Question: Could you solve this problem please? Thanks in advance. CAN YOU DO IT? CALCULATING THE WEIGHTED AVERAGE COST OF CAPITAL In the fall of 2009,

Could you solve this problem please? Thanks in advance.

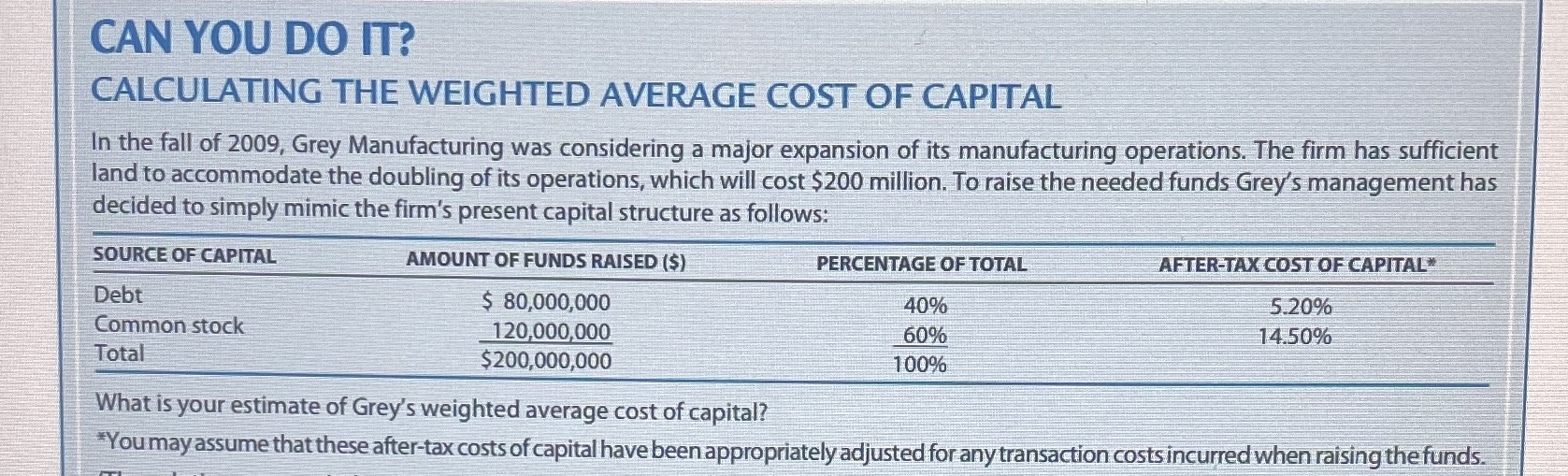

CAN YOU DO IT? CALCULATING THE WEIGHTED AVERAGE COST OF CAPITAL In the fall of 2009, Grey Manufacturing was considering a major expansion of its manufacturing operations. The firm has sufficient land to accommodate the doubling of its operations, which will cost $200 million. To raise the needed funds Grey's management has decided to simply mimic the firm's present capital structure as follows: SOURCE OF CAPITAL AMOUNT OF FUNDS RAISED ($) PERCENTAGE OF TOTAL AFTER-TAX COST OF CAPITAL" Debt $ 80,000,000 40% 5.20% Common stock 120,000,000 60% 14.50% Total $200,000,000 100% What is your estimate of Grey's weighted average cost of capital? *You may assume that these after-tax costs of capital have been appropriately adjusted for any transaction costs incurred when raising the funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts