Question: Course: Financial Case Study Read the passage to answer the questions. Teacher Artificial Intelligence Device A new project being considered by California Intel Corp (CIC),

Course: Financial Case Study

Read the passage to answer the questions.

Teacher Artificial Intelligence Device

A new project being considered by California Intel Corp (CIC), a large Los Angeles-based technology company. CIC's research and development department has been applying its expertise in microprocessor technology to develop a small computer designed to control office appliances. Once programmed, the computer will automatically control the heating and air-conditioning systems, security system, fax and copy machines, scanners and even small printers. By increasing an office's energy efficiency, the computer can cut costs enough to pay for itself within a few years.

Development has now reached the stage where a decision must be made about whether or not to go forward with full-scale production. CIC's marketing vice president believes that annual sales would be 20,000 units if the units were priced at $3,000 each, so annual sales are estimated at $60 million. CIC expects no growth in unit sales, and it believes that the unit price will rise by 2 percent each year. The necessary equipment would be purchased and installed in late 2007, and it would be paid for on December 31, 2007. The equipment would fall into the MACRS 5-year class, and it would cost $8 million, including transportation and installation.

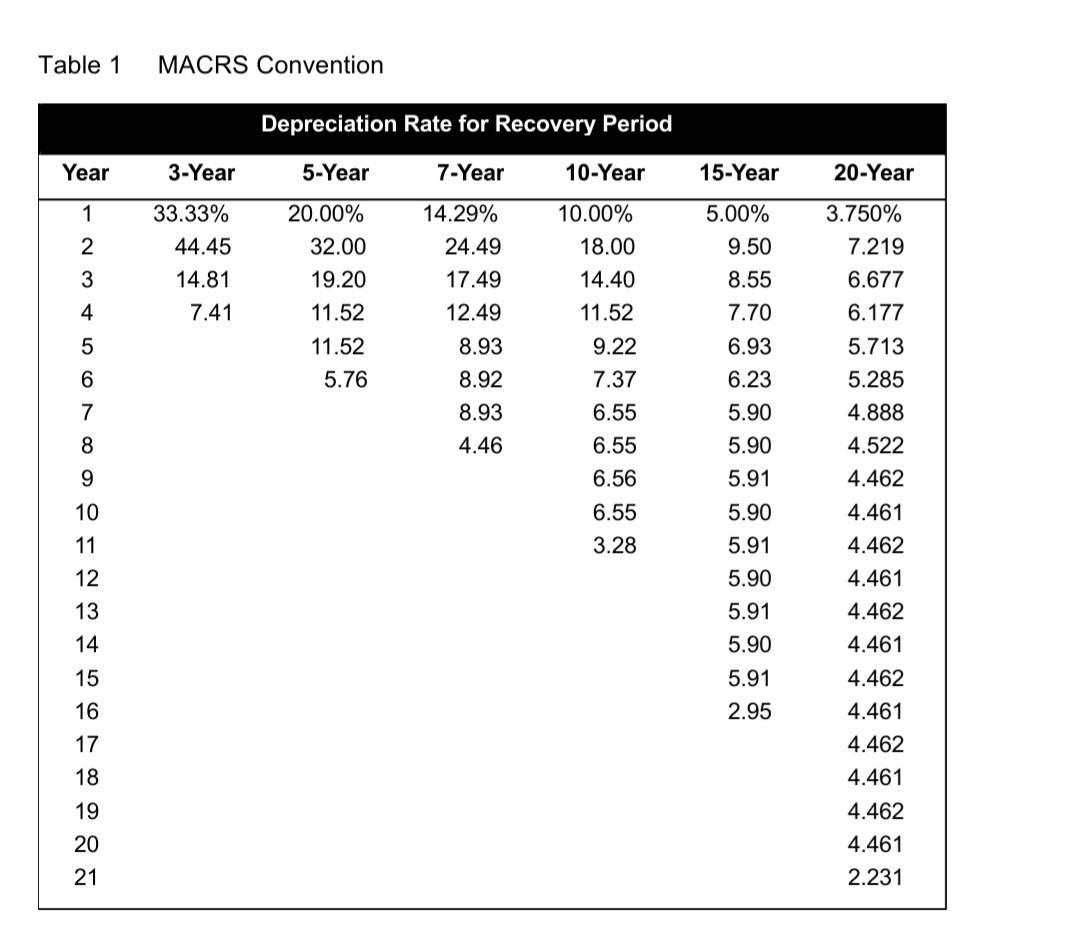

The project's estimated economic life is four years. At the end of that time, the equipment is expected to have a market value matching the book value. The production department has estimated that variable manufacturing costs would be $2,100 per unit, and that fixed overhead costs, excluding depreciation, would be $8 million a year. They expect variable costs to rise by 2 percent per year, and fixed costs to rise by 1 percent per year. Depreciation expenses would be determined in accordance with MACRS rates (Schedule shown below). CIC's marginal tax rate is 40 percent; its cost of capital is 12 percent; and, for capital budgeting purposes, the company's policy is to assume that operating cash flows occur at the end of each year. Because the plant would begin operations on January 1, 2008, the first operating cash flows would occur on December 31, 2008.

Assume that you have been assigned to conduct the capital budgeting analysis.

1) List three (3) possible implications should the firm delay the project for at a year. [3 marks]

2) Why is there a general emphasis on cash flows as opposed to net income or accounting profits? [5 marks]

3)Explain the following terms: (i) incremental cash flow (ii) sunk cost. [4 marks]

4)Construct a table to show the annual depreciation expenses and the ending book value for each year. [8 marks]

5)Construct annual incremental operating cash flow statements for the four years. [20 marks]

6)There is an offer to purchase the microprocessor technology for $750M to be paid over 3 years. However, there are two options to receive payments. Option 1 has a receipt of $250M up front, followed by receipts of $150M, $150M, and $200M in years 1, 2, and 3 respectively. Option 2 has a receipt of $400M up front, followed by a single receipt of $350M in year 3. Determine which option should be preferred by California Intel Corp. Assume the 12% interest rates hold. [8 marks]

Table 1 MACRS Convention Depreciation Rate for Recovery Period Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 1 2 33.33% 44.45 14.81 7.41 3 20.00% 32.00 19.20 11.52 11.52 5.76 4 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5 6 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 7 8 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 9 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 10 11 12 13 14 15 16 17 18 19 20 4.462 4.461 2.231 21 Table 1 MACRS Convention Depreciation Rate for Recovery Period Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 1 2 33.33% 44.45 14.81 7.41 3 20.00% 32.00 19.20 11.52 11.52 5.76 4 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5 6 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 7 8 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 9 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 10 11 12 13 14 15 16 17 18 19 20 4.462 4.461 2.231 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts