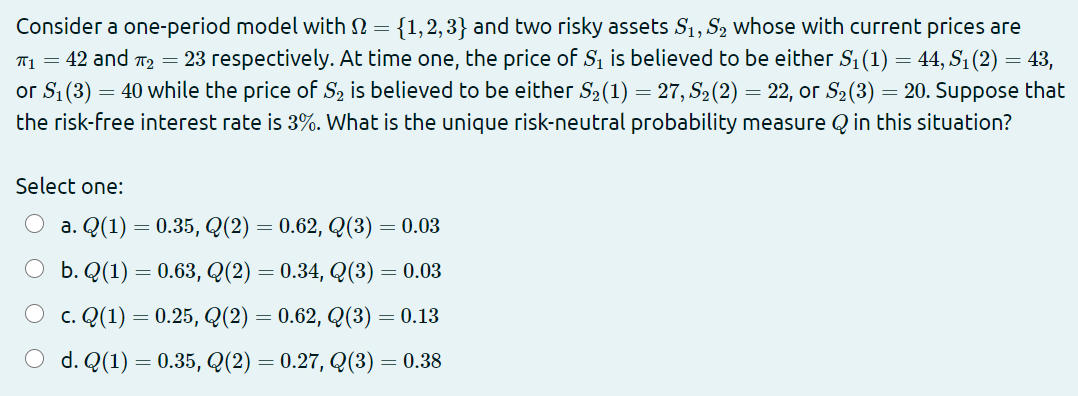

Consider a one-period model with N = {1,2,3} and two risky assets S1, S2 whose with current prices are 711 = 42 and T2 = 23 respectively. At time one, the price of S is believed to be either Si(1) = 44, S1 (2) = 43, or Si(3) = 40 while the price of S2 is believed to be either S2(1) = 27, S2(2) = 22, or S2(3) = 20. Suppose that the risk-free interest rate is 3%. What is the unique risk-neutral probability measure Q in this situation? Select one: O a. Q(1) = 0.35, Q(2) = 0.62, Q(3) = 0.03 O b.Q(1) = 0.63, Q(2) = 0.34, Q(3) = 0.03 C. Q(1) = 0.25, Q(2) = 0.62, Q(3) = 0.13 d. Q(1) = 0.35, Q(2) = 0.27, Q(3) = 0.38 Consider a one-period model with N = {1,2,3} and two risky assets S1, S2 whose with current prices are 711 = 42 and T2 = 23 respectively. At time one, the price of S is believed to be either Si(1) = 44, S1 (2) = 43, or Si(3) = 40 while the price of S2 is believed to be either S2(1) = 27, S2(2) = 22, or S2(3) = 20. Suppose that the risk-free interest rate is 3%. What is the unique risk-neutral probability measure Q in this situation? Select one: O a. Q(1) = 0.35, Q(2) = 0.62, Q(3) = 0.03 O b.Q(1) = 0.63, Q(2) = 0.34, Q(3) = 0.03 C. Q(1) = 0.25, Q(2) = 0.62, Q(3) = 0.13 d. Q(1) = 0.35, Q(2) = 0.27, Q(3) = 0.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts