Question: Course Name: Financial Management II Please answer correctly SECTION B Instruction: Complete ALL questions. Question 1 A. Use an example to explain the relationship among

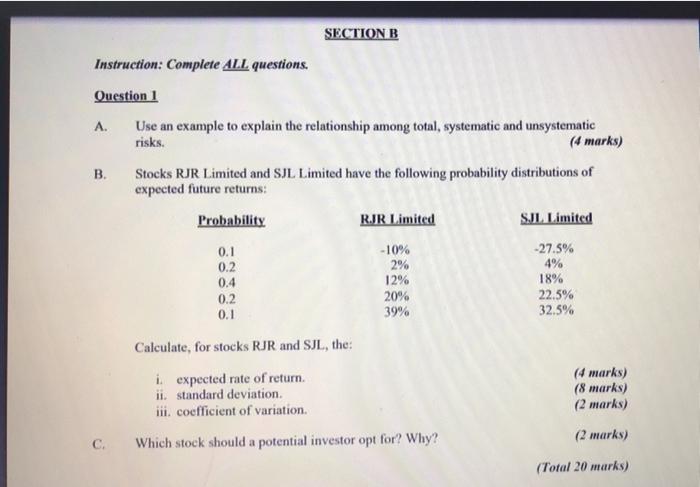

SECTION B Instruction: Complete ALL questions. Question 1 A. Use an example to explain the relationship among total, systematic and unsystematic (4 marks) risks. B. Stocks RJR Limited and SJL Limited have the following probability distributions of expected future returns: Probability RJR Limited SJL Limited 0.1 -10% -27.5% 0.2 2% 4% 0.4 12% 18% 0.2 20% 22.5% 0.1 39% 32.5% Calculate, for stocks RJR and SJL, the: i. expected rate of return. ii. standard deviation. iii. coefficient of variation. Which stock should a potential investor opt for? Why? C. (4 marks) (8 marks) (2 marks) (2 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts