Question: could you solve this problem ? Kitchen Innovations, Inc., is considering introducing a new line of toaster ovens. Before proceeding with a more thorough analysis,

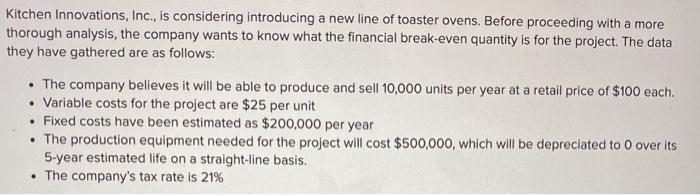

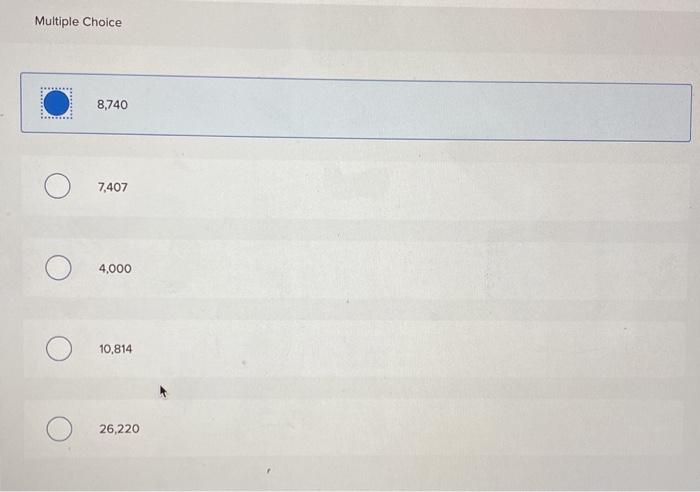

Kitchen Innovations, Inc., is considering introducing a new line of toaster ovens. Before proceeding with a more thorough analysis, the company wants to know what the financial break-even quantity is for the project. The data they have gathered are as follows: The company believes it will be able to produce and sell 10,000 units per year at a retail price of $100 each. Variable costs for the project are $25 per unit Fixed costs have been estimated as $200,000 per year The production equipment needed for the project will cost $500,000, which will be depreciated to 0 over its 5-year estimated life on a straight-line basis. The company's tax rate is 21% . Multiple Choice 8,740 7,407 4,000 10,814 26,220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts