Question: Course Content / Chapter 1 1 / HM 0 3 HM 0 3 Required a . On January 1 , record the entry for (

Course Content Chapter HM

HM

Required

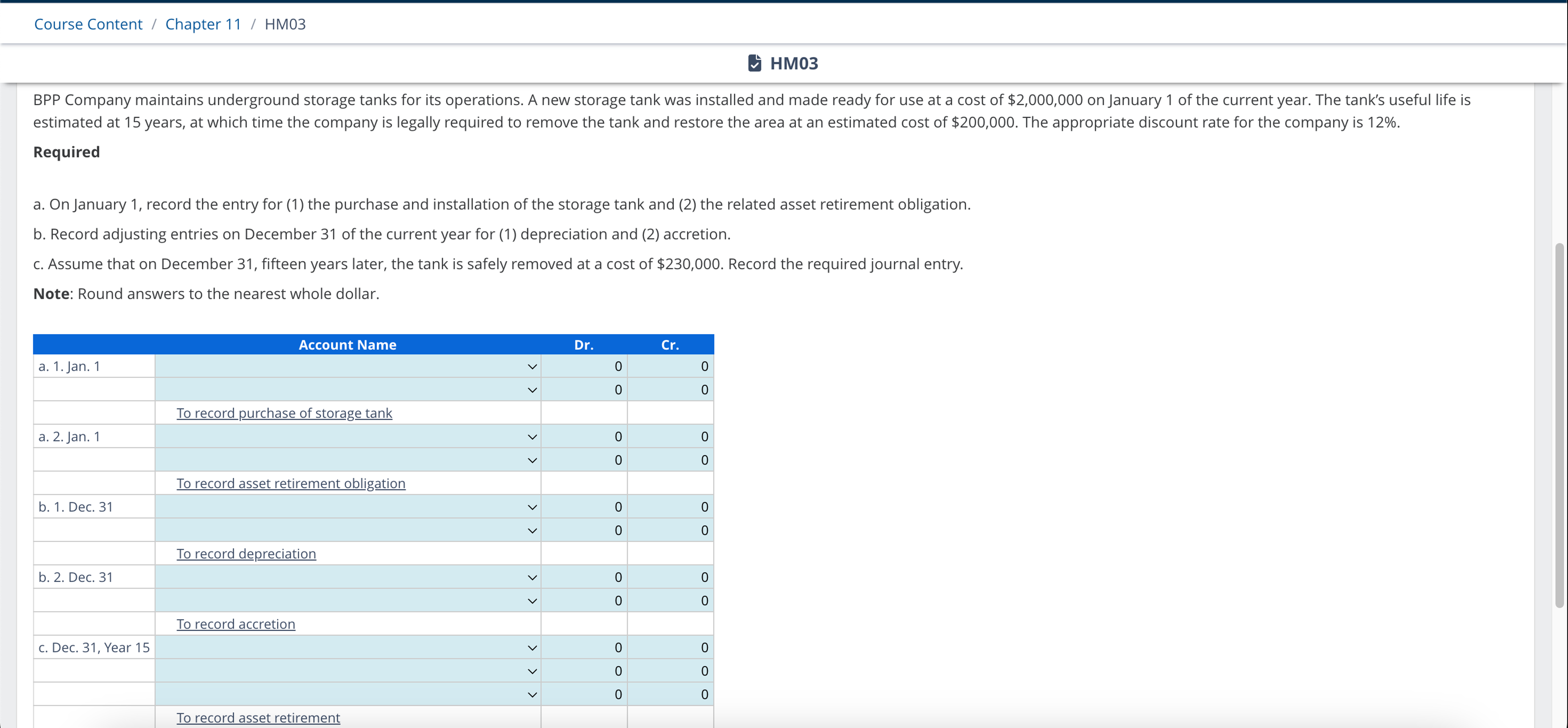

a On January record the entry for the purchase and installation of the storage tank and the related asset retirement obligation.

b Record adjusting entries on December of the current year for depreciation and accretion.

c Assume that on December fifteen years later, the tank is safely removed at a cost of $ Record the required journal entry.

Note: Round answers to the nearest whole dollar.

tableAccount Name,DrCra Jan. To record purchase of storage tank,,a Jan. To record asset retirement obligation,,b Dec. To record depreciation,,b Dec. To record accretion c Dec. Year To record asset retirement,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock