Question: Coupons are issued semiannually, so why are two coupons discounted for 3 months and 6 months separately, why not 6 months and 12 months? There

Coupons are issued semiannually, so why are two coupons discounted for 3 months and 6 months separately, why not 6 months and 12 months? There was a 10-month gap between the valuation date and the maturity date. Why was the second coupon included?

Coupons are issued semiannually, so why are two coupons discounted for 3 months and 6 months separately, why not 6 months and 12 months? There was a 10-month gap between the valuation date and the maturity date. Why was the second coupon included?

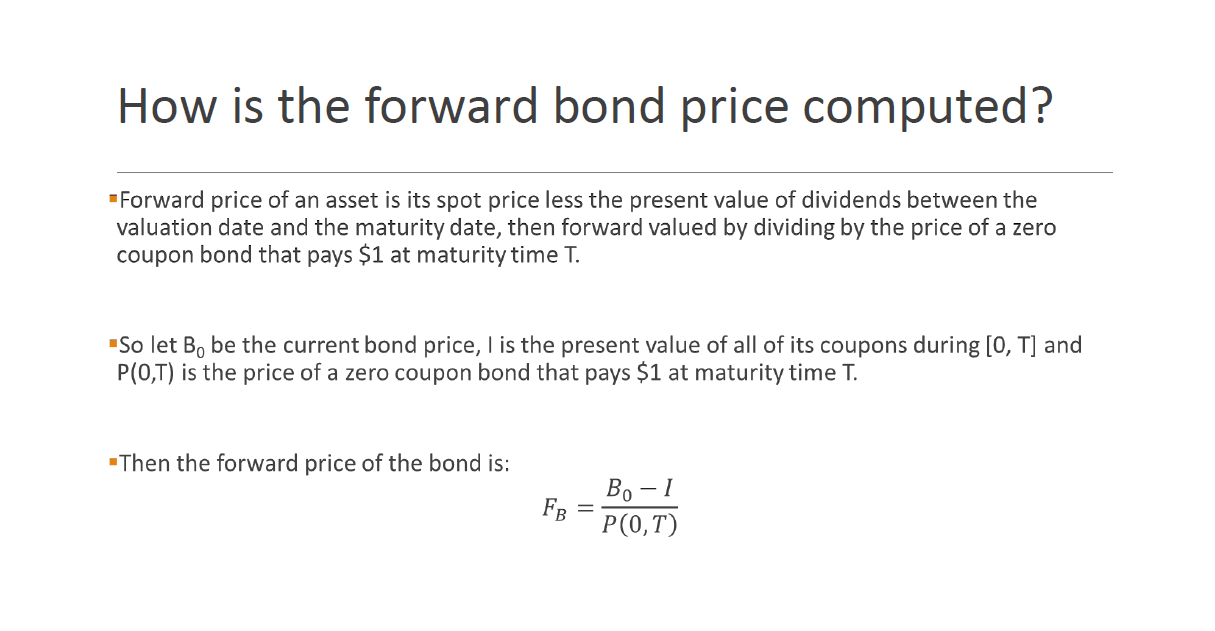

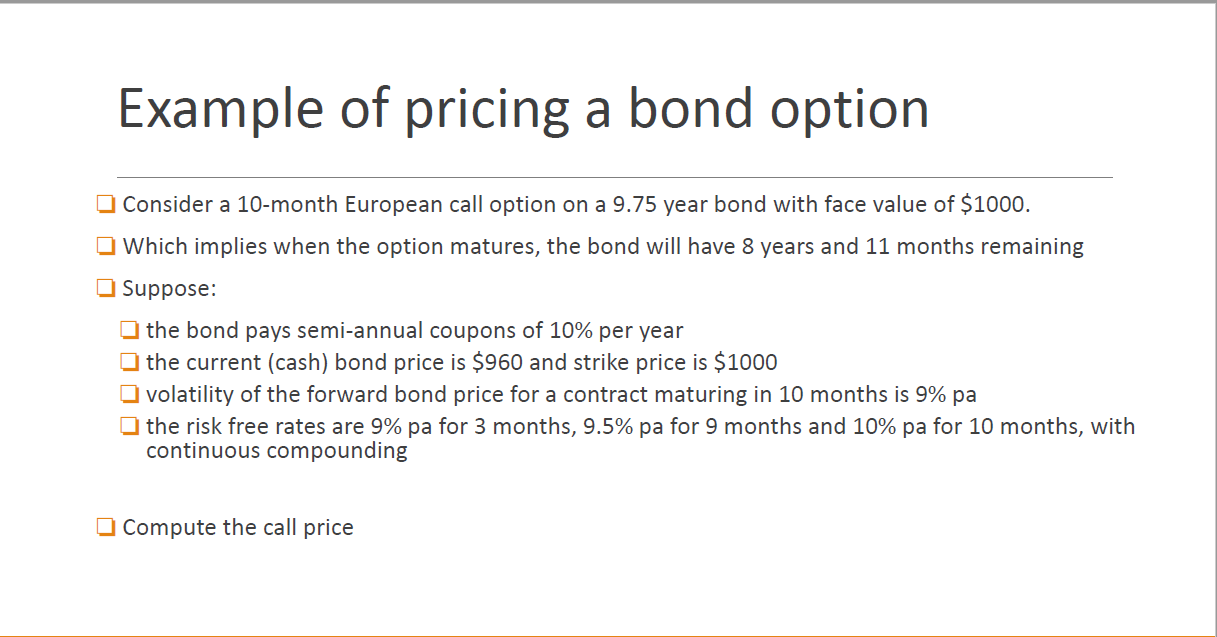

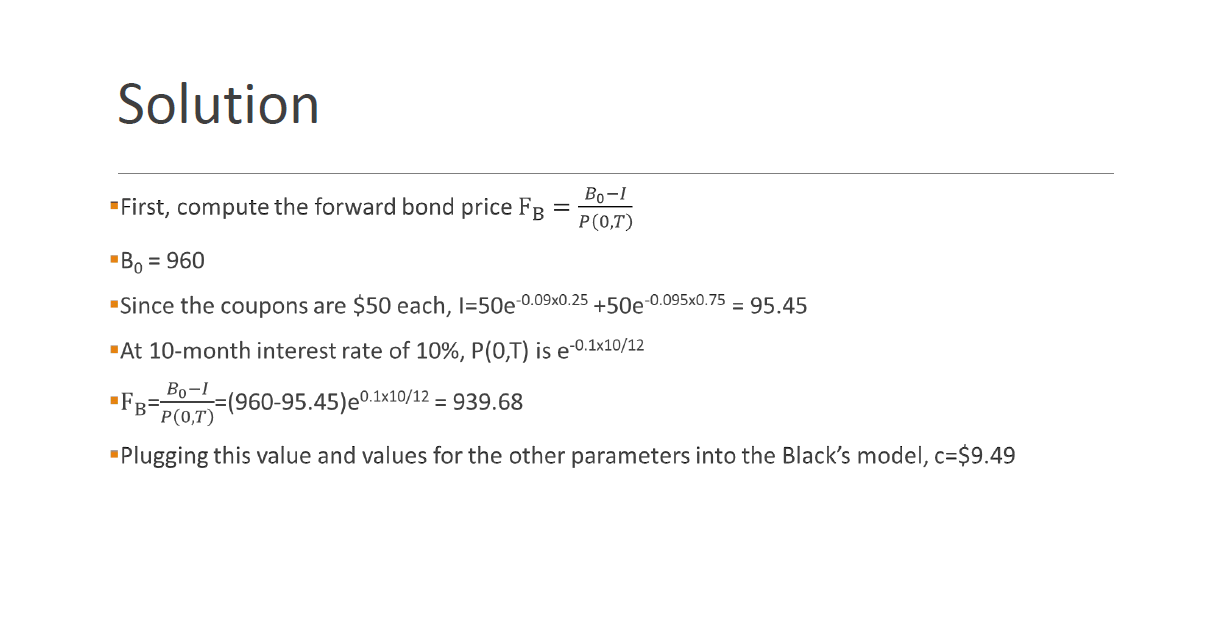

How is the forward bond price computed? -Forward price of an asset is its spot price less the present value of dividends between the valuation date and the maturity date, then forward valued by dividing by the price of a zero coupon bond that pays $1 at maturity time T. So let B, be the current bond price, I is the present value of all of its coupons during [O, T) and P(0,T) is the price of a zero coupon bond that pays $1 at maturity time T. Then the vard price of the bond is: FB Bo-1 P(0,T) Example of pricing a bond option Consider a 10-month European call option on a 9.75 year bond with face value of $1000. Which implies when the option matures, the bond will have 8 years and 11 months remaining Suppose: the bond pays semi-annual coupons of 10% per year the current (cash) bond price is $960 and strike price is $1000 volatility of the forward bond price for a contract maturing in 10 months is 9% pa the risk free rates are 9% pa for 3 months, 9.5% pa for 9 months and 10% pa for 10 months, with continuous compounding Compute the call price Solution Bo-1 - First, compute the forward bond price FB P(0,7) -Bo = 960 Since the coupons are $50 each, 1=50e-0.09x0.25 +50e-0.095x0.75 = 95.45 -At 10-month interest rate of 10%, P(0,T) is e-0.1x10/12 Bo-1 -F3 =1960-95.45)0.1x10/12 = 939.68 P(0,7) Plugging this value and values for the other parameters into the Black's model, c=$9.49 How is the forward bond price computed? -Forward price of an asset is its spot price less the present value of dividends between the valuation date and the maturity date, then forward valued by dividing by the price of a zero coupon bond that pays $1 at maturity time T. So let B, be the current bond price, I is the present value of all of its coupons during [O, T) and P(0,T) is the price of a zero coupon bond that pays $1 at maturity time T. Then the vard price of the bond is: FB Bo-1 P(0,T) Example of pricing a bond option Consider a 10-month European call option on a 9.75 year bond with face value of $1000. Which implies when the option matures, the bond will have 8 years and 11 months remaining Suppose: the bond pays semi-annual coupons of 10% per year the current (cash) bond price is $960 and strike price is $1000 volatility of the forward bond price for a contract maturing in 10 months is 9% pa the risk free rates are 9% pa for 3 months, 9.5% pa for 9 months and 10% pa for 10 months, with continuous compounding Compute the call price Solution Bo-1 - First, compute the forward bond price FB P(0,7) -Bo = 960 Since the coupons are $50 each, 1=50e-0.09x0.25 +50e-0.095x0.75 = 95.45 -At 10-month interest rate of 10%, P(0,T) is e-0.1x10/12 Bo-1 -F3 =1960-95.45)0.1x10/12 = 939.68 P(0,7) Plugging this value and values for the other parameters into the Black's model, c=$9.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts