Question: Could you show work and explain how you got the answers for a, b, and c please? 9.5 Suppose S0S/=$1.25/,F1S/=$1.20/,i=11.56 percent, and iS=9.82 percent. You

Could you show work and explain how you got the answers for a, b, and c please?

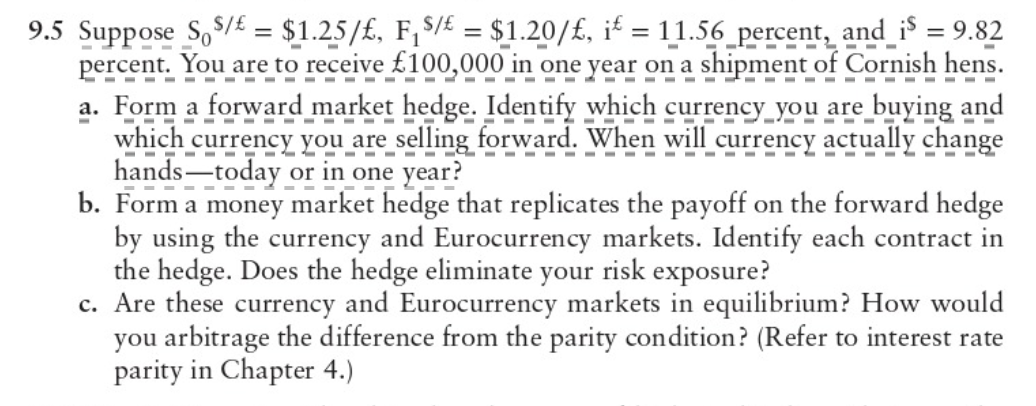

9.5 Suppose S0S/=$1.25/,F1S/=$1.20/,i=11.56 percent, and iS=9.82 percent. You are to receive 100,000 in one year on a shipment of Cornish hens. a. Form a forward market hedge. Identify which currency you are buying and which currency you are selling forward. When will currency actually change hands - today or in one year? b. Form a money market hedge that replicates the payoff on the forward hedge by using the currency and Eurocurrency markets. Identify each contract in the hedge. Does the hedge eliminate your risk exposure? c. Are these currency and Eurocurrency markets in equilibrium? How would you arbitrage the difference from the parity condition? (Refer to interest rate parity in Chapter 4.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts