Question: Course Content / Chapter 14 Chapter 14 Homework Questions Partrany correct MBTK 0:43 06:35 Entries for HTM Debt Securities: Effective Interest Method On July 1

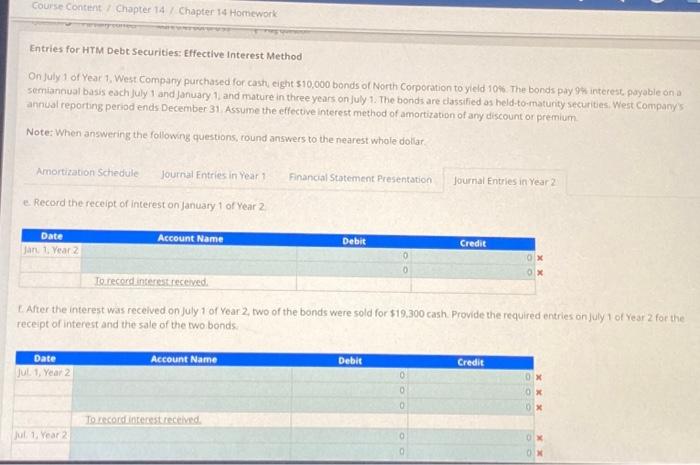

Entries for HTM Debt Securities: Effective Interest Method On July 1 of Year 1, West Compary purchased for cash eight $10,000 bonds of North Corporation to yeld 10%. The bonds pily 94 interest, payabie on is semiannual basis each July 1 and january 1 , and mature in three years on july 1. The bonds are dassified as held-to-maturity securities, West company's annual reporting period ends December 31 . Assume the effective interest method of amortization of any discount or premium. Note: When answering the followng questions, cound answers to the nearest whole dollar e. Record the receipt of interest on January 1 of Year 2 E. After the interest was recelved on July 1 of Year 2 , two of the bonds were sold for $19,300 cash. Provide the required entries on july 1 of Year 2 for the receipt of interest and the sale of the two bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts