Question: Course Content / Graded Assignments / Module 13 and 14 Graded Assignment Estimating Share Value Using the ROPI Model Module 13 and 14 Graded

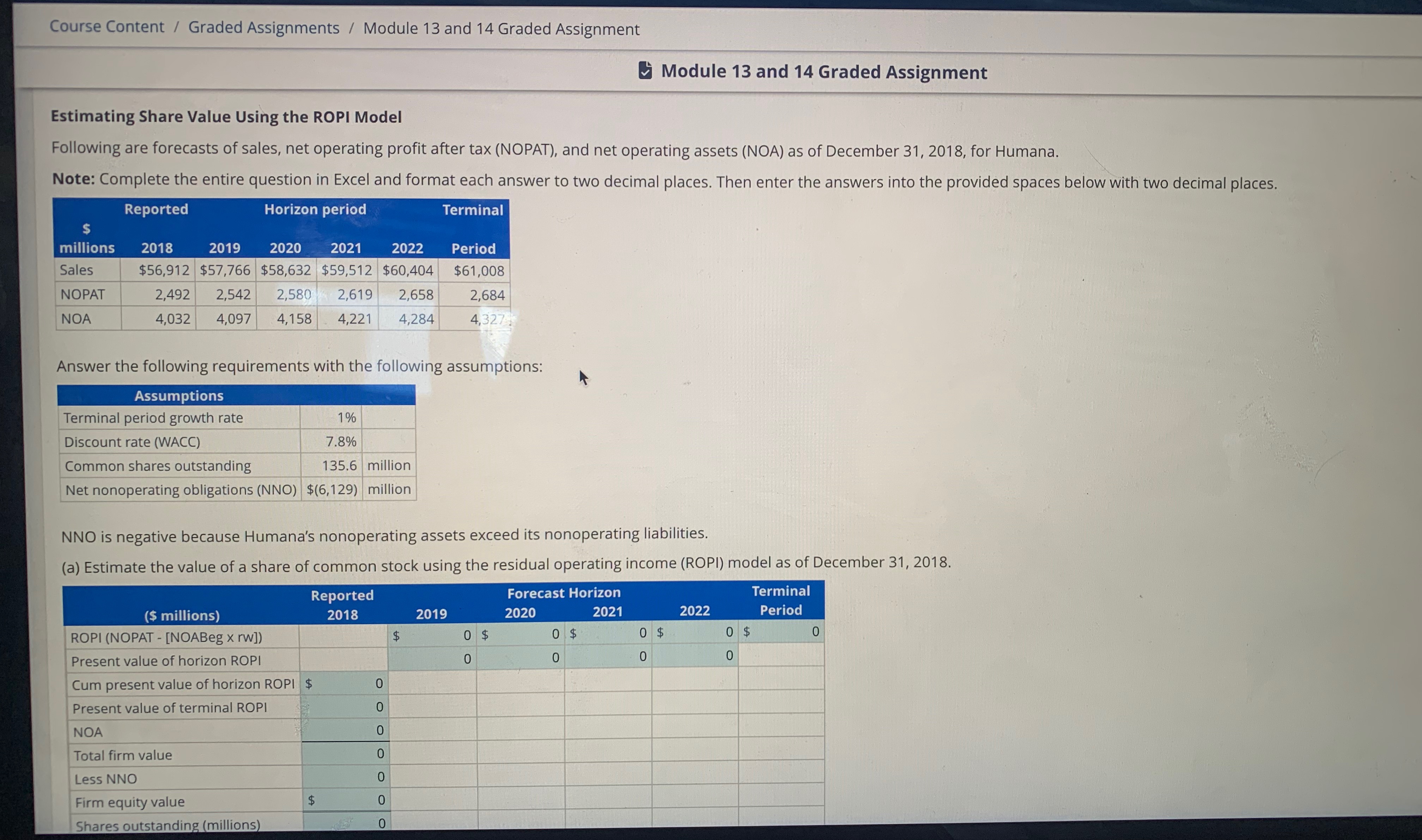

Course Content / Graded Assignments / Module 13 and 14 Graded Assignment Estimating Share Value Using the ROPI Model Module 13 and 14 Graded Assignment Following are forecasts of sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 31, 2018, for Humana. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Horizon period Terminal $ millions Sales NOPAT NOA 2018 2019 2020 2021 2022 Period $56,912 $57,766 $58,632 $59,512 $60,404 $61,008 2,492 2,542 2,580 2,619 2,658 4,032 4,097 4,158 4,221 4,284 2,684 4,327 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate 1% 7.8% 135.6 million Discount rate (WACC) Common shares outstanding Net nonoperating obligations (NNO) $(6,129) million NNO is negative because Humana's nonoperating assets exceed its nonoperating liabilities. (a) Estimate the value of a share of common stock using the residual operating income (ROPI) model as of December 31, 2018. ($ millions) Reported 2018 Forecast Horizon 2019 2020 2021 2022 Terminal Period ROPI (NOPAT - [NOABeg x rw]) Present value of horizon ROPI $ 0 $ 0 $ 0 0 0 $ 0 0 $ 0 0 0 0 0 0 0 $ 0 Cum present value of horizon ROPI $ Present value of terminal ROPI NOA Total firm value Less NNO Firm equity value Shares outstanding (millions) tA 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts