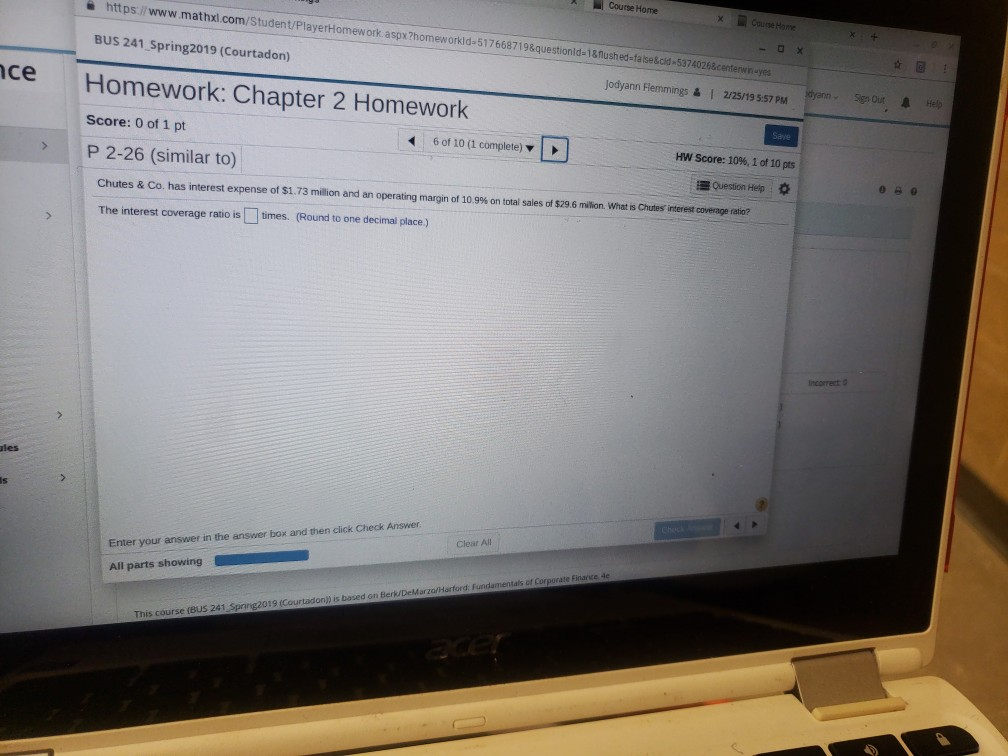

Question: Course Home https BUS 241 Spring2019 (Courtadon) Homework: Chapter 2 Homework Score: 0 of 1 pt P 2-26 (similar to) www.mathxi com Student/PlayerHomework aspx?homeworkld-51766871 9&questionld-ianushedtabeko.5g740260ere

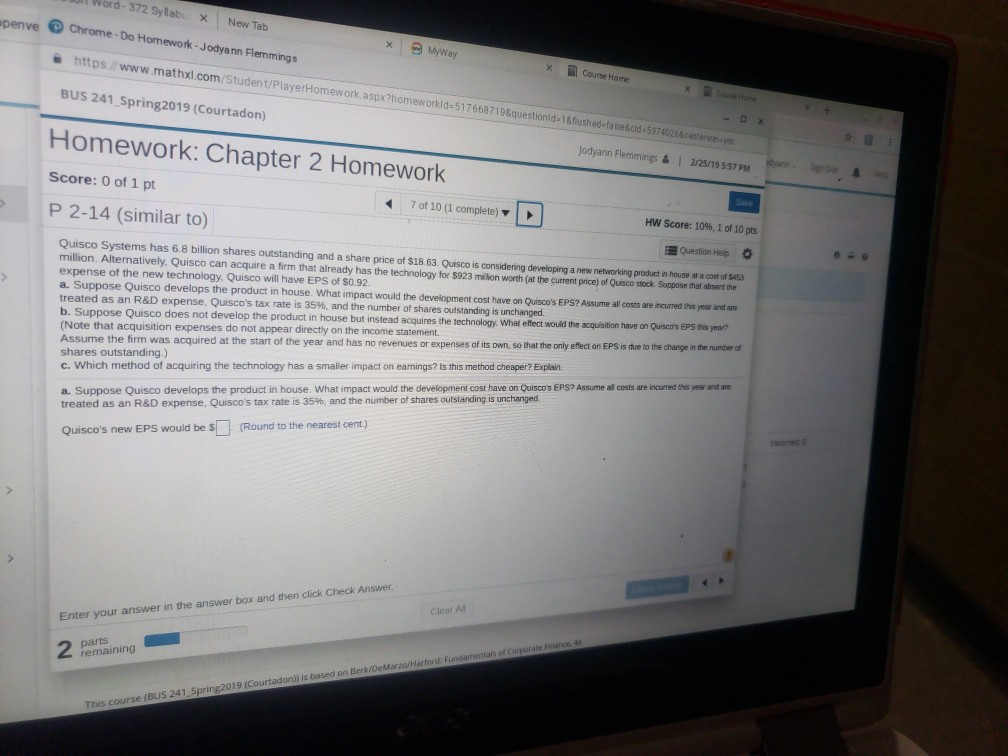

Course Home https BUS 241 Spring2019 (Courtadon) Homework: Chapter 2 Homework Score: 0 of 1 pt P 2-26 (similar to) www.mathxi com Student/PlayerHomework aspx?homeworkld-51766871 9&questionld-ianushedtabeko.5g740260ere wr Couse Home ce Jodyann Flemmings& 225/19557 PM SgnOut Help Save 60t 10 (1 complete) HWScore: 10%, 1 of 10 pts Question Help chutes & Co. has interest expense of S1 73 million and an operating margin of 10.9% on total sales of $29.6 milion whats nutes i terest coverage to? The interest coverage ratio is times. (Round to one decimal place.) Incorrect les Clear All Enter your answer in the answer box and then click Check Answer All parts showing is based on Berk/DeMarzarHarford: Fundamentals of Corporate Finarce 4e This course (BUS 241 Spring2019 (C t word . 372 Syllabi | New Tab Chrome- Do Homework-Jodyann Flemmings e https/www.mathxi.com/Student/PlayerHomework BUS 241 Spring2019 (Courtadon) xyWay Couse Home PlayerHomew ork.aspx?homeworkld-517668719&questionld-1&flushed- faise &cld-53740268centerwn Jodyann Flemmings Homework: Chapter 2 Homework 2/25/19557 PM Score: 0 of 1 pt ave 4-7 of 10(1 complete) P 2-14 (similar to) L HW Score: 10%, 1 of 10 pts Question Hep Quisco Systems has 6.8 billion shares outstanding and a share price of $18.63. Quisco is considening developing a new networking product in house at a cost of S453 million. Alternatively. Quisco can acquire a firm that already has the technology for $923 millon worth (at the current price) of Quisco stock. Suppose that ahsent the expense of the new technology, Quisco will have EPS of $0.92 a. Suppose Quisco develops the product in house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense. Quscos tax rate is 35%, and the number of shares outstanding is unchanged. Quisco does not develop the product in house but instead acquires the technology. What effect wouid the acquisition have on Quisca's EPS this ymar Note that acquisition expenses do not appear directly on the income statement Assume the firm was acquired at the start of the year and has no revenues or ex shares outstanding.) c. Which method of acquiring the technology has a smaliler impact on earnings? Is this method cheaper? Explair. penses of its own, so that the only effect on EPS is due to the change in the number of a Suppose Quisco develops the product in house. What impact would the development cost have on Quisco's EPS? Assume al costs are incurred this year and are treated as an R&D expense, Quiscos tax rate is 35%, and the number of shares outstanding is unchanged. Quisco's new EPS would be (Round to the nearest cent) Clear Al Enter your answer in the answer box and then click Check Answer pars remaining adon)) is based on Berk/DeMa course (BUs 241 Spring2019 (Court

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts