Question: Course Code: EACC506 Registration Number: Instructions: a. Attempt all questions given below in your own handwriting. Assignment in typed format will not be considered for

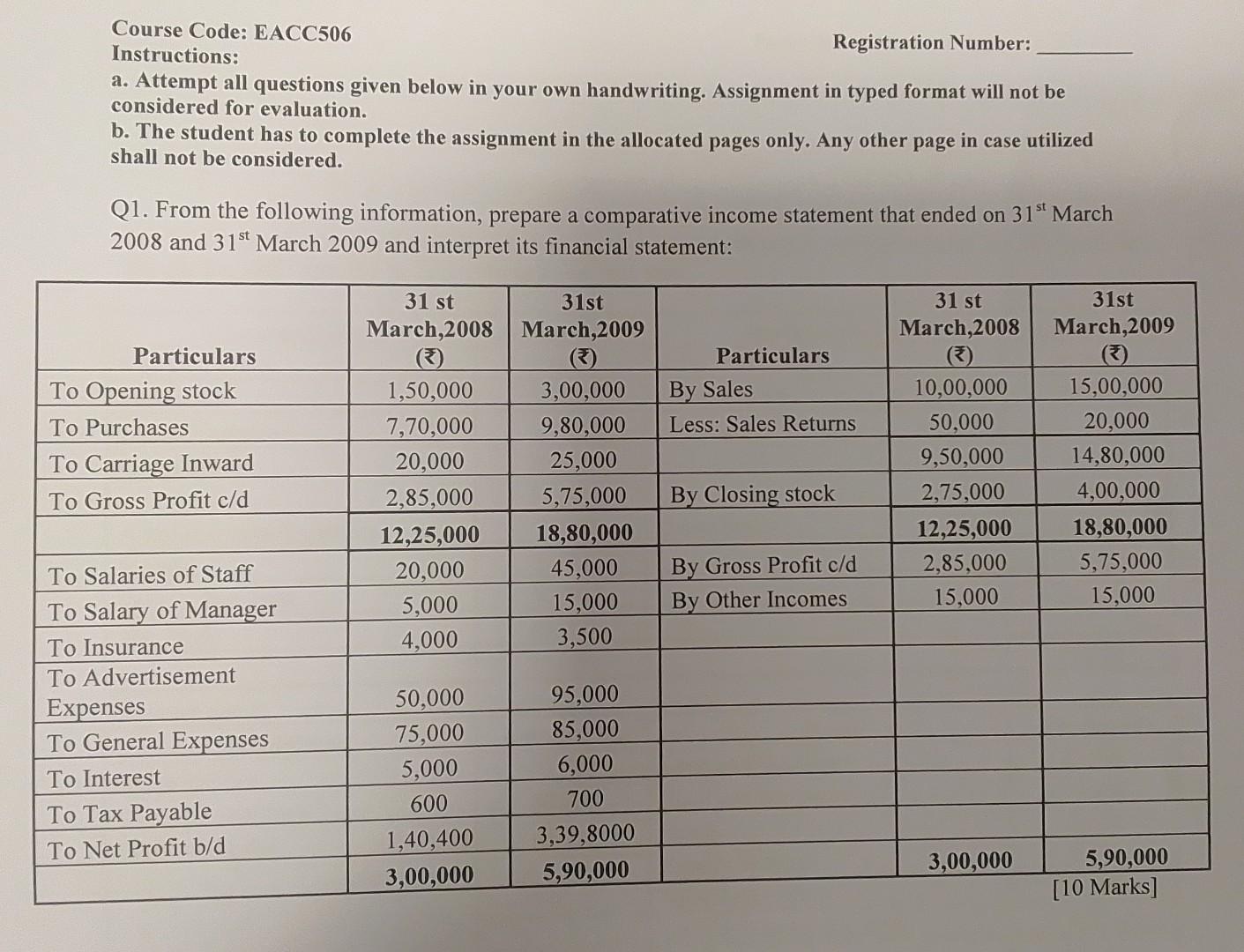

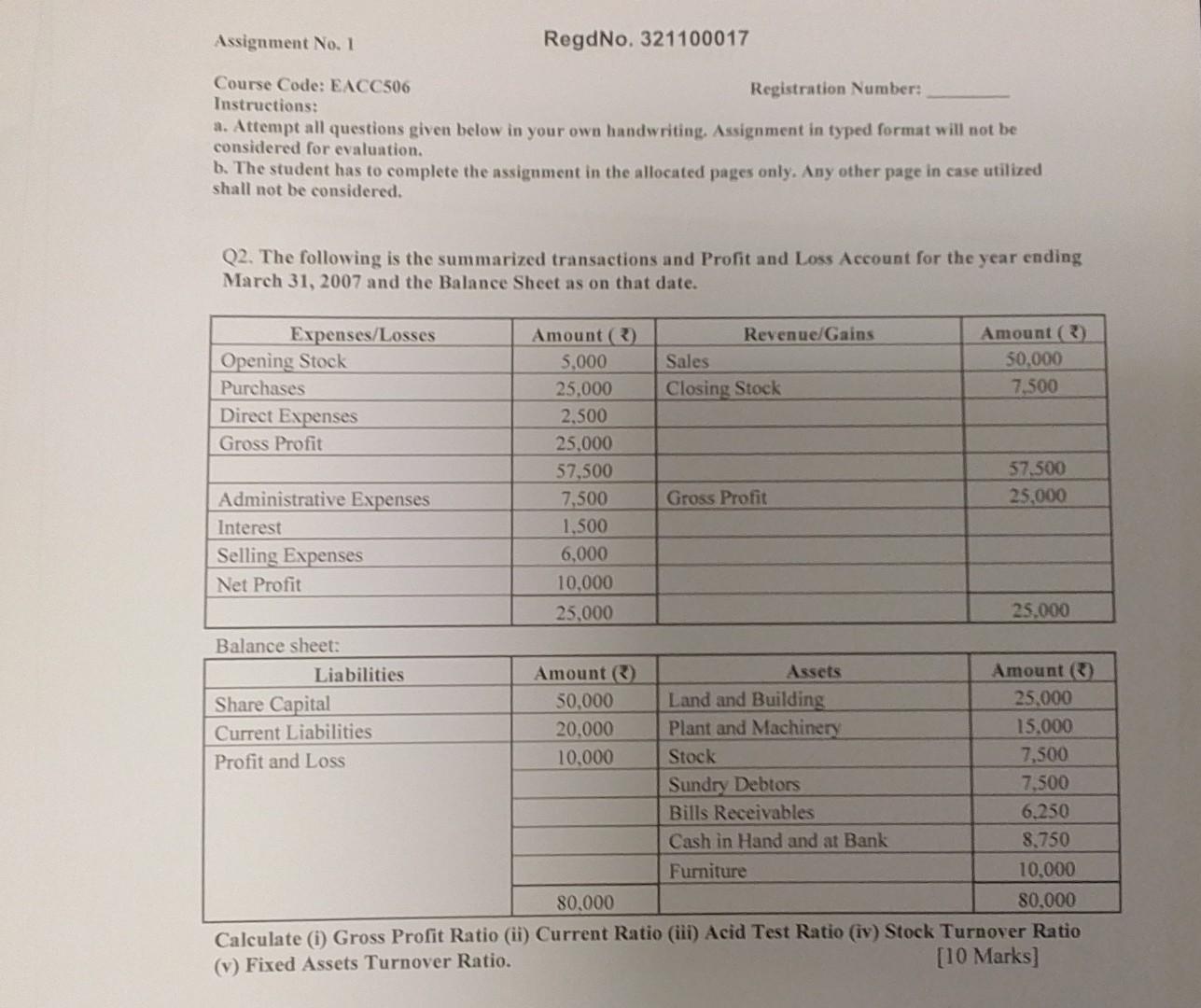

Course Code: EACC506 Registration Number: Instructions: a. Attempt all questions given below in your own handwriting. Assignment in typed format will not be considered for evaluation. b. The student has to complete the assignment in the allocated pages only. Any other page in case utilized shall not be considered. Q1. From the following information, prepare a comparative income statement that ended on 31" March 2008 and 31st March 2009 and interpret its financial statement: 31 st 31st March 2008 March 2009 31 st March 2008 31st March 2009 Particulars To Opening stock To Purchases To Carriage Inward To Gross Profit c/d Particulars By Sales Less: Sales Returns By Closing stock 1,50,000 7,70,000 20,000 2,85,000 12,25,000 20,000 5,000 4,000 3,00,000 9,80,000 25,000 5,75,000 18,80,000 45,000 15,000 3,500 10,00,000 50,000 9,50,000 2,75,000 12,25,000 2,85,000 15,000 15,00,000 20,000 14,80,000 4,00,000 18,80,000 5,75,000 15,000 By Gross Profit c/d By Other Incomes To Salaries of Staff To Salary of Manager To Insurance To Advertisement Expenses To General Expenses To Interest To Tax Payable To Net Profit b/d 50,000 75,000 5,000 600 1,40,400 3,00,000 95,000 85,000 6,000 700 3,39,8000 5,90,000 3,00,000 5,90,000 [10 Marks] Assignment No. 1 RegdNo. 321100017 Course Code: EACC506 Registration Number: Instructions: a. Attempt all questions given below in your own handwriting. Assignment in typed format will not be considered for evaluation. b. The student has to complete the assignment in the allocated pages only. Any other page in case utilized shall not be considered. Q2. The following is the summarized transactions and Profit and Loss Account for the year ending March 31, 2007 and the Balance Sheet as on that date. Expenses/Losses Amount Revenue/Gains Amount Opening Stock 5.000 Sales 50,000 Purchases 25,000 Closing Stock 7.500 Direct Expenses 2.500 Gross Profit 25.000 57,500 57.500 Administrative Expenses 7,500 Gross Profit 25,000 Interest 1,500 Selling Expenses 6,000 Net Profit 10,000 25,000 25.000 Balance sheet: Liabilities Amount @ Assets Amount Share Capital 50,000 Land and Building 25,000 Current Liabilities 20.000 Plant and Machinery 15.000 Profit and Loss 10,000 Stock 7.500 Sundry Debtors 7.500 Bills Receivables 6.250 Cash in Hand and at Bank 8,750 Furniture 10,000 80,000 80,000 Calculate (i) Gross Profit Ratio (ii) Current Ratio (iii) Acid Test Ratio (iv) Stock Turnover Ratio (v) Fixed Assets Turnover Ratio. [10 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts