Question: could you please walk me through this preferable on excel and explain in detail the steps. thanks pg 2 Ace, Inc., a US company, has

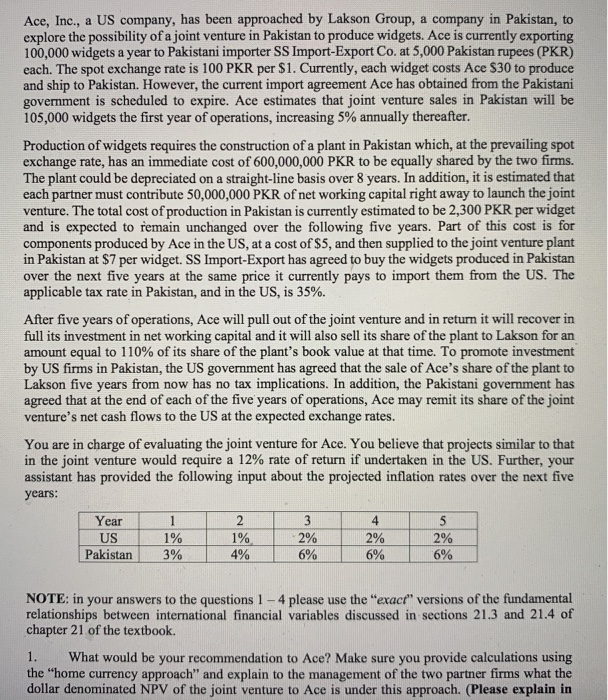

Ace, Inc., a US company, has been approached by Lakson Group, a company in Pakistan, to explore the possibility of a joint venture in Pakistan to produce widgets. Ace is currently exporting 100,000 widgets a year to Pakistani importer SS Import-Export Co. at 5,000 Pakistan rupees (PKR) each. The spot exchange rate is 100 PKR per $1. Currently, each widget costs Ace $30 to produce and ship to Pakistan. However, the current import agreement Ace has obtained from the Pakistani government is scheduled to expire. Ace estimates that joint venture sales in Pakistan will be 105,000 widgets the first year of operations, increasing 5% annually thereafter. Production of widgets requires the construction of a plant in Pakistan which, at the prevailing spot exchange rate, has an immediate cost of 600,000,000 PKR to be equally shared by the two firms. The plant could be depreciated on a straight-line basis over 8 years. In addition, it is estimated that each partner must contribute 50,000,000 PKR of net working capital right away to launch the joint venture. The total cost of production in Pakistan is currently estimated to be 2,300 PKR per widget and is expected to remain unchanged over the following five years. Part of this cost is for components produced by Ace in the US, at a cost of $5, and then supplied to the joint venture plant in Pakistan at $7 per widget. SS Import-Export has agreed to buy the widgets produced in Pakistan over the next five years at the same price it currently pays to import them from the US. The applicable tax rate in Pakistan, and in the US, is 35%. After five years of operations, Ace will pull out of the joint venture and in return it will recover in full its investment in net working capital and it will also sell its share of the plant to Lakson for an amount equal to 110% of its share of the plant's book value at that time. To promote investment by US firms in Pakistan, the US government has agreed that the sale of Ace's share of the plant to Lakson five years from now has no tax implications. In addition, the Pakistani government has agreed that at the end of each of the five years of operations, Ace may remit its share of the joint venture's net cash flows to the US at the expected exchange rates. You are in charge of evaluating the joint venture for Ace. You believe that projects similar to that in the joint venture would require a 12% rate of return if undertaken in the US. Further, your assistant has provided the following input about the projected inflation rates over the next five years: Year US Pakistan 1% 3% 2 1% 4% 34 2% 2% E6% 6% 2% 6% NOTE: in your answers to the questions 1 - 4 please use the "exact" versions of the fundamental relationships between international financial variables discussed in sections 21.3 and 21.4 of chapter 21 of the textbook. 1. What would be your recommendation to Ace? Make sure you provide calculations using the "home currency approach" and explain to the management of the two partner firms what the dollar denominated NPV of the joint venture to Ace is under this approach. (Please explain in detail your calculations for t=2, as well as for any one time items you encounter at t= 0 and t=5 in your analysis.) The following three questions are independent of each other. 2. Assume that Ace decides to enter in the joint venture. However, Ace has only $1,500,000 in cash available for investment in the project. Hence, Ace wants to get a two year dollar- denominated loan now from its US bank at 10% annual interest rate against its share of the joint venture's first and second year net cash flows. How much would Ace be able to borrow if it enters in to a forward contract at 102.5 PKR per $1? Would the total of the loan and the cash currently available enable Ace to proceed with the project? 3. Assume Ace enters in the joint venture and Bank of Khyber, a Pakistani bank, offers to remit all future net cash flows to Ace at the fixed exchange rate of 110 PKR per $1 for a $20,000 fee payable immediately. Would you recommend that Ace accepts this offer or not? 4. In the "foreign currency approach" we determine the required return on PKR investment, and discount the PKR cash flows to find the NPV in PKRs. Then we convert this PKR NPV to a dollar NPV, Calculate the rate at which you should discount the PKR cash floys of the joint. venture project (i) in year 1 and (ii) in year 2. (This is a bonus question for 2 points.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts