Question: Could you solve clearly and step by step? Thanks a lot 12. A special tool for the manufacture of finished plastic products (MACRS-GDS 3 year

Could you solve clearly and step by step? Thanks a lot

Could you solve clearly and step by step? Thanks a lot

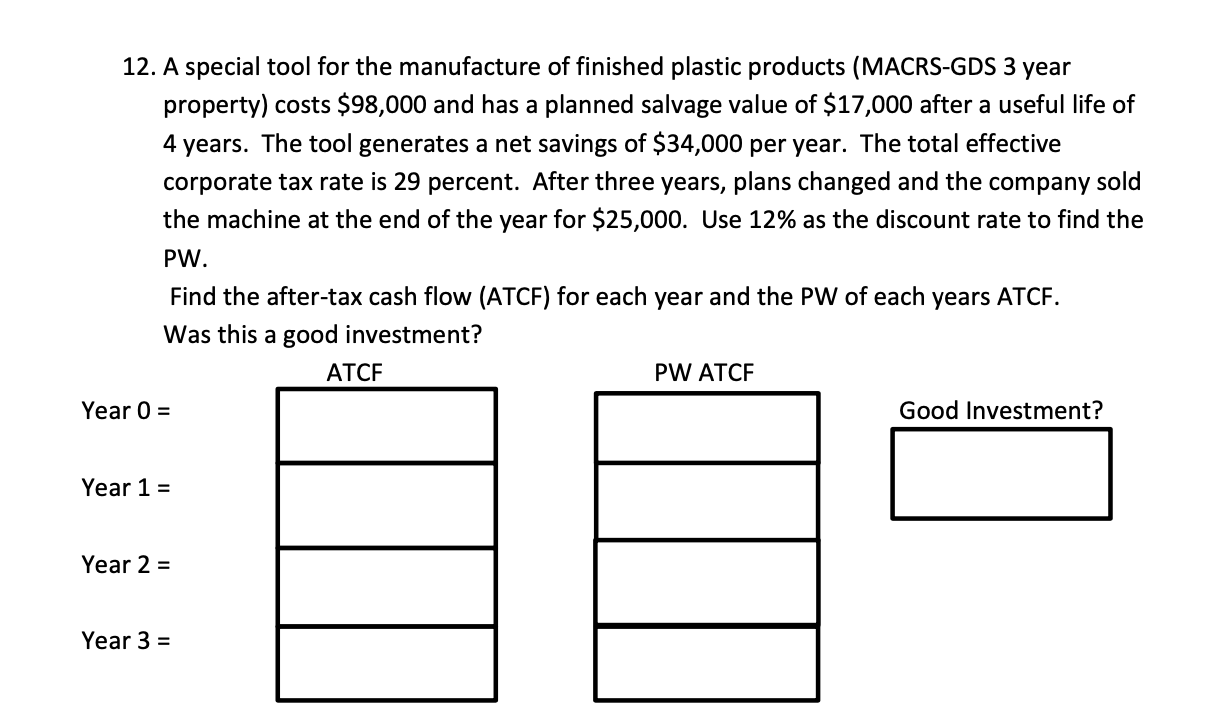

12. A special tool for the manufacture of finished plastic products (MACRS-GDS 3 year property) costs $98,000 and has a planned salvage value of $17,000 after a useful life of 4 years. The tool generates a net savings of $34,000 per year. The total effective corporate tax rate is 29 percent. After three years, plans changed and the company sold the machine at the end of the year for $25,000. Use 12% as the discount rate to find the PW. Find the after-tax cash flow (ATCF) for each year and the PW of each years ATCF. Was this a good investment? ATCE PW ATCF Year 0 = Good Investment? Year 1 = Year 2 = Year 3 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts