Question: COURSES FACULTY SUPPORT UB ONLINE STUDENT ORIENTATIO Time left 0:20:41 M 7 of The firm's cost of debt is 9 percent, and the cost of

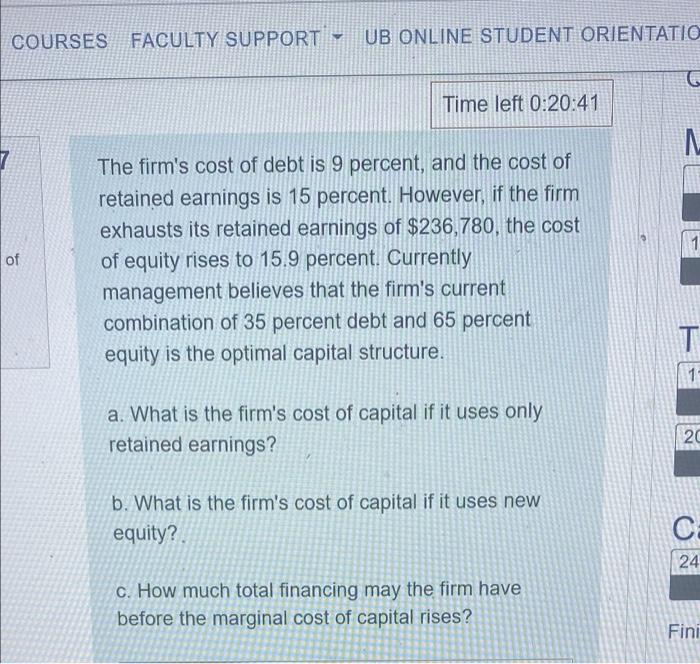

COURSES FACULTY SUPPORT UB ONLINE STUDENT ORIENTATIO Time left 0:20:41 M 7 of The firm's cost of debt is 9 percent, and the cost of retained earnings is 15 percent. However, if the firm exhausts its retained earnings of $236,780, the cost of equity rises to 15.9 percent. Currently management believes that the firm's current combination of 35 percent debt and 65 percent equity is the optimal capital structure. T 1 a. What is the firm's cost of capital if it uses only retained earnings? 20 b. What is the firm's cost of capital if it uses new equity? 24 c. How much total financing may the firm have before the marginal cost of capital rises? Fini

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts