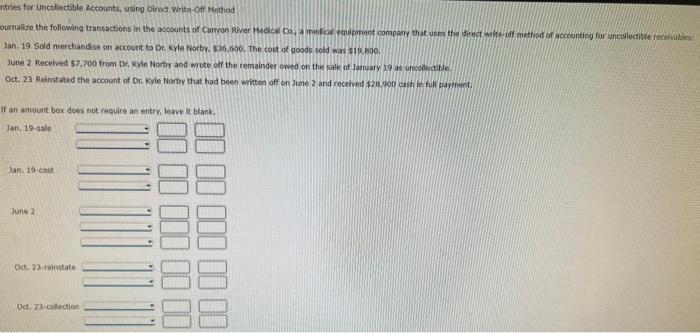

Question: countries for Uncollectible Accounts, using Direct Write-Off Method journalize the following transactions in the accounts of Canyon River Medical Co., a medical equipment company that

ntries for Uncollectible Accounts, using Direct Write-Off Method mournalize the following transactions in the accounts of Canyon River Medical Co, a medical equipment company that uses the direct write-off method of accounting for uncollectible recibe Jan. 19 Sold merchandise on account to De Kyle Norby, 536,500. The cost of goods sold was $19.500 June 2 Received $7.700 from Dr. Kyle Norty and wrote off the remainder owed on the sale of January 19 a collectible Oct. 23 Reinstated the account of Dr. Kyle Norty that had been written off on June 2 and received $28.900 cash in full payment If an amount box does not require an entry, leave It blank, Jan. 19-sale Jan. 19 cost June 2 Oct 23-state 11 11 11 Oct. 23.collection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts