Question: Course Name: Financial Management II SECTION A Instruction: Complete ALL questions. Caribbean Power Supply Limited has the following capital structure: i. Debt 40% ii. Preferred

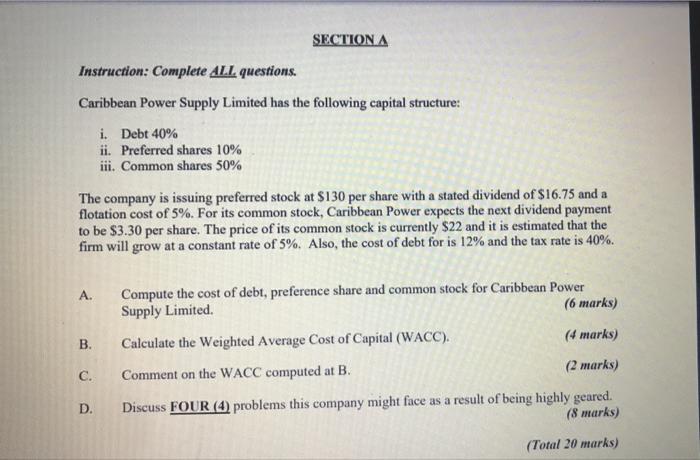

SECTION A Instruction: Complete ALL questions. Caribbean Power Supply Limited has the following capital structure: i. Debt 40% ii. Preferred shares 10% iii. Common shares 50% The company is issuing preferred stock at $130 per share with a stated dividend of $16.75 and a flotation cost of 5%. For its common stock, Caribbean Power expects the next dividend payment to be $3.30 per share. The price of its common stock is currently $22 and it is estimated that the firm will grow at a constant rate of 5%. Also, the cost of debt for is 12% and the tax rate is 40%. A. Compute the cost of debt, preference share and common stock for Caribbean Power Supply Limited. (6 marks) (4 marks) B. Calculate the Weighted Average Cost of Capital (WACC). (2 marks) C. Comment on the WACC computed at B. D. Discuss FOUR (4) problems this company might face as a result of being highly geared. (8 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts