Question: Course: Human Resources Management Project title: Reputation and Attraction Project assignment resources: Employer brand management I need a presentation with a ppt file, it would

Course: Human Resources Management

Project title: Reputation and Attraction

Project assignment resources: Employer brand management

I need a presentation with a ppt file, it would be great if it was about 7-8 pages

I would appreciate if you share the screenshot.

---------------------------------------------------

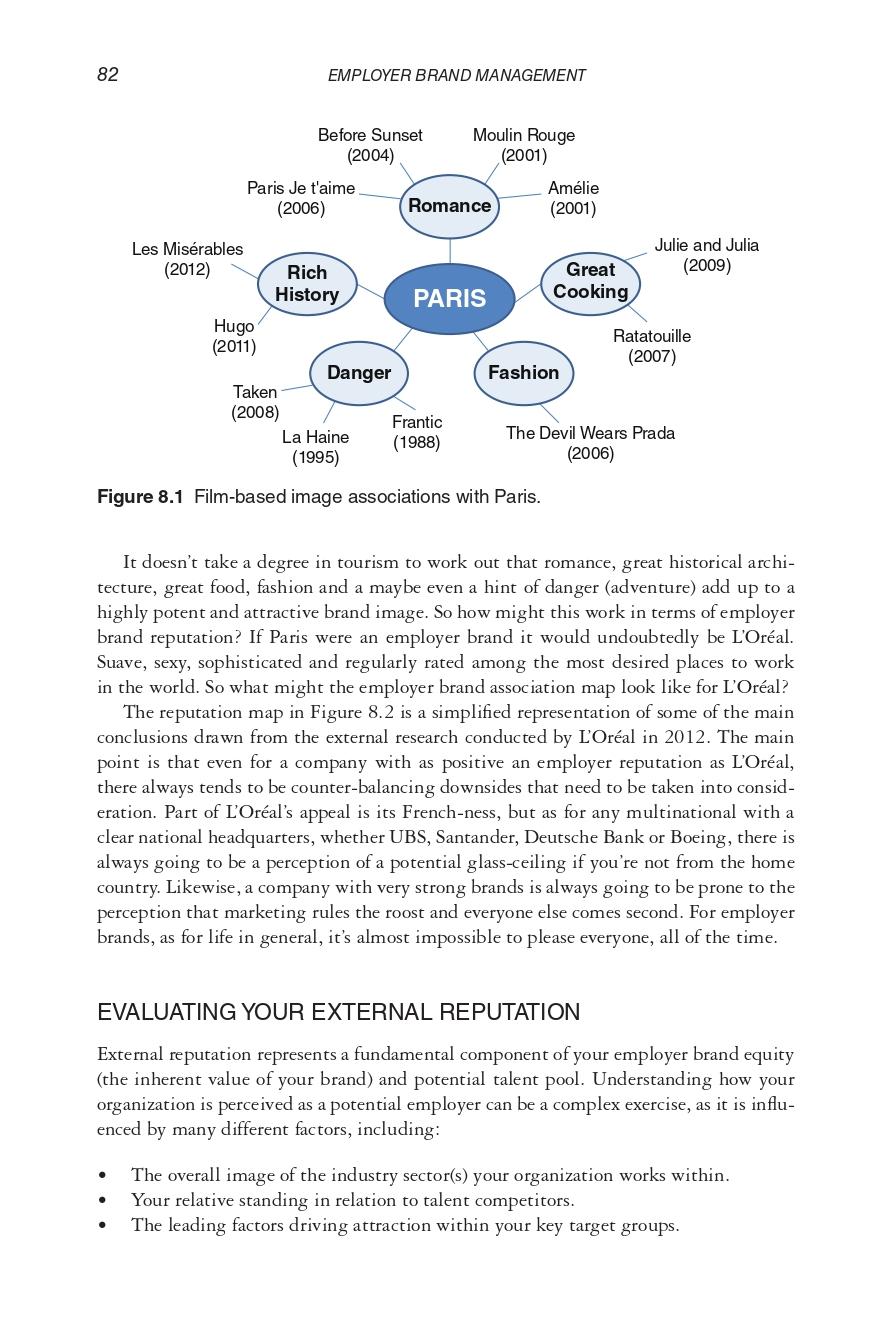

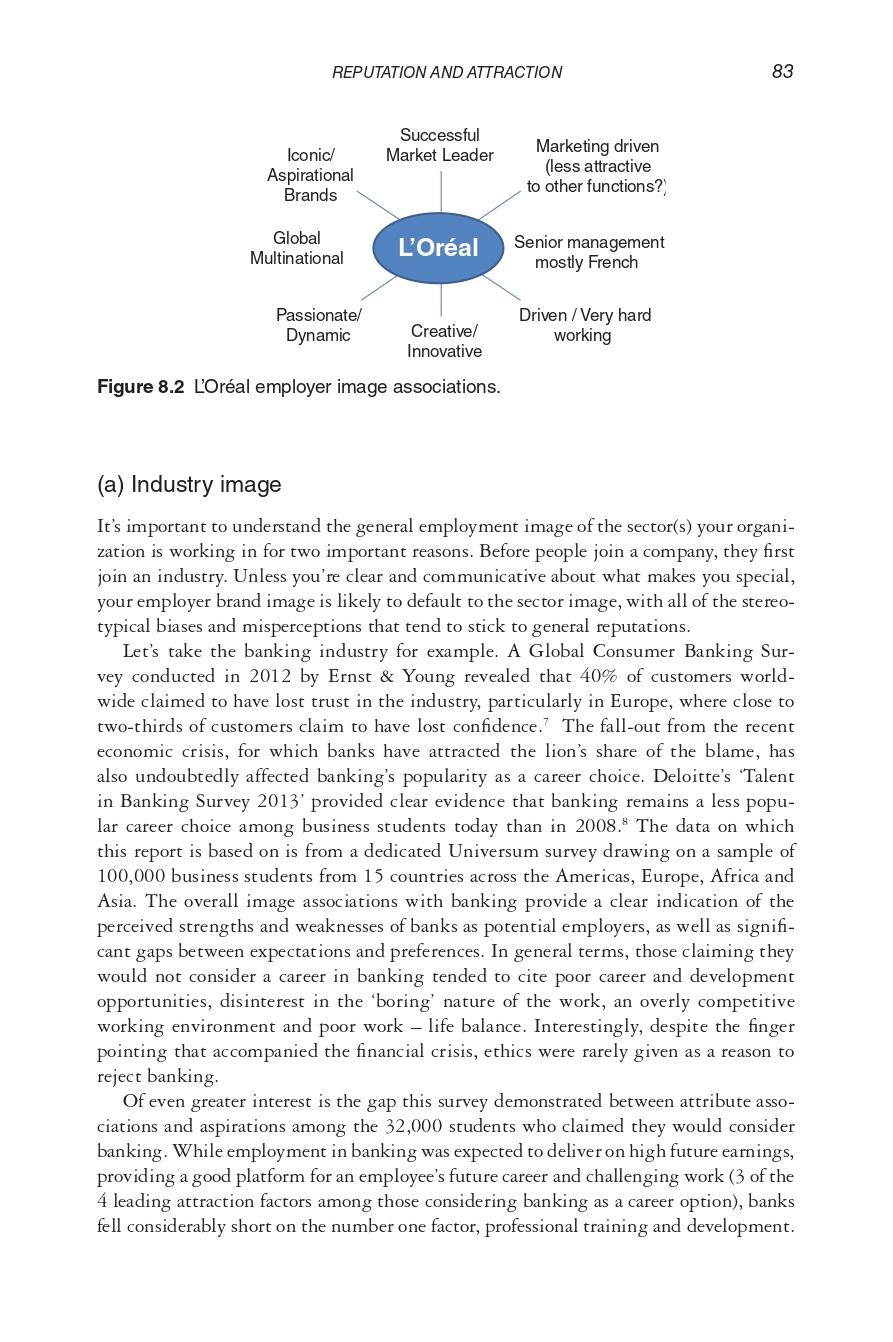

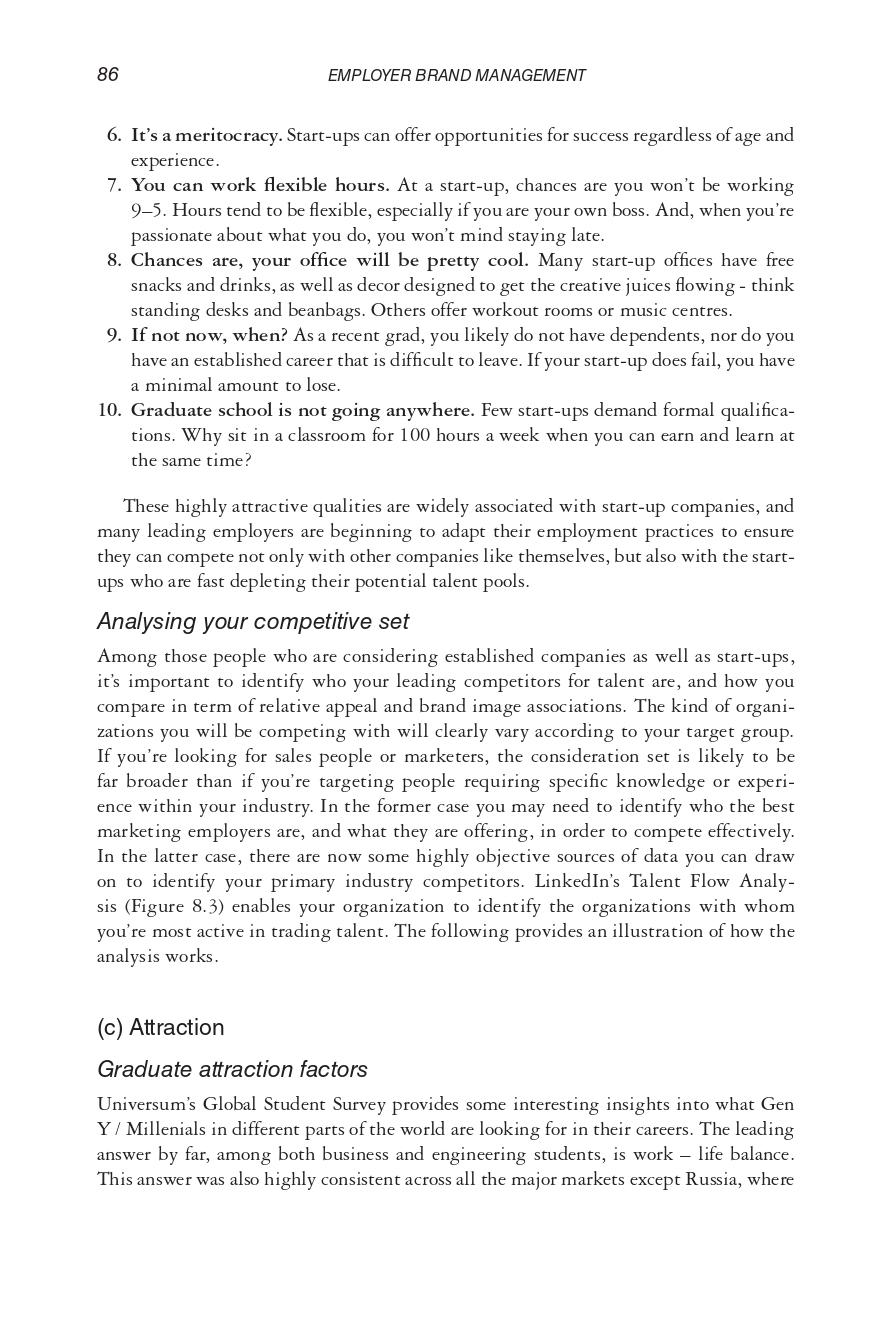

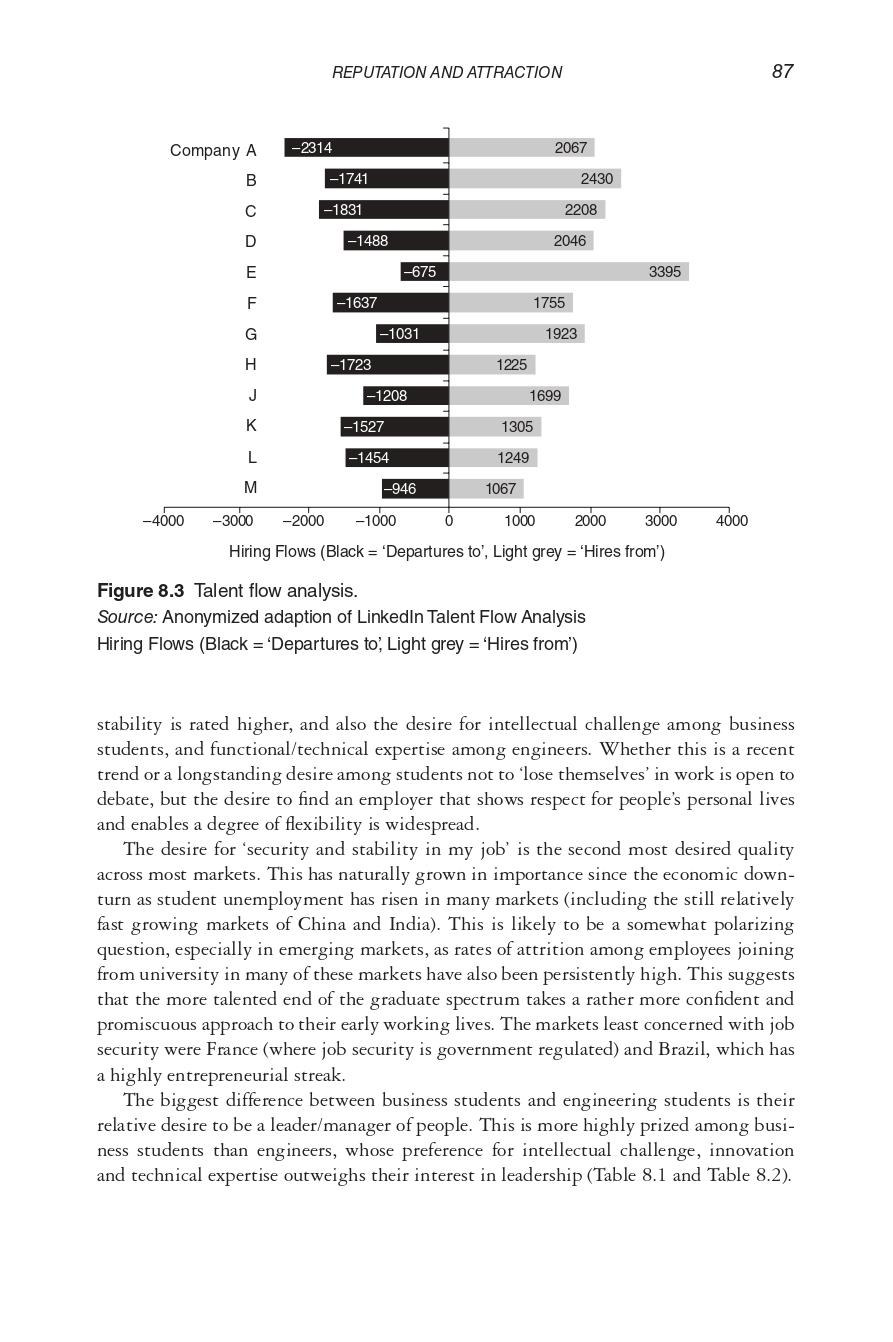

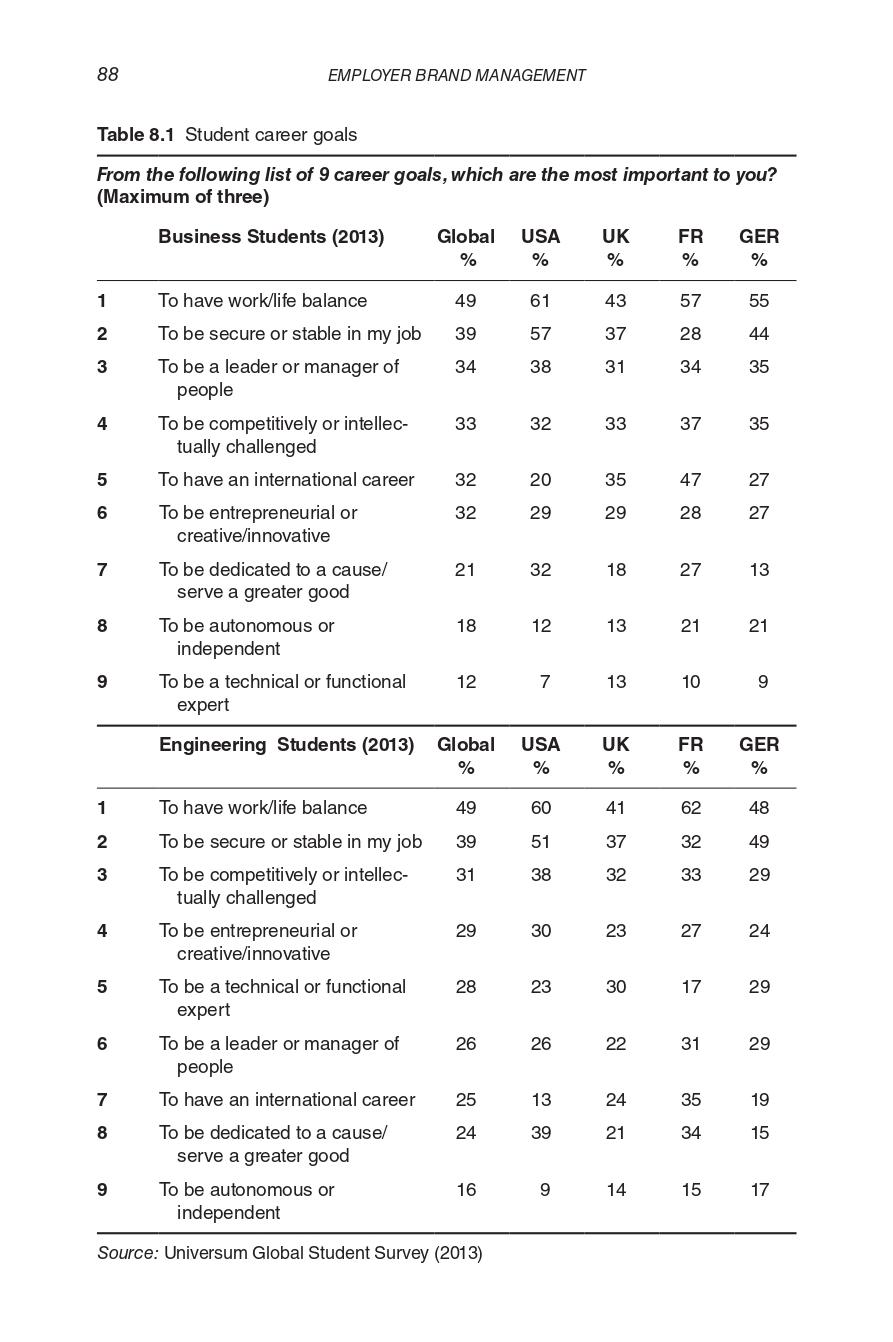

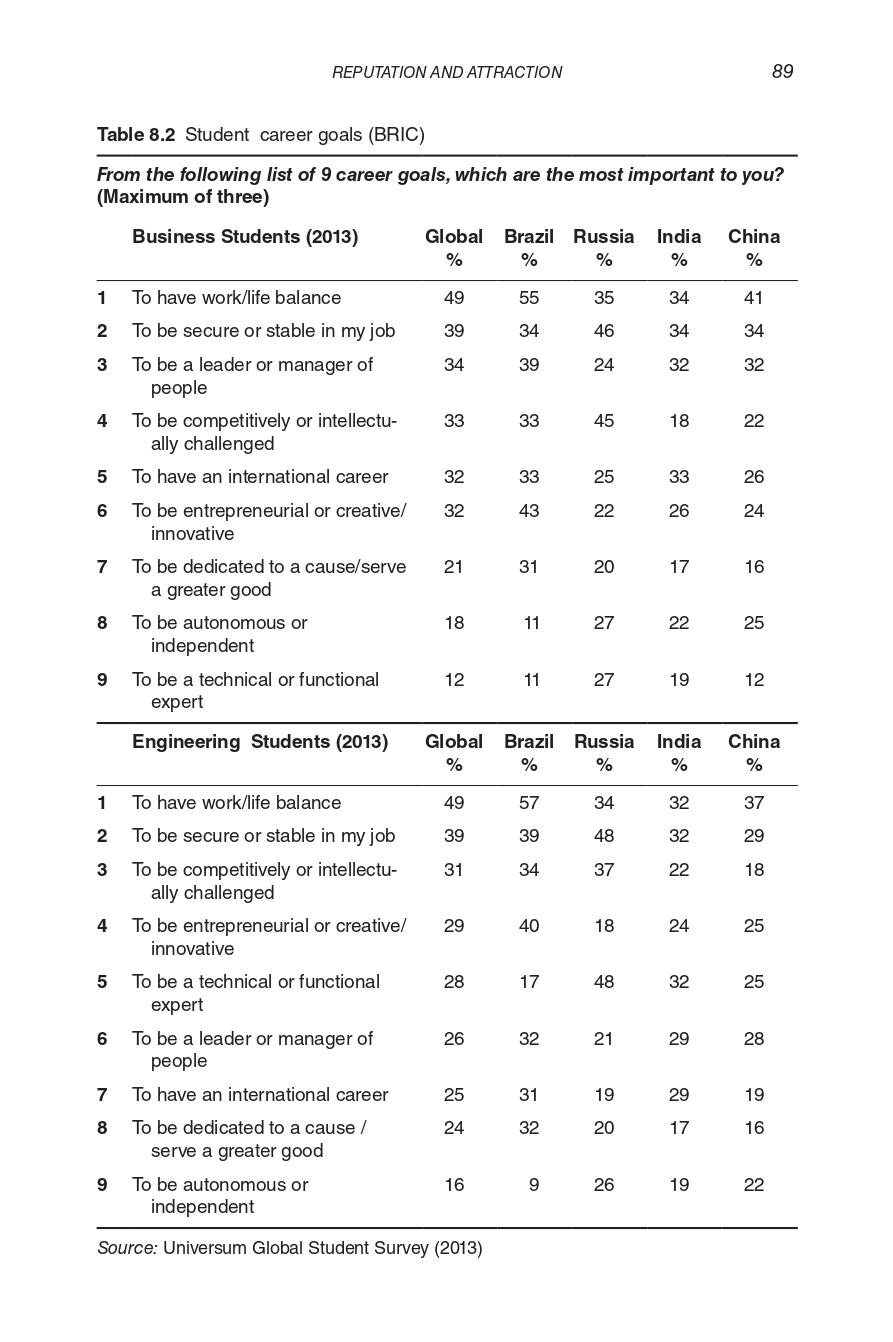

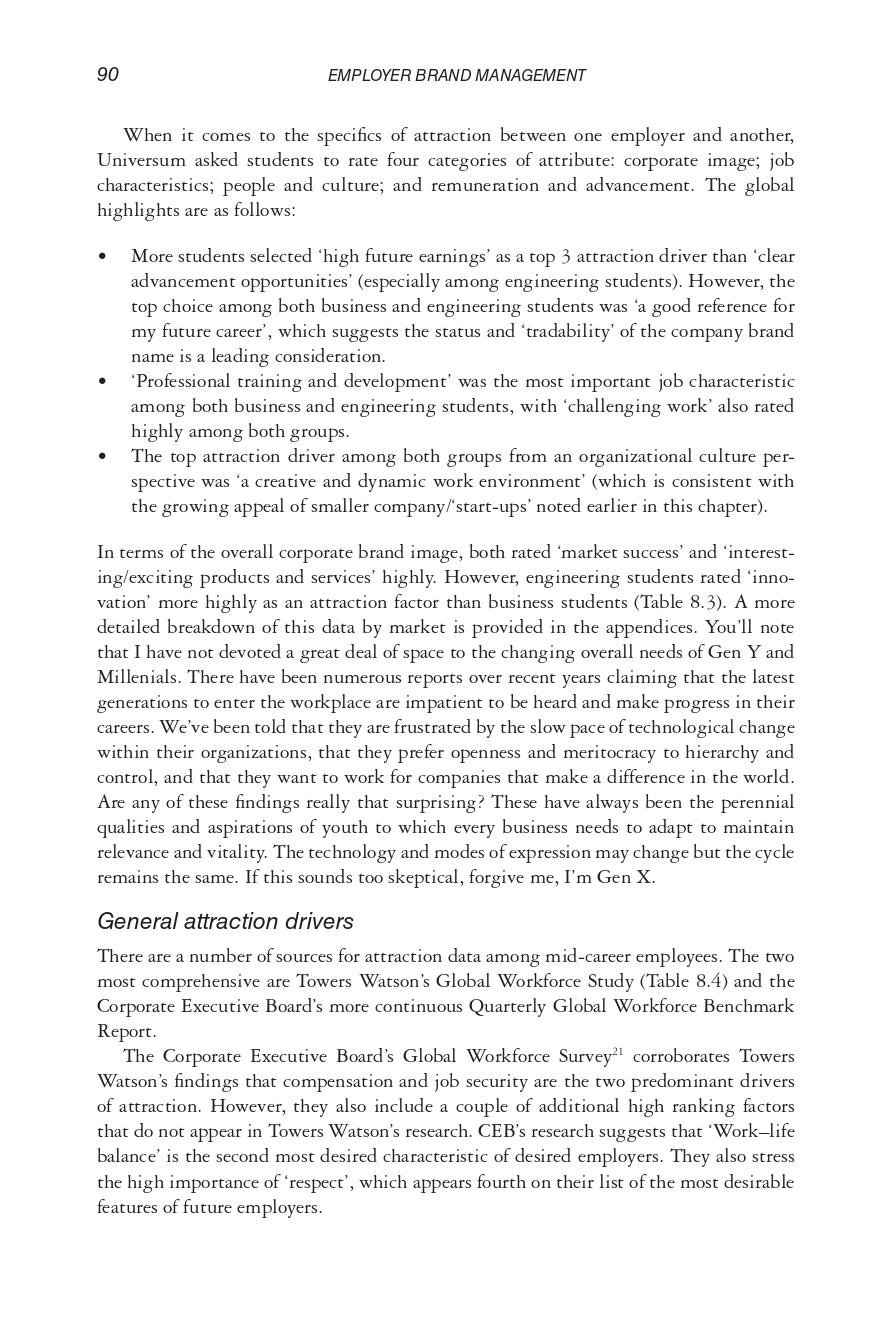

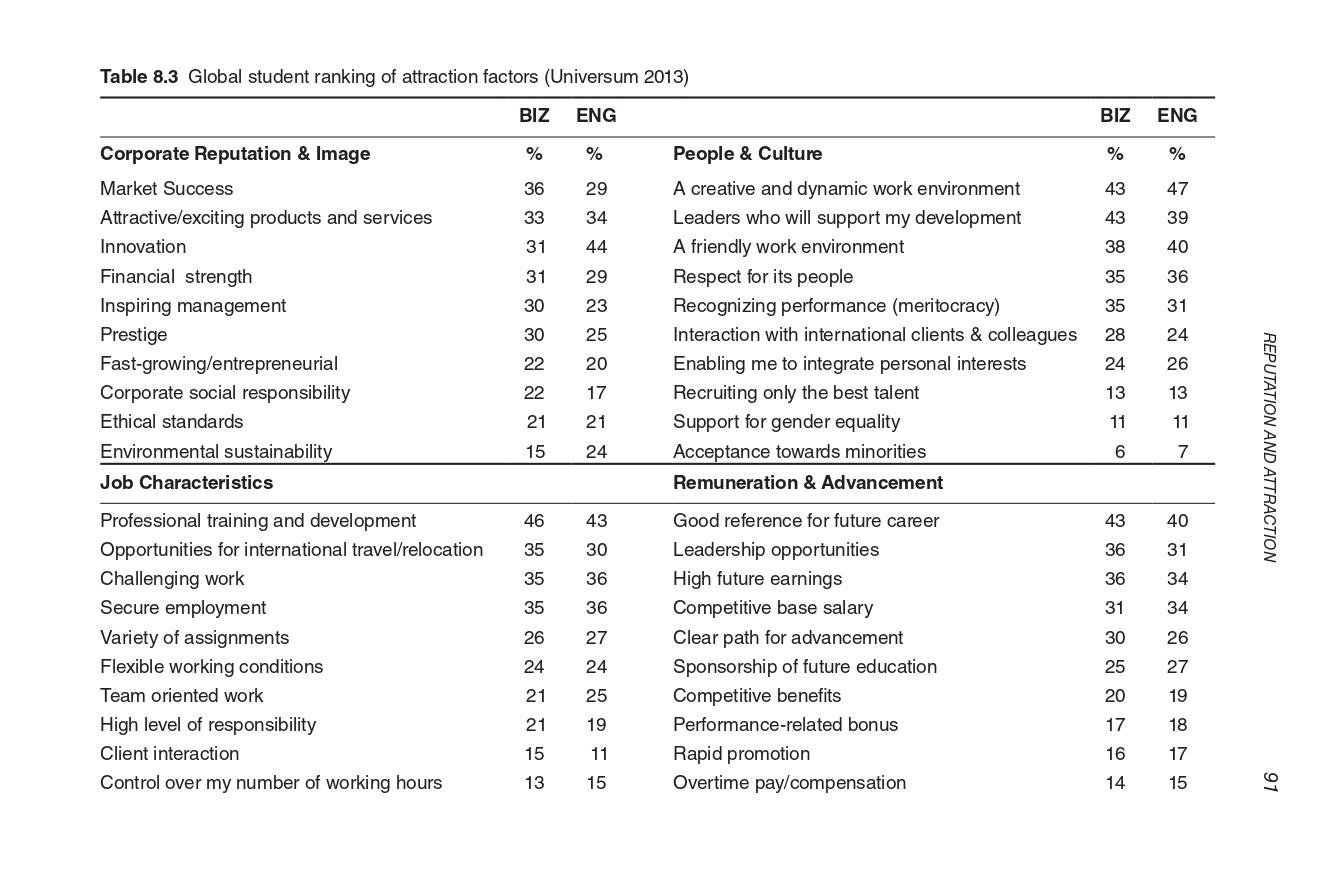

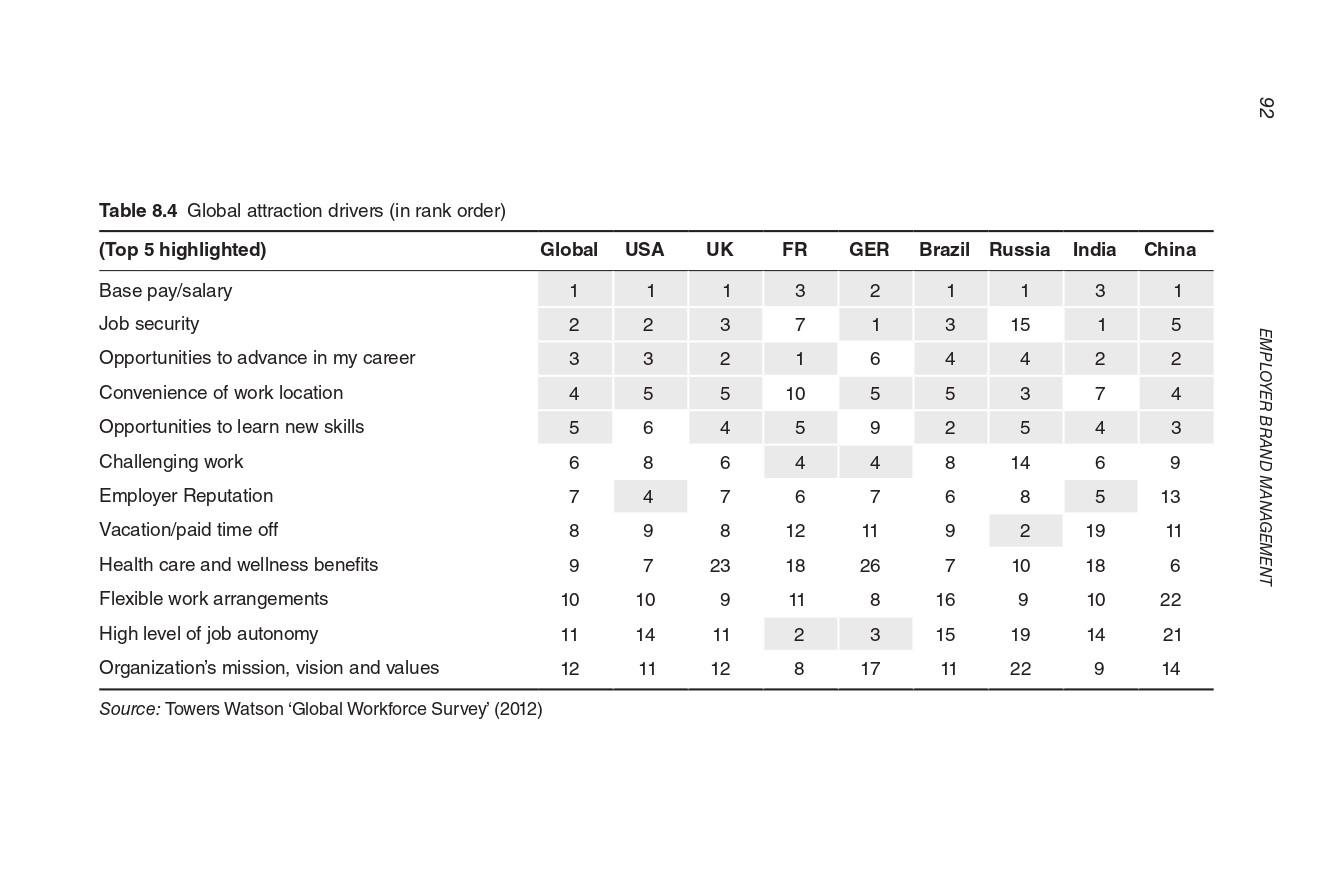

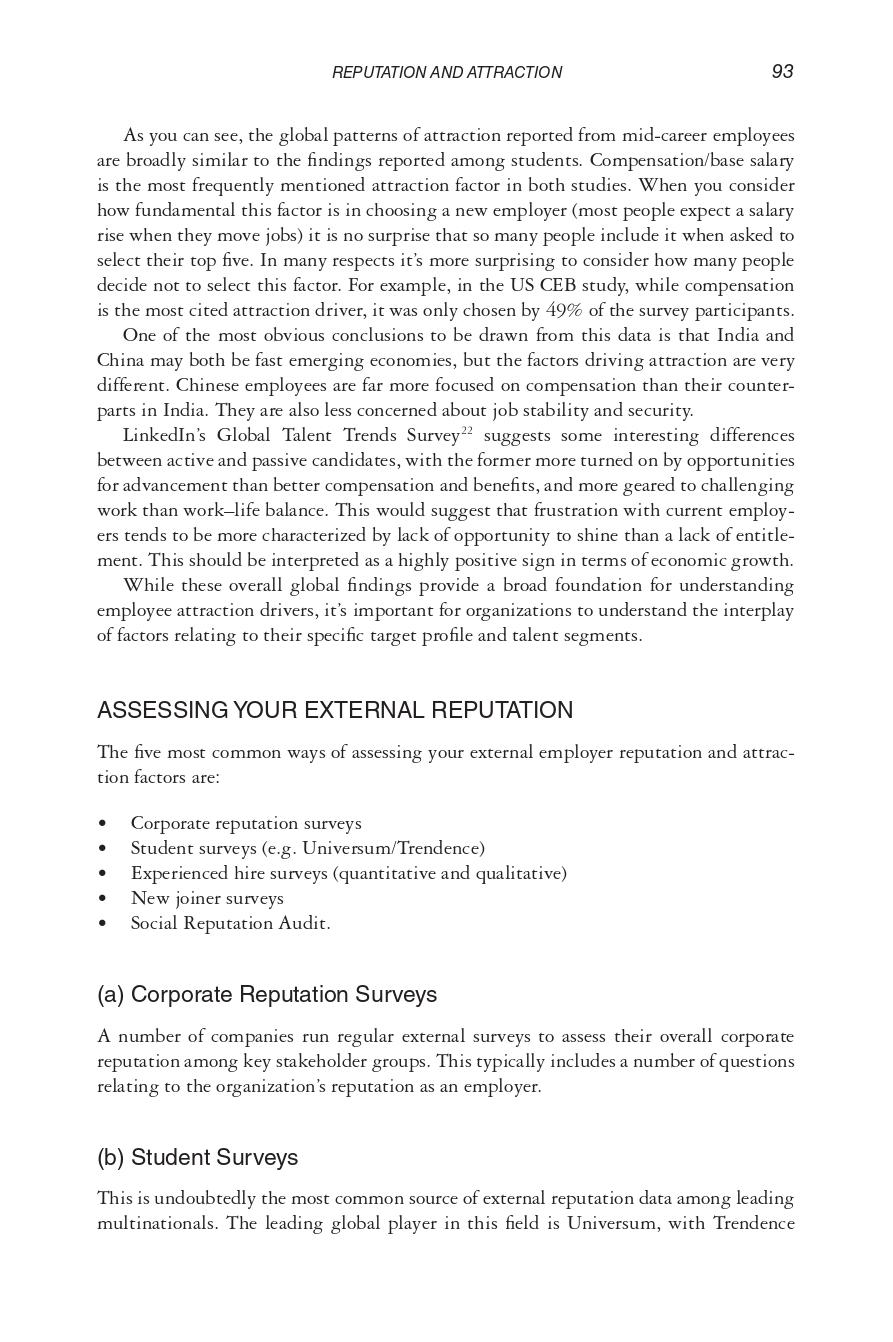

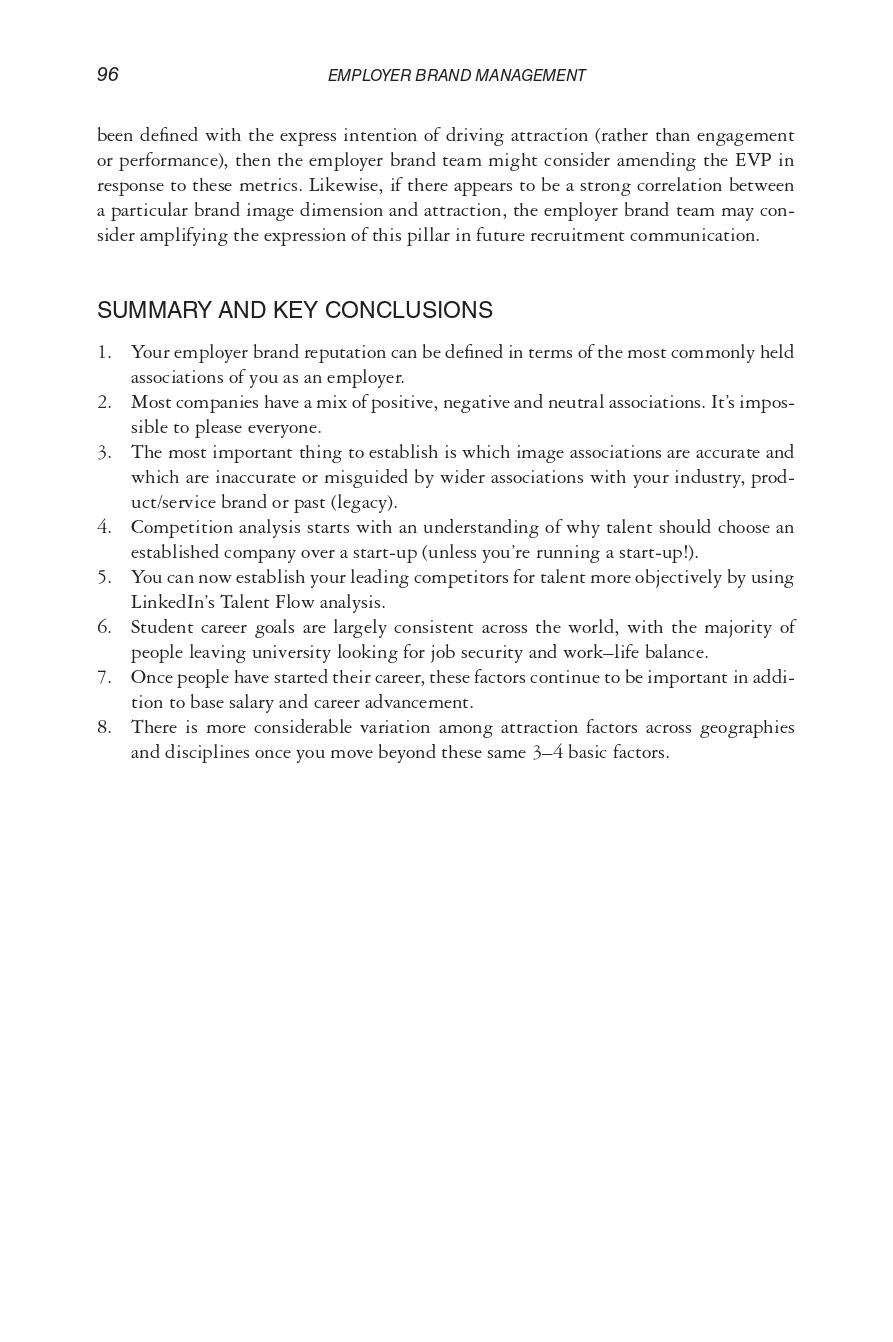

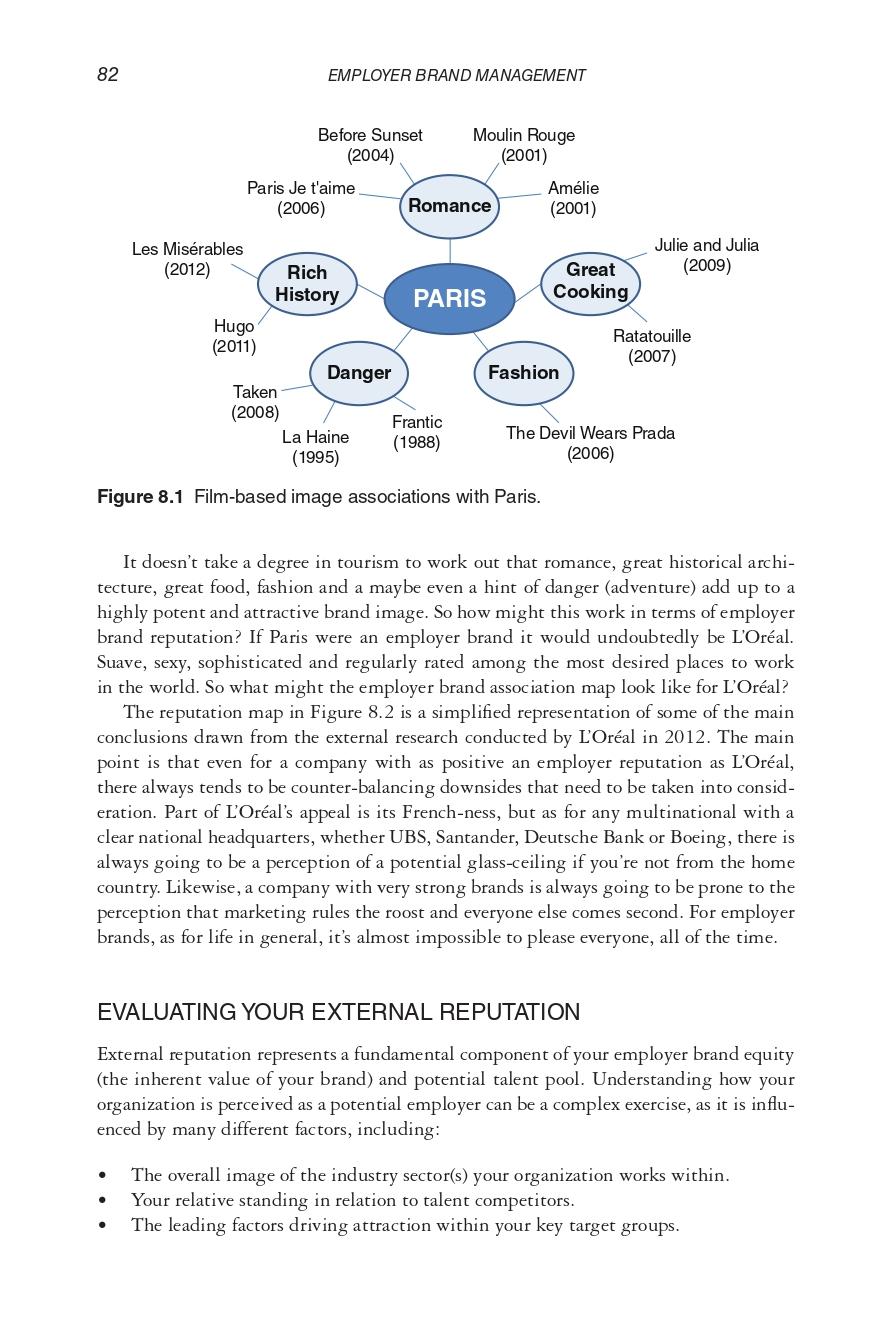

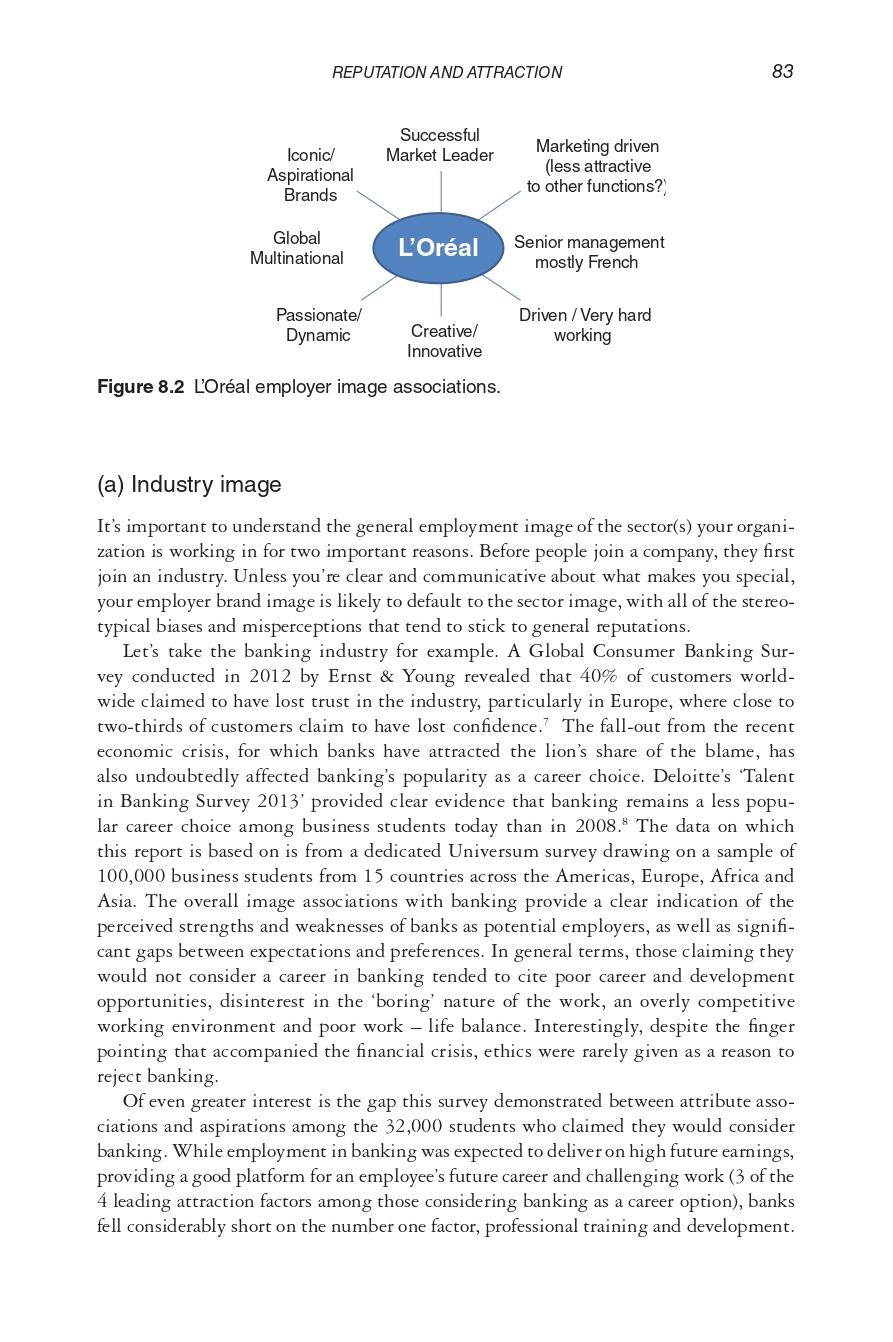

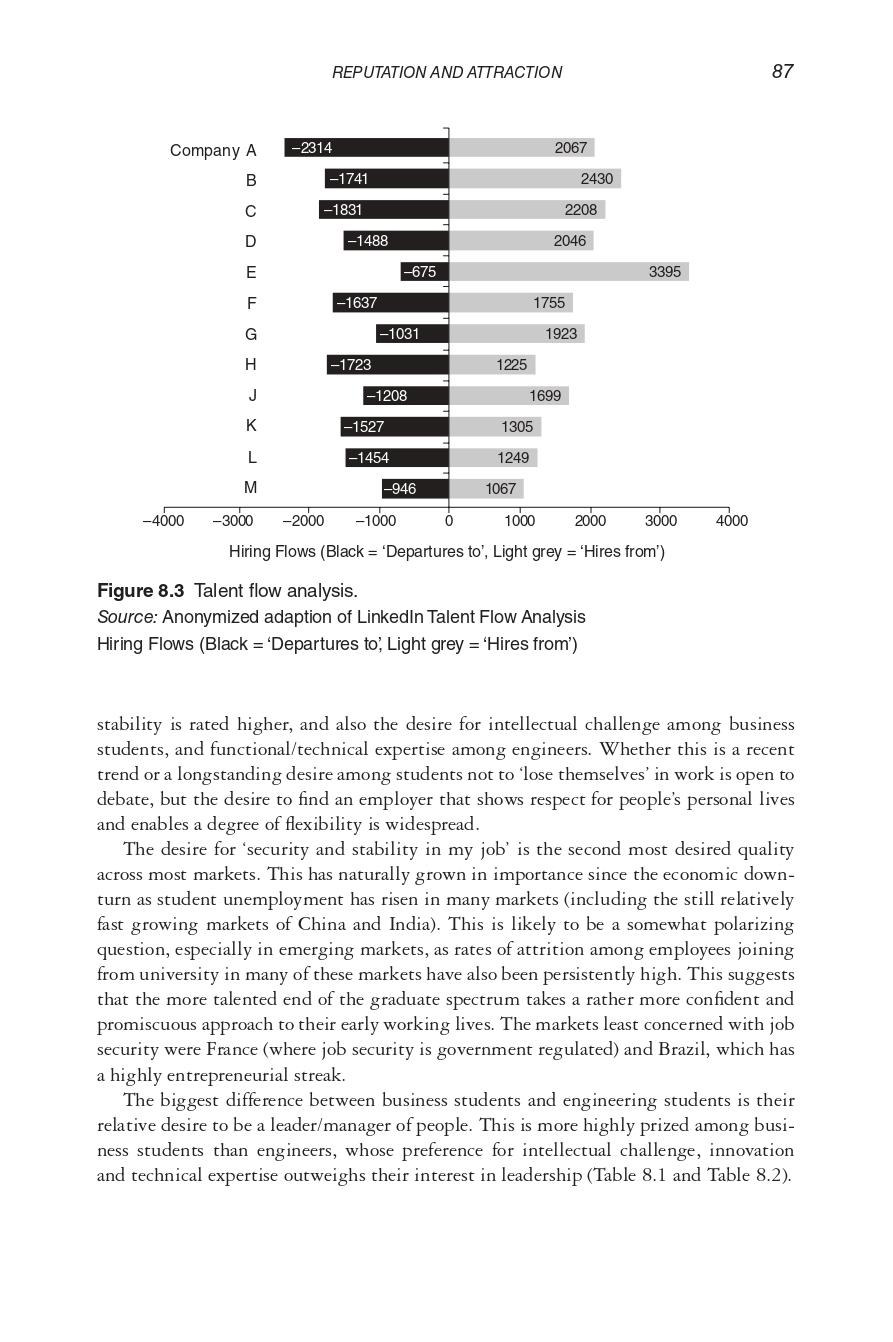

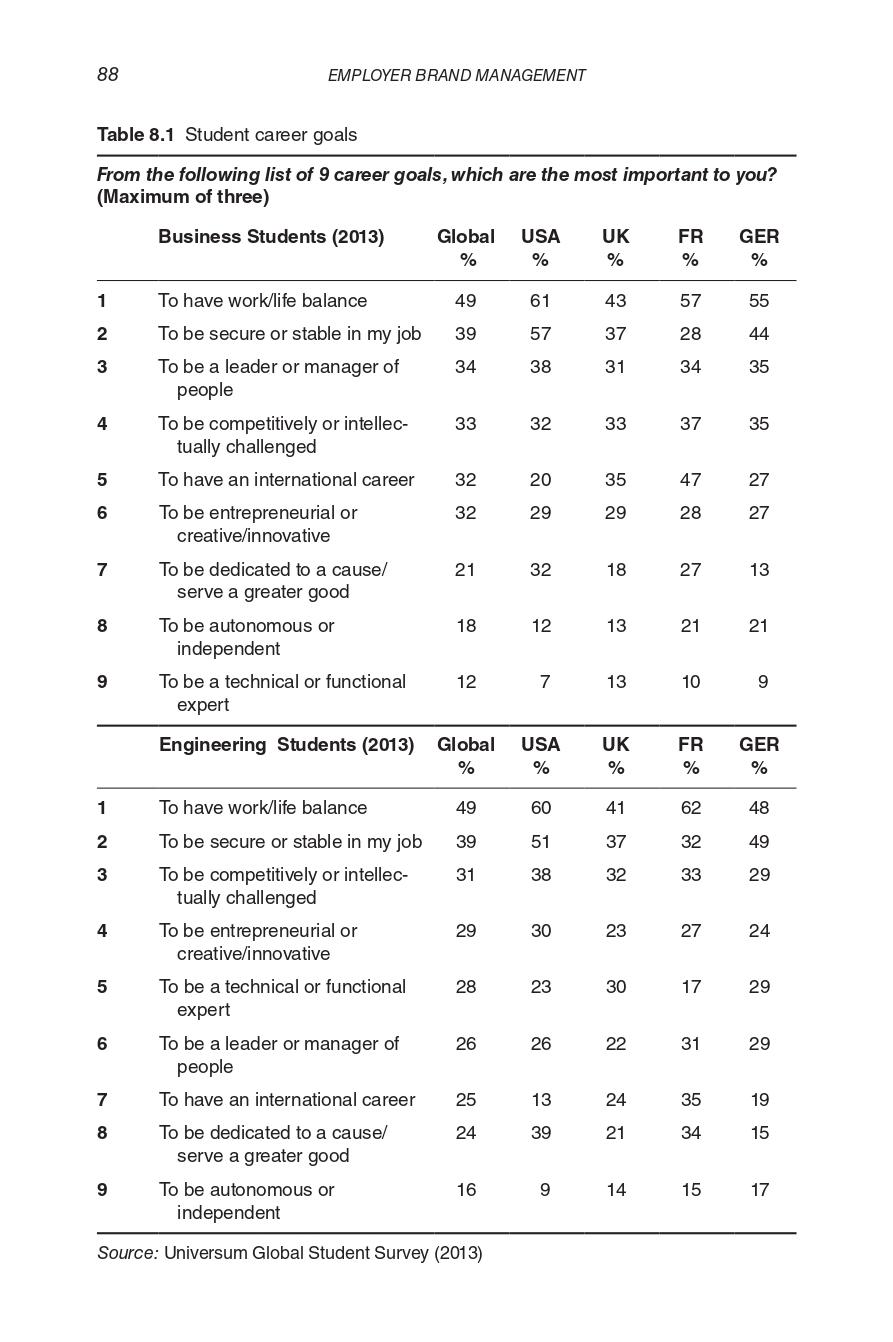

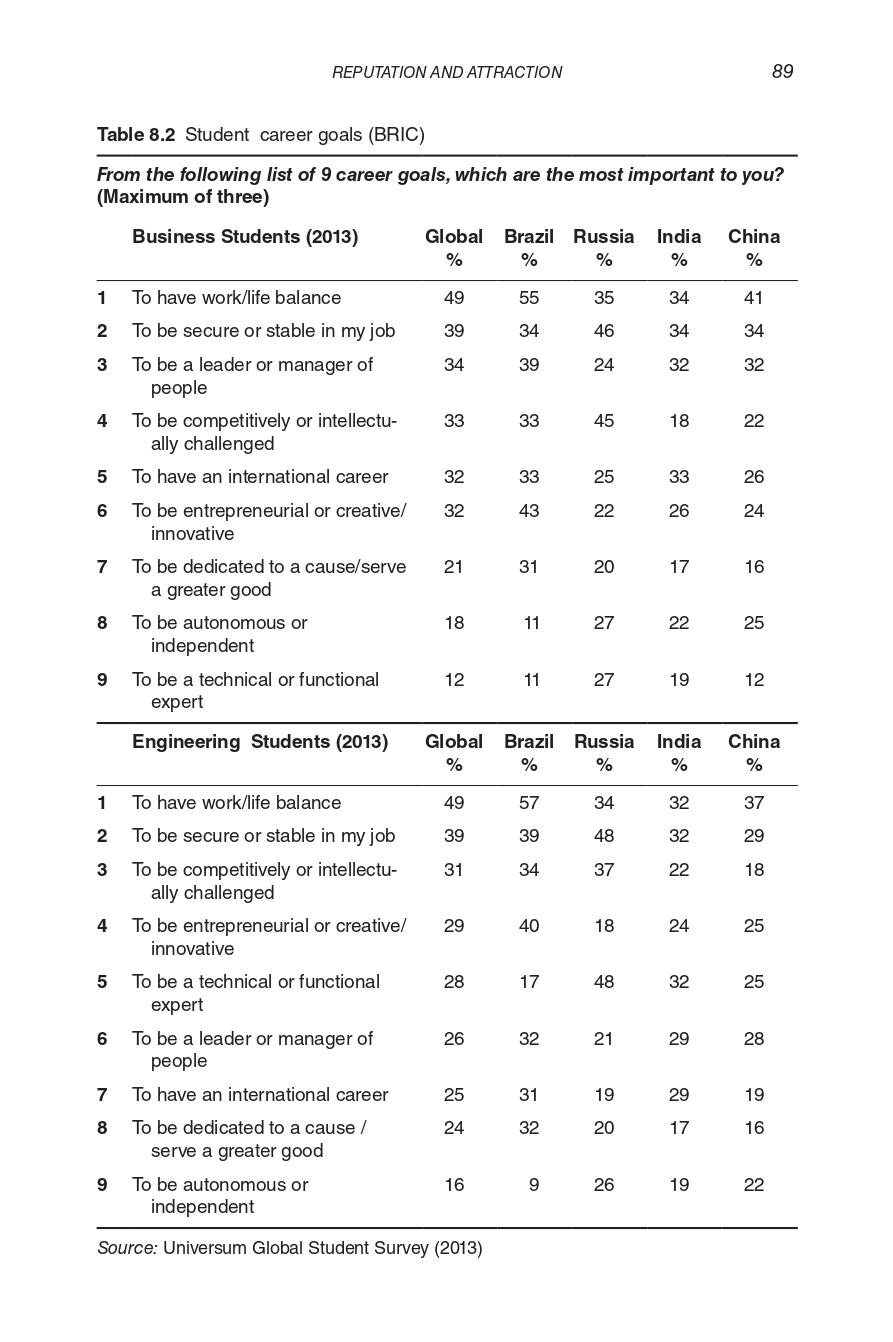

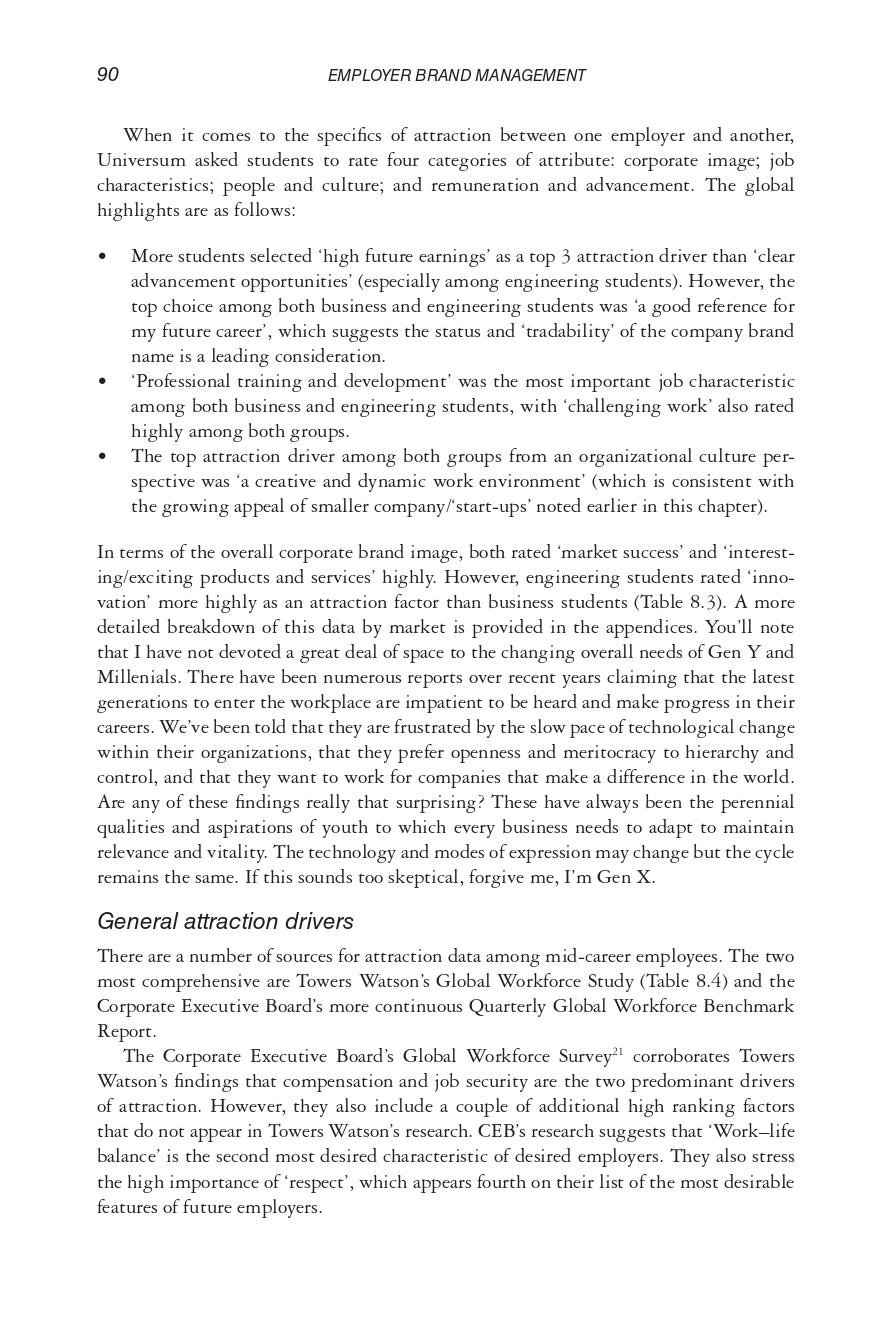

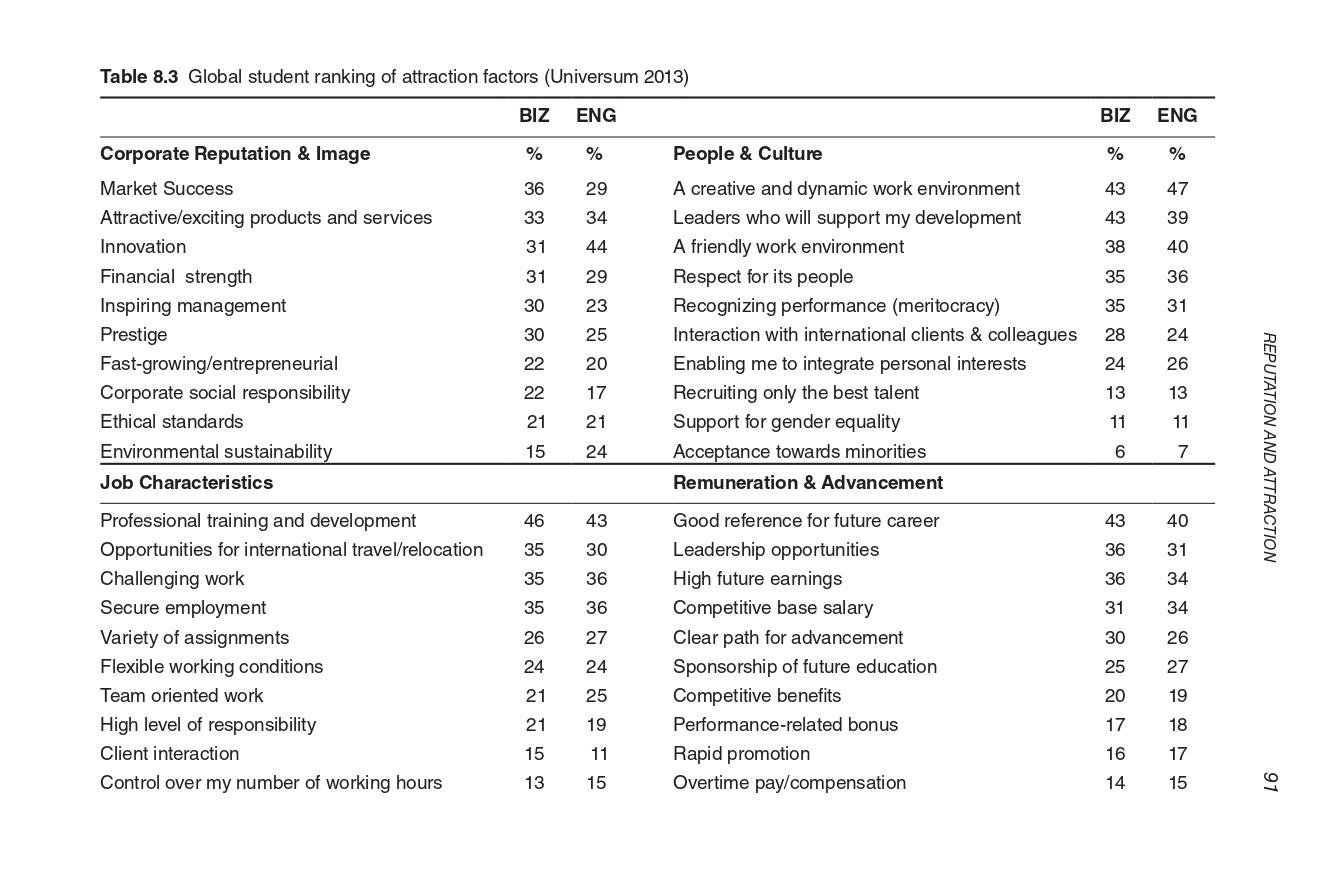

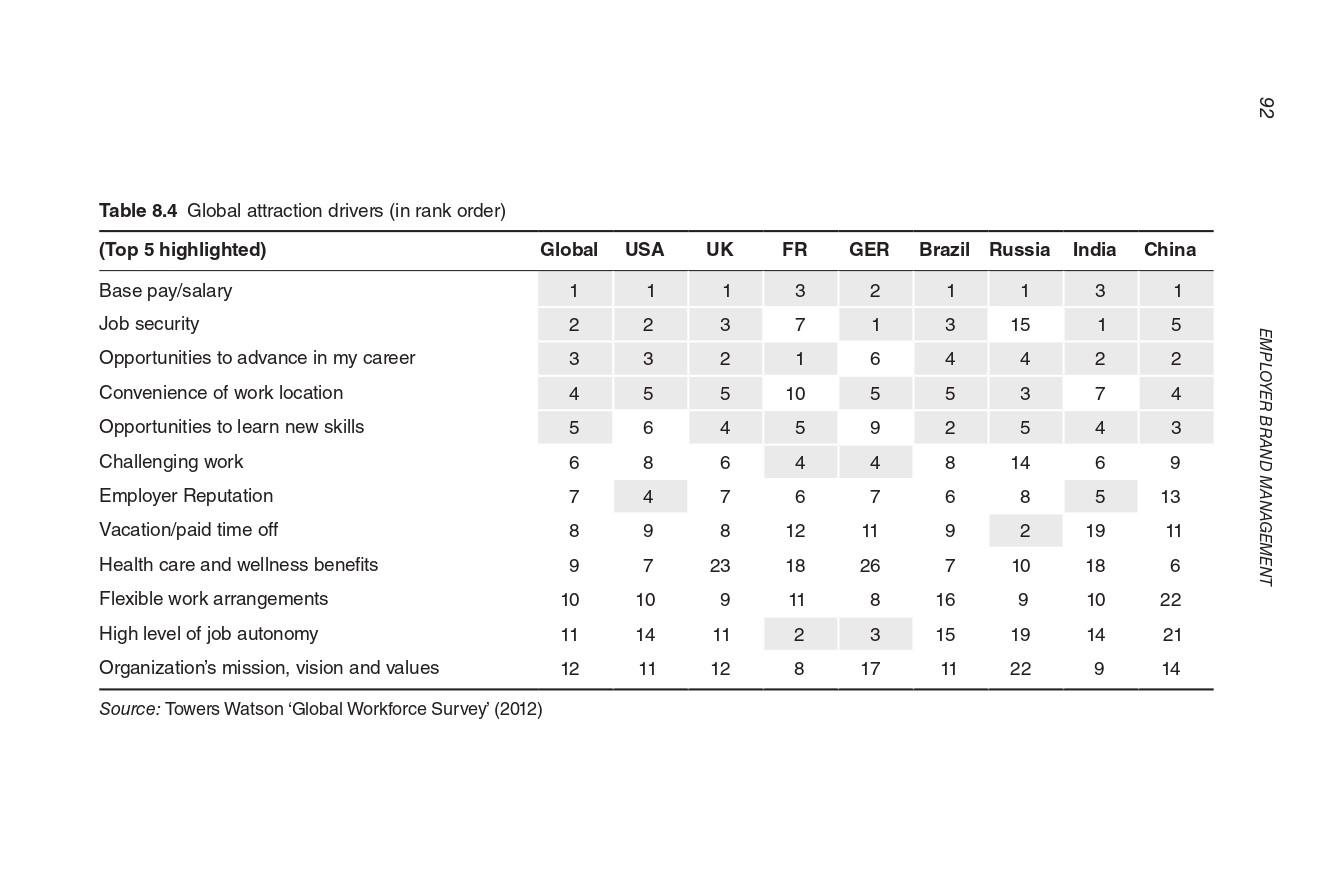

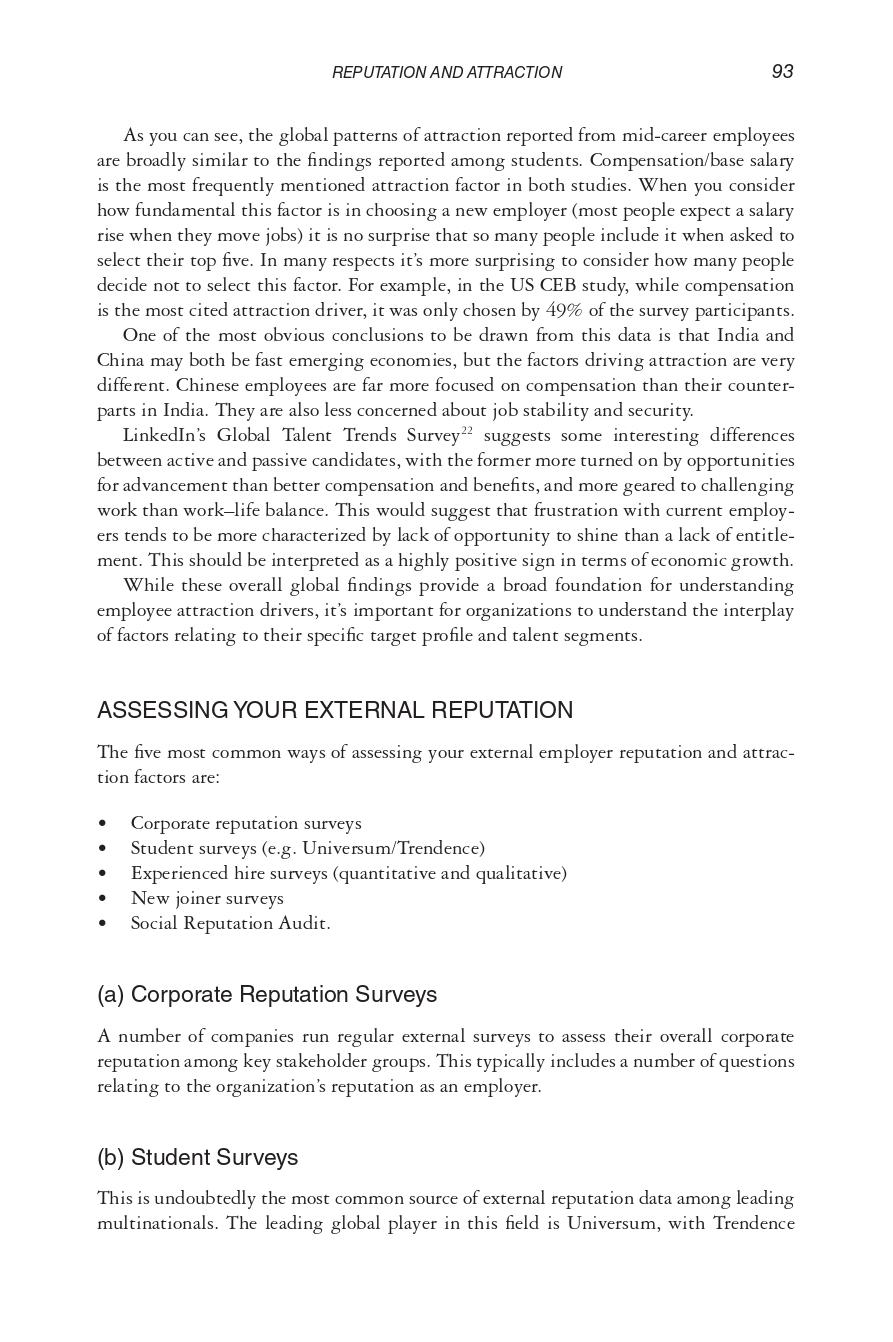

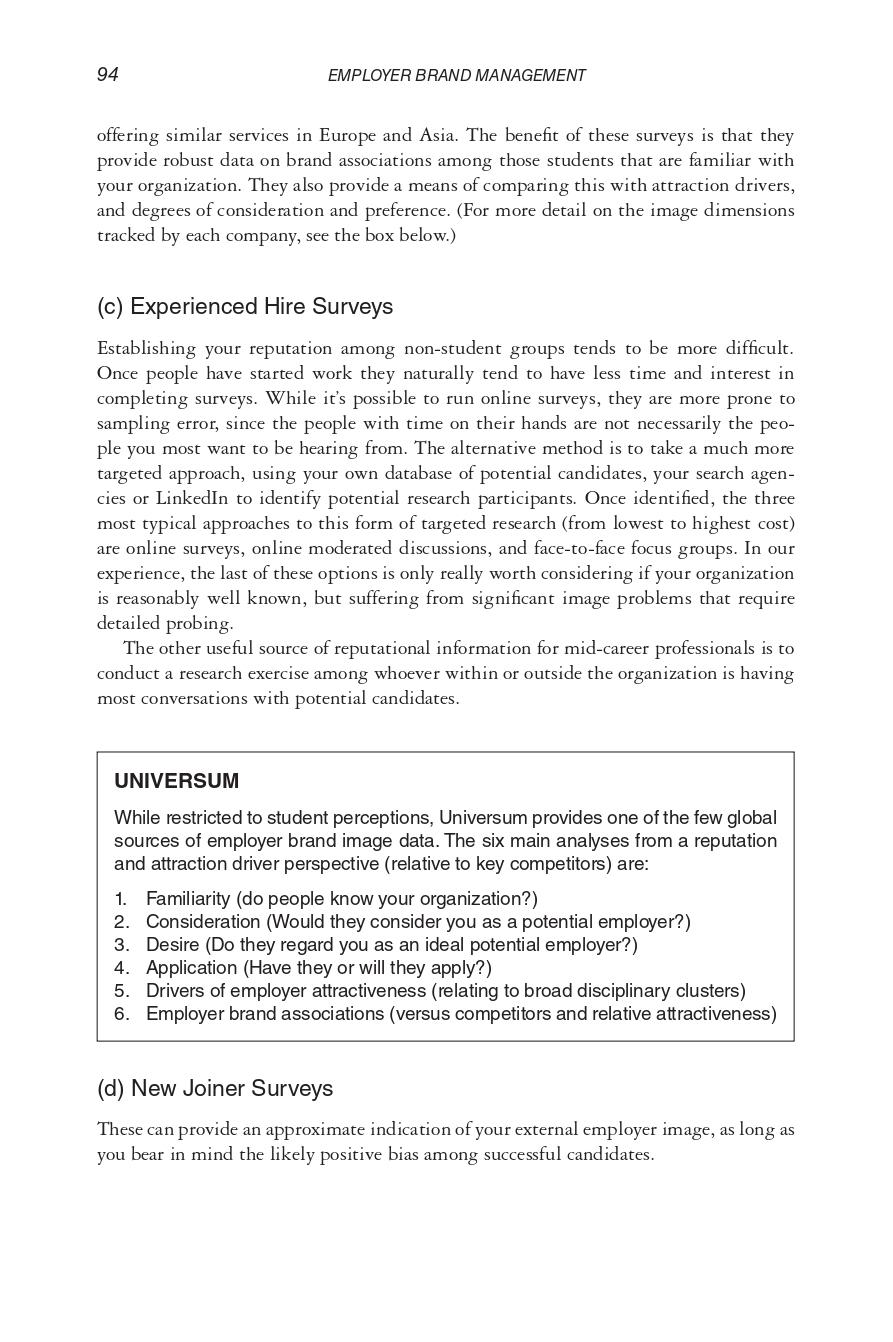

82 EMPLOYER BRAND MANAGEMENT Before Sunset Moulin Rouge (2004) (2001) Paris Je t'aime Amlie (2006) Romance (2001) Les Misrables Julie and Julia (2012) Rich Great (2009) History PARIS Cooking Hugo Ratatouille (2011) (2007) Danger Fashion Taken (2008) Frantic La Haine The Devil Wears Prada (1988) (1995) (2006) Figure 8.1 Film-based image associations with Paris. It doesn't take a degree in tourism to work out that romance, great historical archi- tecture, great food, fashion and a maybe even a hint of danger (adventure) add up to a highly potent and attractive brand image. So how might this work in terms of employer brand reputation? If Paris were an employer brand it would undoubtedly be L'Oral. Suave, sexy, sophisticated and regularly rated among the most desired places to work in the world. So what might the employer brand association map look like for L'Oral? The reputation map in Figure 8.2 is a simplified representation of some of the main conclusions drawn from the external research conducted by L'Oral in 2012. The main point is that even for a company with as positive an employer reputation as L'Oral, there always tends to be counter-balancing downsides that need to be taken into consid- eration. Part of L'Oral's appeal is its French-ness, but as for any multinational with a clear national headquarters, whether UBS, Santander, Deutsche Bank or Boeing, there is always going to be a perception of a potential glass-ceiling if you're not from the home country. Likewise, a company with very strong brands is always going to be prone to the perception that marketing rules the roost and everyone else comes second. For employer brands, as for life in general, it's almost impossible to please everyone, all of the time. EVALUATING YOUR EXTERNAL REPUTATION External reputation represents a fundamental component of your employer brand equity (the inherent value of your brand) and potential talent pool. Understanding how your organization is perceived as a potential employer can be a complex exercise, as it is influ- enced by many different factors, including: The overall image of the industry sector(s) your organization works within. Your relative standing in relation to talent competitors. The leading factors driving attraction within your key target groups. REPUTATION AND ATTRACTION 83 Successful Market Leader Iconic/ Aspirational Brands Marketing driven (less attractive to other functions? Global Multinational L'Oral Senior management mostly French Passionate/ Dynamic Creative/ Innovative Driven / Very hard working Figure 8.2 L'Oral employer image associations. (a) Industry image It's important to understand the general employment image of the sector(s) your organi- zation is working in for two important reasons. Before people join a company, they first join an industry. Unless you're clear and communicative about what makes you special, your employer brand image is likely to default to the sector image, with all of the stereo- typical biases and misperceptions that tend to stick to general reputations. Let's take the banking industry for example. A Global Consumer Banking Sur- vey conducted in 2012 by Ernst & Young revealed that 40% of customers world- wide claimed to have lost trust in the industry, particularly in Europe, where close to two-thirds of customers claim to have lost confidence. The fall-out from the recent economic crisis, for which banks have attracted the lion's share of the blame, has also undoubtedly affected banking's popularity as a career choice. Deloitte's Talent in Banking Survey 2013' provided clear evidence that banking remains a less popu- lar career choice among business students today than in 2008. The data on which this report is based on is from a dedicated Universum survey drawing on a sample of 100,000 business students from 15 countries across the Americas, Europe, Africa and Asia. The overall image associations with banking provide a clear indication of the perceived strengths and weaknesses of banks as potential employers, as well as signifi- cant gaps between expectations and preferences. In general terms, those claiming they would not consider a career in banking tended to cite poor career and development opportunities, disinterest in the 'boring' nature of the work, an overly competitive working environment and poor work - life balance. Interestingly, despite the finger pointing that accompanied the financial crisis, ethics were rarely given as a reason to reject banking Of even greater interest is the gap this survey demonstrated between attribute asso- ciations and aspirations among the 32,000 students who claimed they would consider banking. While employment in banking was expected to deliver on high future earnings, providing a good platform for an employee's future career and challenging work (3 of the 4 leading attraction factors among those considering banking as a career option), banks fell considerably short on the number one factor, professional training and development. 84 EMPLOYER BRAND MANAGEMENT There were also considerable gaps between student aspirations and five areas in which the banking industry was generally felt to be particularly lacking: A creative and dynamic working environment A friendly work environment Secure employment Innovation Flexible working conditions. . In summary, banks are generally perceived to pay well, provide a solid start to a career and challenging work, but they are also felt to be poor at developing people, uncreative, unfriendly and inflexible. When it comes to investment banks, the research suggested that they were generally associated with the same characteristics as banks as a whole, but to an even more extreme degree. In other words, investment banks pay more, but are even more insecure and unfriendly. If you are managing the employer brand of a bank, and this reflects what your employ- ees are telling you, then you're likely to be providing a fairly generic employment expe- rience. To compete more effectively for future banking talent you need to change. If, on the other hand, your employee research suggests you are strong in those areas where the industry as a whole is perceived to be weak, you need to communicate. While I have focused on a high profile sector, banking is not the only industry suffer- ing from a mismatch between career aspirations and relatively poor generic associations, or finding itself losing ground in terms of overall attractiveness to other competing indus- tries. Despite the financial crisis, the average bank fell only five places out of Universum's normalized group of 100 employers during the five-year period leading up to 2013. Over the same period 'Engineering & Manufacturing' fell ten places. The authors of the 2008 Deloitte report, Managing the Talent Crisis in Global Manufacturing, put much of this down to the sector's generally negative public image.' As they commented: 'A central problem for manufacturers in attracting talent is a lack of confi- dence in the future of manufacturing because it is perceived as a stagnat- ing industry. The perception arises from the reality that many manufacturers are shedding production workers in large numbers.' The report goes on to say that these workforce reductions have in many cases been driven by increases in productivity and a shift to higher-skilled labour. However, these reasons are generally lost in the debate. It is therefore not surprising that Generation Y workers are generally reluctant to pursue careers in the manufacturing industry. (b) Competitor analysis Company vs start-up? The first question to consider in terms of competition is whether your target talent wants to work for an established company at all: 70% of the young talent participating REPUTATION AND ATTRACTION 85 in Deloitte's Millennial Survey claimed they might reject 'traditional organizations in favour of a more independent entrepreneurial route to career success. Over the last decade, the poster boys and girls of international business success have tended to be the people who have started up new companies rather than established captains of industry. Mark Zuckerberg set up Facebook in 2004. A decade later, his annual salary may only be $1, but his net worth has been calculated at somewhere close to $20 billion. Sean Parker, who founded the file sharing site, Napster, before joining to become Facebook's first president, allegedly spent $10 million on his wedding celebrations. These are the kind of people who spawn legends, films and aspirations among the most highly tal- ented wannabees of the early twenty-first century. And it's not just a US phenomenon. In China, there are similar young entrepreneurial success stories. Robin Li who founded Baidu, China's leading search engine, in 2000 when he was 32, is now believed to be the country's richest man, with a net worth of more than $12.2bn. He made $4.8bn in 2013 alone. Ma Huateng, the fourth richest man in China, founded the Internet company Ten- cent in 1998, when he was 17.3 There are similar young entrepreneurial success stories in India, including Sridhar Vembu, founder of Zoho, who has built a highly profitable, rapidly growing company, currently generating over $ 200 million per year in revenue, with zero outside financing 14, 15 The same is also true in Brazil where, according to the Global Entrepreneurial Monitor, published in 2012, one in six adults is either trying to launch a business or is the owner of a new venture less than 42 months old. Nevermind the fact that research suggests that four in every five start-ups fail within 5 years and less than 1 in 20 survives beyond a decade. The entrepreneurial dream is strong, especially amongst the young In a global survey conducted in early 2008 among 2277 students from 114 countries, the number one career choice (drawing over 50% of the total vote) was running 'my own business'. 18 The more recent student survey data from Universum is not quite so extreme. Nevertheless, up to 1 in 4 students in some leading markets, claim a preference for working for a start-up or starting their own business, rather than joining a major corporation, with particularly high levels in the UK, India, Russia, Mexico and Turkey. 19 The implications are fairly obvious. As discussed in Chapter 6, for organizations to attract the kind of motivated, digitally savvy and creative people they need to compete in a super-charged knowledge economy, they need replicate more of the qualities that make start-ups so attractive to talented young people. Forbes magazine recently listed 10 reasons why recent graduates are attracted to start-ups:20 1. You can have an impact. Start-ups provide the opportunity to reach individuals and change people's lives in a tangible way. 2. You will learn a lot, and you will learn it quickly. Start-ups provide a unique environment to apprentice, since you can observe CEOs at work in close quarters. 3. You can work with your peers. Many start-up employees are relatively young, which can lead to social benefits. 4. You will see results, fast. In a start-up with its ear to the ground, customer feed- back comes quickly. 5. Start-ups have a flat structure. Many start-ups tend to avoid the hierarchical structure of big companies. 86 EMPLOYER BRAND MANAGEMENT 6. It's a meritocracy. Start-ups can offer opportunities for success regardless of age and experience. 7. You can work flexible hours. At a start-up, chances are you won't be working 9-5. Hours tend to be flexible, especially if you are your own boss. And, when you're passionate about what you do, you won't mind staying late. 8. Chances are, your office will be pretty cool. Many start-up offices have free snacks and drinks, as well as decor designed to get the creative juices flowing - think standing desks and beanbags. Others offer workout rooms or music centres. 9. If not now, when? As a recent grad, you likely do not have dependents, nor do you have an established career that is difficult to leave. If your start-up does fail, you have a minimal amount to lose. 10. Graduate school is not going anywhere. Few start-ups demand formal qualifica- tions. Why sit in a classroom for 100 hours a week when you can earn and learn at the same time? These highly attractive qualities are widely associated with start-up companies, and many leading employers are beginning to adapt their employment practices to ensure they can compete not only with other companies like themselves, but also with the start- ups who are fast depleting their potential talent pools. Analysing your competitive set Among those people who are considering established companies as well as start-ups, it's important to identify who your leading competitors for talent are, and how you compare in term of relative appeal and brand image associations. The kind of organi- zations you will be competing with will clearly vary according to your target group. If you're looking for sales people or marketers, the consideration set is likely to be far broader than if you're targeting people requiring specific knowledge or experi- ence within your industry. In the former case you may need to identify who the best marketing employers are, and what they are offering, in order to compete effectively. In the latter case, there are now some highly objective sources of data you can draw on to identify your primary industry competitors. LinkedIn's Talent Flow Analy- sis (Figure 8.3) enables your organization to identify the organizations with whom you're most active in trading talent. The following provides an illustration of how the analysis works. (c) Attraction Graduate attraction factors Universum's Global Student Survey provides some interesting insights into what Gen Y/Millenials in different parts of the world are looking for in their careers. The leading answer by far, among both business and engineering students, is work life balance. This answer was also highly consistent across all the major markets except Russia, where REPUTATION AND ATTRACTION 87 Company A -2314 2067 B -1741 2430 -1831 2208 D -1488 2046 E -675 3395 F -1637 1755 G -1031 1923 H -1723 1225 J -1208 1699 -1527 1305 L -1454 1249 -4000 M -946 1067 -3000 -2000 -1000 0 1000 2000 3000 Hiring Flows (Black = 'Departures to', Light grey = 'Hires from') 4000 Figure 8.3 Talent flow analysis. Source: Anonymized adaption of LinkedIn Talent Flow Analysis Hiring Flows (Black = 'Departures to Light grey = "Hires from') stability is rated higher, and also the desire for intellectual challenge among business students, and functional/technical expertise among engineers. Whether this is a recent trend or a longstanding desire among students not to lose themselves' in work is open to debate, but the desire to find an employer that shows respect for people's personal lives and enables a degree of flexibility is widespread. The desire for security and stability in my job' is the second most desired quality across most markets. This has naturally grown in importance since the econ down- turn as student unemployment has risen in many markets (including the still relatively fast growing markets of China and India). This is likely to be a somewhat polarizing question, especially in emerging markets, as rates of attrition among employees joining from university in many of these markets have also been persistently high. This suggests that the more talented end of the graduate spectrum takes a rather more confident and promiscuous approach to their early working lives. The markets least concerned with job security were France (where job security is government regulated) and Brazil, which has a highly entrepreneurial streak. The biggest difference between business students and engineering students is their relative desire to be a leader/manager of people. This is more highly prized among busi- ness students than engineers, whose preference for intellectual challenge, innovation and technical expertise outweighs their interest in leadership (Table 8.1 and Table 8.2). 88 EMPLOYER BRAND MANAGEMENT Table 8.1 Student career goals From the following list of 9 career goals, which are the most important to you? (Maximum of three) Business Students (2013) me Global % USA % UK % FR % GER % 1 49 61 43 57 55 2 39 57 37 28 44 3 34 38 31 34 35 4 33 32 33 37 35 5 To have work/life balance To be secure or stable in my job To be a leader or manager of people To be competitively or intellec- tually challenged To have an international career To be entrepreneurial or creative/innovative To be dedicated to a cause/ / serve a greater good To be autonomous or independent 32 20 35 47 27 6 32 29 29 28 27 7 21 32 18 27 13 8 18 12 13 21 21 9 12 7 13 10 9 To be a technical or functional expert Engineering Students (2013) Global ( % USA % UK % FR % GER % 1 To have work/life balance 49 60 41 62 48 2 39 51 37 32 49 3 31 38 32 33 29 4 29 30 23 27 24 To be secure or stable in my job To be competitively or intellec- tually challenged To be entrepreneurial or creative/innovative To be a technical or functional expert To be a leader or manager of people 5 28 23 30 17 29 6 26 26 22 31 29 7 To have an international career 25 13 24 35 19 8 24 39 21 34 15 To be dedicated to a cause/ serve a greater good To be autonomous or independent 9 16 9 9 14 15 17 Source: Universum Global Student Survey (2013) REPUTATION AND ATTRACTION 89 Table 8.2 Student career goals (BRIC) From the following list of 9 career goals, which are the most important to you? (Maximum of three) Business Students (2013) Global Brazil Russia India % % % % India China % 49 55 35 34 41 39 34 46 34 34 34 39 24 32 32 33 33 45 18 22 32 33 25 33 26 1 To have work/life balance 2 To be secure or stable in my job 3 To be a leader or manager of people 4 To be competitively or intellectu- ally challenged 5 To have an international career 6 To be entrepreneurial or creative/ innovative 7 To be dedicated to a cause/serve a greater good 8 To be autonomous or independent 9 To be a technical or functional expert 32 43 22 26 24 21 31 20 16 17 22 18 11 27 25 12 11 27 19 12 Engineering Students (2013) Global Brazil Russia India % % % % China % 49 57 34 32 37 39 39 48 32 29 31 34 37 22 18 29 40 18 24 25 28 17 48 32 25 1 To have work/life balance 2 To be secure or stable in my job 3 To be competitively or intellectu- ally challenged 4 To be entrepreneurial or creative/ innovative 5 To be a technical or functional expert 6 To be a leader or manager of people 7 To have an international career 8 To be dedicated to a cause / / serve a greater good 9 To be autonomous or independent 26 32 21 29 28 25 31 19 29 19 24 32 20 17 16 16 9 26 19 22 Source: Universum Global Student Survey (2013) 90 EMPLOYER BRAND MANAGEMENT When it comes to the specifics of attraction between one employer and another, Universum asked students to rate four categories of attribute: corporate image; job characteristics; people and culture, and remuneration and advancement. The global highlights are as follows: More students selected 'high future earnings' as a top 3 attraction driver than 'clear advancement opportunities' (especially among engineering students). However, the top choice among both business and engineering students was a good reference for my future career', which suggests the status and 'tradability of the company brand name is a leading consideration. "Professional training and development' was the most important job characteristic among both business and engineering students, with challenging work' also rated highly among both groups. The top attraction driver among both groups from an organizational culture per- spective was 'a creative and dynamic work environment' (which is consistent with the growing appeal of smaller company/start-ups' noted earlier in this chapter). In terms of the overall corporate brand image, both rated 'market success' and 'interest- ing/exciting products and services' highly. However, engineering students rated 'inno- vation' more highly as an attraction factor than business students (Table 8.3). A more detailed breakdown of this data by market is provided in the appendices. You'll note that I have not devoted a great deal of space to the changing overall needs of Gen Y and Millenials. There have been numerous reports over recent years claiming that the latest generations to enter the workplace are impatient to be heard and make progress in their careers. We've been told that they are frustrated by the slow pace of technological change within their organizations, that they prefer openness and meritocracy to hierarchy and control, and that they want to work for companies that make a difference in the world. Are any of these findings really that surprising? These have always been the perennial qualities and aspirations of youth to which every business needs to adapt to maintain relevance and vitality. The technology and modes of expression may change but the cycle remains the same. If this sounds too skeptical, forgive me, I'm Gen X. General attraction drivers There are a number of sources for attraction data among mid-career employees. The two most comprehensive are Towers Watson's Global Workforce Study (Table 8.4) and the Corporate Executive Board's more continuous Quarterly Global Workforce Benchmark Report. The Corporate Executive Board's Global Workforce Survey corroborates Towers Watson's findings that compensation and job security are the two predominant drivers of attraction. However, they also include a couple of additional high ranking factors that do not appear in Towers Watson's research. CEB's research suggests that 'Work-life balance' is the second most desired characteristic of desired employers. They also stress the high importance of respect', which appears fourth on their list of the most desirable features of future employers. Table 8.3 Global student ranking of attraction factors (Universum 2013) BIZ ENG BIZ ENG % People & Culture % % 29 43 47 34 39 43 38 44 40 29 35 36 35 31 Corporate Reputation & Image Market Success Attractive/exciting products and services Innovation Financial strength Inspiring management Prestige Fast-growing/entrepreneurial Corporate social responsibility Ethical standards Environmental sustainability Job Characteristics %%WWE 23 25 A creative and dynamic work environment Leaders who will support my development A friendly work environment Respect for its people Recognizing performance (meritocracy) Interaction with international clients & colleagues Enabling me to integrate personal interests Recruiting only the best talent Support for gender equality Acceptance towards minorities Remuneration & Advancement 28 24 20 24 26 17 13 13 21 11 11 24 6 7 REPUTATION AND ATTRACTION 43 43 40 46 35 30 36 31 35 36 36 34 35 36 31 34 26 Professional training and development Opportunities for international travel/relocation Challenging work Secure employment Variety of assignments Flexible working conditions Team oriented work High level of responsibility Client interaction Control over my number of working hours 27 24 Good reference for future career Leadership opportunities High future earnings Competitive base salary Clear path for advancement Sponsorship of future education Competitive benefits Performance-related bonus Rapid promotion Overtime pay/compensation 30 25 26 27 24 21 25 20 19 21 19 17 18 17 15 11 16 13 15 14 15 91 92 Table 8.4 Global attraction drivers (in rank order) (Top 5 highlighted) Global USA UK FR GER Brazil Russia India China 1 1 1 2 1 1 3 2 2 3 7 1 3 15 1 3 No 3 2 on W 6 4 N0 W 4 2 2 4 5 10 5 3 7 5 6 4 5 9 2 5 4 6 8 6 4 4 8 14 6 Base pay/salary Job security Opportunities to advance in my career Convenience of work location Opportunities to learn new skills Challenging work Employer Reputation Vacation/paid time off Health care and wellness benefits Flexible work arrangements High level of job autonomy Organization's mission, vision and values Source: Towers Watson 'Global Workforce Survey' (2012) EMPLOYER BRAND MANAGEMENT 7 4 7 7 6 8 5 13 8 9 8 12 11 9 2 19 11 9 7 23 + 0 0 F N 00 18 26 7 10 18 6 10 10 9 11 8 16 9 10 22 1 2 11 14 11 2 3 15 19 14 21 12 11 12 8 17 11 22 0 14 REPUTATION AND ATTRACTION 93 As you can see, the global patterns of attraction reported from mid-career employees are broadly similar to the findings reported among students. Compensation/base salary is the most frequently mentioned attraction factor in both studies. When you consider how fundamental this factor is in choosing a new employer (most people expect a salary rise when they move jobs) it is no surprise that so many people include it when asked to select their top five. In many respects it's more surprising to consider how many people decide not to select this factor. For example, in the US CEB study, while compensation is the most cited attraction driver, it was only chosen by 49% of the survey participants. One of the most obvious conclusions to be drawn from this data is that India and China may both be fast emerging economies, but the factors driving attraction are very different. Chinese employees are far more focused on compensation than their counter- parts in India. They are also less concerned about job stability and security. LinkedIn's Global Talent Trends Survey22 suggests some interesting differences between active and passive candidates, with the former more turned on by opportunities for advancement than better compensation and benefits, and more geared to challenging work than work-life balance. This would suggest that frustration with current employ- ers tends to be more characterized by lack of opportunity to shine than a lack of entitle- ment. This should be interpreted as a highly positive sign in terms of economic growth. While these overall global findings provide a broad foundation for understanding employee attraction drivers, it's important for organizations to understand the interplay of factors relating to their specific target profile and talent segments. ASSESSING YOUR EXTERNAL REPUTATION The five most common ways of assessing your external employer reputation and attrac- tion factors are: Corporate reputation surveys Student surveys (e.g. Universum/Trendence) ienced hire surveys (quantitative and qualitative) New joiner surveys Social Reputation Audit. (a) Corporate Reputation Surveys A number of companies run regular external surveys to assess their overall corporate reputation among key stakeholder groups. This typically includes a number of questions relating to the organization's reputation as an employer. (b) Student Surveys This is undoubtedly the most common source of external reputation data among leading multinationals. The leading global player in this field is Universum, with Trendence 94 EMPLOYER BRAND MANAGEMENT offering similar services in Europe and Asia. The benefit of these surveys is that they provide robust data on brand associations among those students that are familiar with your organization. They also provide a means of comparing this with attraction drivers, and degrees of consideration and preference. (For more detail on the image dimensions tracked by each company, see the box below.) (c) Experienced Hire Surveys Establishing your reputation among non-student groups tends to be more difficult. Once people have started work they naturally tend to have less time and interest in completing surveys. While it's possible to run online surveys, they are more prone to sampling error, since the people with time on their hands are not necessarily the peo- ple you most want to be hearing from. The alternative method is to take a much more targeted approach, using your own database of potential candidates, your search agen- cies or LinkedIn to identify potential research participants. Once identified, the three most typical approaches to this form of targeted research (from lowest to highest cost) are online surveys, online moderated discussions, and face-to-face focus groups. In our experience, the last of these options is only really worth considering if your organization is reasonably well known, but suffering from significant image problems that require detailed probing The other useful source of reputational information for mid-career professionals is to conduct a research exercise among whoever within or outside the organization is having most conversations with potential candidates. UNIVERSUM While restricted to student perceptions, Universum provides one of the few global sources of employer brand image data. The six main analyses from a reputation and attraction driver perspective (relative to key competitors) are: 1. Familiarity (do people know your organization?) 2. Consideration (Would they consider you as a potential employer?) 3. Desire (Do they regard you as an ideal potential employer?) 4. Application (Have they or will they apply?) 5. Drivers of employer attractiveness relating to broad disciplinary clusters) 6. Employer brand associations (versus competitors and relative attractiveness) (d) New Joiner Surveys These can provide an approximate indication of your external employer image, as long as you bear in mind the likely positive bias among successful candidates. REPUTATION AND ATTRACTION 95 (e) Social Reputation Audit This is one of the more recent research techniques to be applied to understanding one of the growing sources of influence on your employer reputation. Companies like Glassdoor and Vault provide an opportunity for anonymous employee commentary on their current employers. While these sources may be taken into consideration individually, it is also possible to conduct a more general search and audit of digital social opinion. The three most typical outputs from this kind of audit are: Digital footprint/channel presence (vs key competitors) Sentiment (% positive/% neutral/% negative commentary) Commentary (volume/subject matter). IMAGE ANALYSIS To establish the right EVP, it's vital to understand what your target audiences are look- ing for and how you currently rate on these image dimensions in relation to your com- petitors. Of particular importance in diagnosing the strength of your employer brand is an understanding of: . . Distinctive strengths. Where do you over-index in relation to the industry norm and key competitors? These image dimensions could represent key brand differentiators. Key weaknesses. On which dimensions of highest appeal to your target audience do you rate more poorly than your key competitors? Table-stakes. Which other image dimensions may undermine your overall position- ing as an employer of choice? Reputation vs reality. Where do external perceptions fall short of positive inter- nal perceptions? This clearly provides opportunities for the organization to draw attention to hidden strengths. Are there any areas in which external perceptions are significantly more positive than internal perceptions? This will help to identify areas where you need to tread more carefully in making employer brand claims, and prompt action to address internal weaknesses that may potentially drive post-hire disappointment and attrition. While seldom as debilitating as the 'Paris Syndrome described above, the deflating gap between reputation and reality can be equally disappointing Once your EVP has been defined, brand image metrics are also important in deter- mining the impact of your employer brand marketing activities on brand perceptions and validating the relative value of your overall proposition and key pillars. Ideally, you should be able to identify a strong correlation between specific image improve- ments and higher levels of brand affinity, consideration and preference. If a pillar has 96 EMPLOYER BRAND MANAGEMENT been defined with the express intention of driving attraction (rather than engagement or performance), then the employer brand team might consider amending the EVP in response to these metrics. Likewise, if there appears to be a strong correlation between a particular brand image dimension and attraction, the employer brand team may con- sider amplifying the expression of this pillar in future recruitment communication. SUMMARY AND KEY CONCLUSIONS 1. Your employer brand reputation can be defined in terms of the most commonly held associations of you as an employer. 2. Most companies have a mix of positive, negative and neutral associations. It's impos- sible to please everyone. 3. The most important thing to establish is which image associations are accurate and which are inaccurate or misguided by wider associations with your industry, prod- uct/service brand or past (legacy). 4. Competition analysis starts with an understanding of why talent should choose an established company over a start-up (unless you're running a start-up!). 5. You can now establish your leading competitors for talent more objectively by using LinkedIn's Talent Flow analysis. 6. Student career goals are largely consistent across the world, with the majority of people leaving university looking for job security and work-life balance. 7. Once people have started their career, these factors continue to be important in addi- tion to base salary and career advancement. 8. There is more considerable variation among attraction factors across geographies and disciplines once you move beyond these same 3-4 basic factors. 82 EMPLOYER BRAND MANAGEMENT Before Sunset Moulin Rouge (2004) (2001) Paris Je t'aime Amlie (2006) Romance (2001) Les Misrables Julie and Julia (2012) Rich Great (2009) History PARIS Cooking Hugo Ratatouille (2011) (2007) Danger Fashion Taken (2008) Frantic La Haine The Devil Wears Prada (1988) (1995) (2006) Figure 8.1 Film-based image associations with Paris. It doesn't take a degree in tourism to work out that romance, great historical archi- tecture, great food, fashion and a maybe even a hint of danger (adventure) add up to a highly potent and attractive brand image. So how might this work in terms of employer brand reputation? If Paris were an employer brand it would undoubtedly be L'Oral. Suave, sexy, sophisticated and regularly rated among the most desired places to work in the world. So what might the employer brand association map look like for L'Oral? The reputation map in Figure 8.2 is a simplified representation of some of the main conclusions drawn from the external research conducted by L'Oral in 2012. The main point is that even for a company with as positive an employer reputation as L'Oral, there always tends to be counter-balancing downsides that need to be taken into consid- eration. Part of L'Oral's appeal is its French-ness, but as for any multinational with a clear national headquarters, whether UBS, Santander, Deutsche Bank or Boeing, there is always going to be a perception of a potential glass-ceiling if you're not from the home country. Likewise, a company with very strong brands is always going to be prone to the perception that marketing rules the roost and everyone else comes second. For employer brands, as for life in general, it's almost impossible to please everyone, all of the time. EVALUATING YOUR EXTERNAL REPUTATION External reputation represents a fundamental component of your employer brand equity (the inherent value of your brand) and potential talent pool. Understanding how your organization is perceived as a potential employer can be a complex exercise, as it is influ- enced by many different factors, including: The overall image of the industry sector(s) your organization works within. Your relative standing in relation to talent competitors. The leading factors driving attraction within your key target groups. REPUTATION AND ATTRACTION 83 Successful Market Leader Iconic/ Aspirational Brands Marketing driven (less attractive to other functions? Global Multinational L'Oral Senior management mostly French Passionate/ Dynamic Creative/ Innovative Driven / Very hard working Figure 8.2 L'Oral employer image associations. (a) Industry image It's important to understand the general employment image of the sector(s) your organi- zation is working in for two important reasons. Before people join a company, they first join an industry. Unless you're clear and communicative about what makes you special, your employer brand image is likely to default to the sector image, with all of the stereo- typical biases and misperceptions that tend to stick to general reputations. Let's take the banking industry for example. A Global Consumer Banking Sur- vey conducted in 2012 by Ernst & Young revealed that 40% of customers world- wide claimed to have lost trust in the industry, particularly in Europe, where close to two-thirds of customers claim to have lost confidence. The fall-out from the recent economic crisis, for which banks have attracted the lion's share of the blame, has also undoubtedly affected banking's popularity as a career choice. Deloitte's Talent in Banking Survey 2013' provided clear evidence that banking remains a less popu- lar career choice among business students today than in 2008. The data on which this report is based on is from a dedicated Universum survey drawing on a sample of 100,000 business students from 15 countries across the Americas, Europe, Africa and Asia. The overall image associations with banking provide a clear indication of the perceived strengths and weaknesses of banks as potential employers, as well as signifi- cant gaps between expectations and preferences. In general terms, those claiming they would not consider a career in banking tended to cite poor career and development opportunities, disinterest in the 'boring' nature of the work, an overly competitive working environment and poor work - life balance. Interestingly, despite the finger pointing that accompanied the financial crisis, ethics were rarely given as a reason to reject banking Of even greater interest is the gap this survey demonstrated between attribute asso- ciations and aspirations among the 32,000 students who claimed they would consider banking. While employment in banking was expected to deliver on high future earnings, providing a good platform for an employee's future career and challenging work (3 of the 4 leading attraction factors among those considering banking as a career option), banks fell considerably short on the number one factor, professional training and development. 84 EMPLOYER BRAND MANAGEMENT There were also considerable gaps between student aspirations and five areas in which the banking industry was generally felt to be particularly lacking: A creative and dynamic working environment A friendly work environment Secure employment Innovation Flexible working conditions. . In summary, banks are generally perceived to pay well, provide a solid start to a career and challenging work, but they are also felt to be poor at developing people, uncreative, unfriendly and inflexible. When it comes to investment banks, the research suggested that they were generally associated with the same characteristics as banks as a whole, but to an even more extreme degree. In other words, investment banks pay more, but are even more insecure and unfriendly. If you are managing the employer brand of a bank, and this reflects what your employ- ees are telling you, then you're likely to be providing a fairly generic employment expe- rience. To compete more effectively for future banking talent you need to change. If, on the other hand, your employee research suggests you are strong in those areas where the industry as a whole is perceived to be weak, you need to communicate. While I have focused on a high profile sector, banking is not the only industry suffer- ing from a mismatch between career aspirations and relatively poor generic associations, or finding itself losing ground in terms of overall attractiveness to other competing indus- tries. Despite the financial crisis, the average bank fell only five places out of Universum's normalized group of 100 employers during the five-year period leading up to 2013. Over the same period 'Engineering & Manufacturing' fell ten places. The authors of the 2008 Deloitte report, Managing the Talent Crisis in Global Manufacturing, put much of this down to the sector's generally negative public image.' As they commented: 'A central problem for manufacturers in attracting talent is a lack of confi- dence in the future of manufacturing because it is perceived as a stagnat- ing industry. The perception arises from the reality that many manufacturers are shedding production workers in large numbers.' The report goes on to say that these workforce reductions have in many cases been driven by increases in productivity and a shift to higher-skilled labour. However, these reasons are generally lost in the debate. It is therefore not surprising that Generation Y workers are generally reluctant to pursue careers in the manufacturing industry. (b) Competitor analysis Company vs start-up? The first question to consider in terms of competition is whether your target talent wants to work for an established company at all: 70% of the young talent participating REPUTATION AND ATTRACTION 85 in Deloitte's Millennial Survey claimed they might reject 'traditional organizations in favour of a more independent entrepreneurial route to career success. Over the last decade, the poster boys and girls of international business success have tended to be the people who have started up new companies rather than established captains of industry. Mark Zuckerberg set up Facebook in 2004. A decade later, his annual salary may only be $1, but his net worth has been calculated at somewhere close to $20 billion. Sean Parker, who founded the file sharing site, Napster, before joining to become Facebook's first president, allegedly spent $10 million on his wedding celebrations. These are the kind of people who spawn legends, films and aspirations among the most highly tal- ented wannabees of the early twenty-first century. And it's not just a US phenomenon. In China, there are similar young entrepreneurial success stories. Robin Li who founded Baidu, China's leading search engine, in 2000 when he was 32, is now believed to be the country's richest man, with a net worth of more than $12.2bn. He made $4.8bn in 2013 alone. Ma Huateng, the fourth richest man in China, founded the Internet company Ten- cent in 1998, when he was 17.3 There are similar young entrepreneurial success stories in India, including Sridhar Vembu, founder of Zoho, who has built a highly profitable, rapidly growing company, currently generating over $ 200 million per year in revenue, with zero outside financing 14, 15 The same is also true in Brazil where, according to the Global Entrepreneurial Monitor, published in 2012, one in six adults is either trying to launch a business or is the owner of a new venture less than 42 months old. Nevermind the fact that research suggests that four in every five start-ups fail within 5 years and less than 1 in 20 survives beyond a decade. The entrepreneurial dream is strong, especially amongst the young In a global survey conducted in early 2008 among 2277 students from 114 countries, the number one career choice (drawing over 50% of the total vote) was running 'my own business'. 18 The more recent student survey data from Universum is not quite so extreme. Nevertheless, up to 1 in 4 students in some leading markets, claim a preference for working for a start-up or starting their own business, rather than joining a major corporation, with particularly high levels in the UK, India, Russia, Mexico and Turkey. 19 The implications are fairly obvious. As discussed in Chapter 6, for organizations to attract the kind of motivated, digitally savvy and creative people they need to compete in a super-charged knowledge economy, they need replicate more of the qualities that make start-ups so attractive to talented young people. Forbes magazine recently listed 10 reasons why recent graduates are attracted to start-ups:20 1. You can have an impact. Start-ups provide the opportunity to reach individuals and change people's lives in a tangible way. 2. You will learn a lot, and you will learn it quickly. Start-ups provide a unique environment to apprentice, since you can observe CEOs at work in close quarters. 3. You can work with your peers. Many start-up employees are relatively young, which can lead to social benefits. 4. You will see results, fast. In a start-up with its ear to the ground, customer feed- back comes quickly. 5. Start-ups have a flat structure. Many start-ups tend to avoid the hierarchical structure of big companies. 86 EMPLOYER BRAND MANAGEMENT 6. It's a meritocracy. Start-ups can offer opportunities for success regardless of age and experience. 7. You can work flexible hours. At a start-up, chances are you won't be working 9-5. Hours tend to be flexible, especially if you are your own boss. And, when you're passionate about what you do, you won't mind staying late. 8. Chances are, your office will be pretty cool. Many start-up offices have free snacks and drinks, as well as decor designed to get the creative juices flowing - think standing desks and beanbags. Others offer workout rooms or music centres. 9. If not now, when? As a recent grad, you likely do not have dependents, nor do you have an established career that is difficult to leave. If your start-up does fail, you have a minimal amount to lose. 10. Graduate school is not going anywhere. Few start-ups demand formal qualifica- tions. Why sit in a classroom for 100 hours a week when you can earn and learn at the same time? These highly attractive qualities are widely associated with start-up companies, and many leading employers are beginning to adapt their employment practices to ensure they can compete not only with other companies like themselves, but also with the start- ups who are fast depleting their potential talent pools. Analysing your competitive set Among those people who are considering established companies as well as start-ups, it's important to identify who your leading competitors for talent are, and how you compare in term of relative appeal and brand image associations. The kind of organi- zations you will be competing with will clearly vary according to your target group. If you're looking for sales people or marketers, the consideration set is likely to be far broader than if you're targeting people requiring specific knowledge or experi- ence within your industry. In the former case you may need to identify who the best marketing employers are, and what they are offering, in order to compete effectively. In the latter case, there are now some highly objective sources of data you can draw on to identify your primary industry competitors. LinkedIn's Talent Flow Analy- sis (Figure 8.3) enables your organization to identify the organizations with whom you're most active in trading talent. The following provides an illustration of how the analysis works. (c) Attraction Graduate attraction factors Universum's Global Student Survey provides some interesting insights into what Gen Y/Millenials in different parts of the world are looking for in their careers. The leading answer by far, among both business and engineering students, is work life balance. This answer was also highly consistent across all the major markets except Russia, where REPUTATION AND ATTRACTION 87 Company A -2314 2067 B -1741 2430 -1831 2208 D -1488 2046 E -675 3395 F -1637 1755 G -1031 1923 H -1723 1225 J -1208 1699 -1527 1305 L -1454 1249 -4000 M -946 1067 -3000 -2000 -1000 0 1000 2000 3000 Hiring Flows (Black = 'Departures to', Light grey = 'Hires from') 4000 Figure 8.3 Talent flow analysis. Source: Anonymized adaption of LinkedIn Talent Flow Analysis Hiring Flows (Black = 'Departures to Light grey = "Hires from') stability is rated higher, and also the desire for intellectual challenge among business students, and functional/technical expertise among engineers. Whether this is a recent trend or a longstanding desire among students not to lose themselves' in work is open to debate, but the desire to find an employer that shows respect for people's personal lives and enables a degree of flexibility is widespread. The desire for security and stability in my job' is the second most desired quality across most markets. This has naturally grown in importance since the econ down- turn as student unemployment has risen in many markets (including the still relatively fast growing markets of China and India). This is likely to be a somewhat polarizing question, especially in emerging markets, as rates of attrition among employees joining from university in many of these markets have also been persistently high. This suggests that the more talented end of the graduate spectrum takes a rather more confident and promiscuous approach to their early working lives. The markets least concerned with job security were France (where job security is government regulated) and Brazil, which has a highly entrepreneurial streak. The biggest difference between business students and engineering students is their relative desire to be a leader/manager of people. This is more highly prized among busi- ness students than engineers, whose preference for intellectual challenge, innovation and technical expertise outweighs their interest in leadership (Table 8.1 and Table 8.2). 88 EMPLOYER BRAND MANAGEMENT Table 8.1 Student career goals From the following list of 9 career goals, which are the most important to you? (Maximum of three) Business Students (2013) me Global % USA % UK % FR % GER % 1 49 61 43 57 55 2 39 57 37 28 44 3 34 38 31 34 35 4 33 32 33 37 35 5 To have work/life balance To be secure or stable in my job To be a leader or manager of people To be competitively or intellec- tually challenged To have an international career To be entrepreneurial or creative/innovative To be dedicated to a cause/ / serve a greater good To be autonomous or independent 32 20 35 47 27 6 32 29 29 28 27 7 21 32 18 27 13 8 18 12 13 21 21 9 12 7 13 10 9 To be a technical or functional expert Engineering Students (2013) Global ( % USA % UK % FR % GER % 1 To have work/life balance 49 60 41 62 48 2 39 51 37 32 49 3 31 38 32 33 29 4 29 30 23 27 24 To be secure or stable in my job To be competitively or intellec- tually challenged To be entrepreneurial or creative/innovative To be a technical or functional expert To be a leader or manager of people 5 28 23 30 17 29 6 26 26 22 31 29 7 To have an international career 25 13 24 35 19 8 24 39 21 34 15 To be dedicated to a cause/ serve a greater good To be autonomous or independent 9 16 9 9 14 15 17 Source: Universum Global Student Survey (2013) REPUTATION AND ATTRACTION 89 Table 8.2 Student career goals (BRIC) From the following list of 9 career goals, which are the most important to you? (Maximum of three) Business Students (2013) Global Brazil Russia India % % % % India China % 49 55 35 34 41 39 34 46 34 34 34 39 24 32 32 33 33 45 18 22 32 33 25 33 26 1 To have work/life balance 2 To be secure or stable in my job 3 To be a leader or manager of people 4 To be competitively or intellectu- ally challenged 5 To have an international career 6 To be entrepreneurial or creative/ innovative 7 To be dedicated to a cause/serve a greater good 8 To be autonomous or independent 9 To be a technical or functional expert 32 43 22 26 24 21 31 20 16 17 22 18 11 27 25 12 11 27 19 12 Engineering Students (2013) Global Brazil Russia India % % % % China % 49 57 34 32 37 39 39 48 32 29 31 34 37 22 18 29 40 18 24 25 28 17 48 32 25 1 To have work/life balance 2 To be secure or stable in my job 3 To be competitively or intellectu- ally challenged 4 To be entrepreneurial or creative/ innovative 5 To be a technical or functional expert 6 To be a leader or manager of people 7 To have an international career 8 To be dedicated to a cause / / serve a greater good 9 To be autonomous or independent 26 32 21 29 28 25 31 19 29 19 24 32 20 17 16 16 9 26 19 22 Source: Universum Global Student Survey (2013) 90 EMPLOYER BRAND MANAGEMENT When it comes to the specifics of attraction between one employer and another, Universum asked students to rate four categories of attribute: corporate image; job characteristics; people and culture, and remuneration and advancement. The global highlights are as follows: More students selected 'high future earnings' as a top 3 attraction driver than 'clear advancement opportunities' (especially among engineering students). However, the top choice among both business and engineering students was a good reference for my future career', which suggests the status and 'tradability of the company brand name is a leading consideration. "Professional training and development' was the most important job characteristic among both business and engineering students, with challenging work' also rated highly among both groups. The top attraction driver among both groups from an organizational culture per- spective was 'a creative and dynamic work environment' (which is consistent with the growing appeal of smaller company/start-ups' noted earlier in this chapter). In terms of the overall corporate brand image, both rated 'market success' and 'interest- ing/exciting products and services' highly. However, engineering students rated 'inno- vation' more highly as an attraction factor than business students (Table 8.3). A more detailed breakdown of this data by market is provided in the appendices. You'll note that I have not devoted a great deal of space to the changing overall needs of Gen Y and Millenials. There have been numerous reports over recent years claiming that the latest generations to enter the workplace are impatient to be heard and make progress in their careers. We've been told that they are frustrated by the slow pace of technological change within their organizations, that they prefer openness and meritocracy to hierarchy and control, and that they want to work for companies that make a difference in the world. Are any of these findings really that surprising? These have always been the perennial qualities and aspirations of youth to which every business needs to adapt to maintain relevance and vitality. The technology and modes of expression may change but the cycle remains the same. If this sounds too skeptical, forgive me, I'm Gen X. General attraction drivers There are a number of sources for attraction data among mid-career employees. The two most comprehensive are Towers Watson's Global Workforce Study (Table 8.4) and the Corporate Executive Board's more continuous Quarterly Global Workforce Benchmark Report. The Corporate Executive Board's Global Workforce Survey corroborates Towers Watson's findings that compensation and job security are the two predominant drivers of attraction. However, they also include a couple of additional high ranking factors that do not appear in Towers Watson's research. CEB's research suggests that 'Work-life balance' is the second most desired characteristic of desired employers. They also stress the high importance of respect', which appears fourth on their list of the most desirable features of future employers. Table 8.3 Global student ranking of attraction factors (Universum 2013) BIZ ENG BIZ ENG % People & Culture % % 29 43 47 34 39 43 38 44 40 29 35 36 35 31 Corporate Reputation & Image Market Success Attractive/exciting products and services Innovation Financial strength Inspiring management Prestige Fast-growing/entrepreneurial Corporate social responsibility Ethical standards Environmental sustainability Job Characteristics %%WWE 23 25 A creative and dynamic work environment Leaders who will support my development A friendly work environment Respect for its people Recognizing performance (meritocracy) Interaction with international clients & colleagues Enabling me to integrate personal interests Recruiting only the best talent Support for gender equality Acceptance towards minorities Remuneration & Advancement 28 24 20 24 26 17 13 13 21 11 11 24 6 7 REPUTATION AND ATTRACTION 43 43 40 46 35 30 36 31 35 36 36 34 35 36 31 34 26 Professional training and development Opportunities for international travel/relocation Challenging work Secure employment Variety of assignments Flexible working conditions Team oriented work High level of responsibility Client interaction Control over my number of working hours 27 24 Good reference for future career Leadership opportunities High future earnings Competitive base salary Clear path for advancement Sponsorship of future education Competitive benefits Performance-related bonus Rapid promotion Overtime pay/compensation 30 25 26 27 24 21 25 20 19 21 19 17 18 17 15 11 16 13 15 14 15 91 92 Table 8.4 Global attraction drivers (in rank order) (Top 5 highlighted) Global USA UK FR GER Brazil Russia India China 1 1 1 2 1 1 3 2 2 3 7 1 3 15 1 3 No 3 2 on W 6 4 N0 W 4 2 2 4 5 10 5 3 7 5 6 4 5 9 2 5 4 6 8 6 4 4 8 14 6 Base pay/salary Job security Opportunities to advance in my career Convenience of work location Opportunities to learn new skills Challenging work Employer Reputation Vacation/paid time off Health care and wellness benefits Flexible work arrangements High level of job autonomy Organization's mission, vision and values Source: Towers Watson 'Global Workforce Survey' (2012) EMPLOYER BRAND MANAGEMENT 7 4 7 7 6 8 5 13 8 9 8 12 11 9 2 19 11 9 7 23 + 0 0 F N 00 18 26 7 10 18 6 10 10 9 11 8 16 9 10 22 1 2 11 14 11 2 3 15 19 14 21 12 11 12 8 17 11 22 0 14 REPUTATION AND ATTRACTION 93 As you can see, the global patterns of attraction reported from mid-career employees are broadly similar to the findings reported among students. Compensation/base salary is the most frequently mentioned attraction factor in both studies. When you consider how fundamental this factor is in choosing a new employer (most people expect a salary rise when they move jobs) it is no surprise that so many people include it when asked to select their top five. In many respects it's more surprising to consider how many people decide not to select this factor. For example, in the US CEB study, while compensation is the most cited attraction driver, it was only chosen by 49% of the survey participants. One of the most obvious conclusions to be drawn from this data is that India and China may both be fast emerging economies, but the factors driving attraction are very different. Chinese employees are far more focused on compensation than their counter- parts in India. They are also less concerned about job stability and security. LinkedIn's Global Talent Trends Survey22 suggests some interesting differences between active and passive candidates, with the former more turned on by opportunities for advancement than better compensation and benefits, and more geared to challenging work than work-life balance. This would suggest that frustration with current employ- ers tends to be more characterized by lack of opportunity to shine than a lack of entitle- ment. This should be interpreted as a highly positive sign in terms of economic growth. While these overall global findings provide a broad foundation for understanding employee attraction drivers, it's important for organizations to understand the interplay of factors relating to their specific target profile and talent segments. ASSESSING YOUR EXTERNAL REPUTATION The five most common ways of assessing your external employer reputation and attrac- tion factors are: Corporate reputation surveys Student surveys (e.g. Universum/Trendence) ienced hire surveys (quantitative and qualitative) New joiner surveys Social Reputation Audit. (a) Corporate Reputation Surveys A number of companies run regular external surveys to assess their overall corporate reputation among key stakeholder groups. This typically includes a number of questions relating to the organization's reputation as an employer. (b) Student Surveys This is undoubtedly the most common source of external reputation data among leading multinationals. The leading global player in this field is Universum, with Trendence 94 EMPLOYER BRAND MANAGEMENT offering similar services in Europe and Asia. The benefit of these surveys is that they provide robust data on brand associations among those students that are familiar with your organization. They also provide a means of comparing this with attraction drivers, and degrees of consideration and preference. (For more detail on the image dimensions tracked by each company, see the box below.) (c) Experienced Hire Surveys Establishing your reputation among non-student groups tends to be more difficult. Once people have started work they naturally tend to have less time and interest in completing surveys. While it's possible to run online surveys, they are more prone to sampling error, since the people with time on their hands are not necessarily the peo- ple you most want to be hearing from. The alternative method is to take a much more targeted approach, using your own database of potential candidates, your search agen- cies or LinkedIn to identify potential research participants. Once identified, the three most typical approaches to this form of targeted research (from lowest to highest cost) are online surveys, online moderated discussions, and face-to-face focus groups. In our experience, the last of these options is only really worth considering if your organization is reasonably well known, but suffering from significant image problems that require detailed probing The other useful source of reputational information for mid-career professionals is to conduct a research exercise among whoever within or outside the organization is having most conversations with potential candidates. UNIVERSUM While restricted to student perceptions, Universum provides one of the few global sources of employer brand image data. The six main analyses from a reputation and attraction driver perspective (relative to key competitors) are: 1. Familiarity (do people know your organization?) 2. Consideration (Would they consider you as a potential employer?) 3. Desire (Do they regard you as an ideal potential employer?) 4. Application (Have they or will they apply?) 5. Drivers of employer attractiveness relating to broad disciplinary clusters) 6. Employer brand associations (versus competitors and relative attractiveness) (d) New Joiner Surveys These can provide an approximate indication of your external employer image,