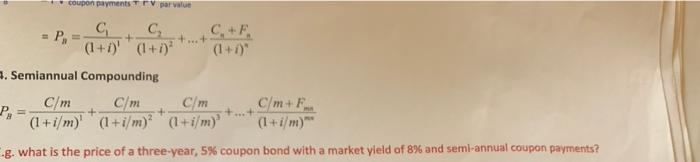

Question: coupon payments par value P, C C.F. + + ... + (1+1)' (1+1) 2. Semiannual Compounding C/m C/m C/m C/ mF + + +... (1+i/m)'

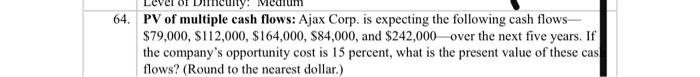

coupon payments par value P, C C.F. + + ... + (1+1)' (1+1) 2. Semiannual Compounding C/m C/m C/m C/ mF + + +... (1+i/m)' (1+i/m) (1+i/m) (1+i/m) g. what is the price of a three-year, 5% coupon bond with a market yield of 8% and semi-annual coupon payments? 64. PV of multiple cash flows: Ajax Corp. is expecting the following cash flows- $79,000, $112,000, $164,000, $84,000, and $242,000 over the next five years. If the company's opportunity cost is 15 percent, what is the present value of these cas flows? (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts