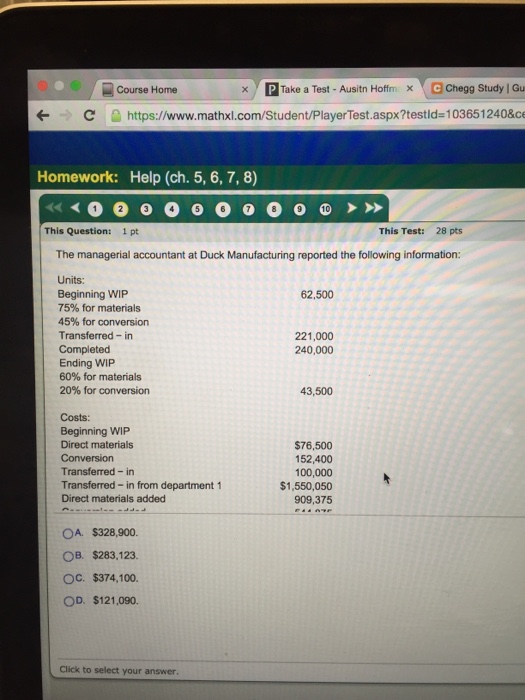

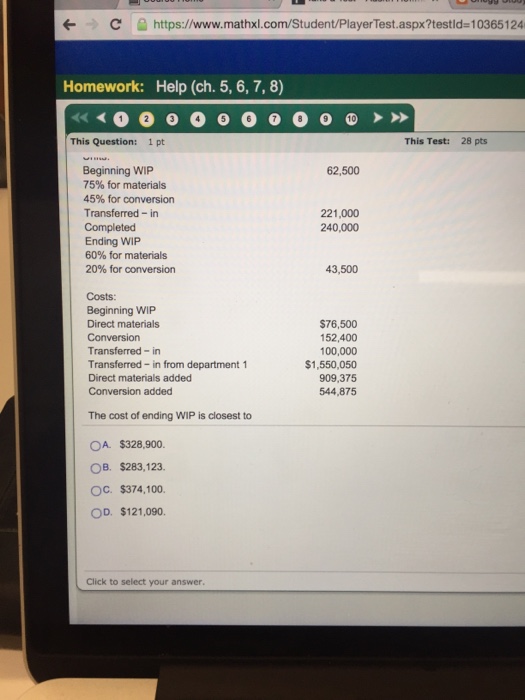

Question: Course Home Take a Test-Ausitn Hoffm)>> This question: 1 pt This Test: 28 pts The managerial accountant at Duck Manufacturing reported the following information: Units:

Course Home Take a Test-Ausitn Hoffm)>> This question: 1 pt This Test: 28 pts The managerial accountant at Duck Manufacturing reported the following information: Units: Beginning WIP 75% for materials 45% for conversion Transferred-in Completed Ending WIP 60% for materials 20% for conversion 62,500 221,000 240,000 43,500 Costs: Beginning WIP Direct materials Conversion Transferred-in Transferred- in from department 1 Direct materials added $76,500 152,400 100,000 $1,550,050 909,375 OA $328,900 OB. $283,123. OC. $374,100. OD. $121,090. Click to select your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock