Question: courses Which method will produce the highest values for work in process and finished goods inventories? Select one: O a. They produce the same values

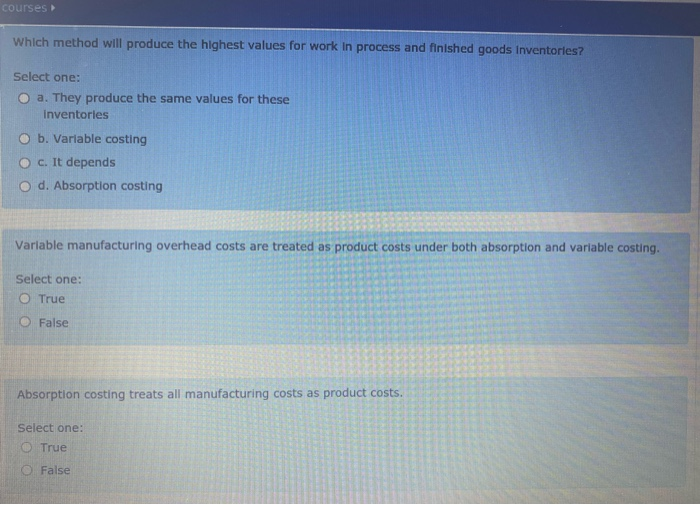

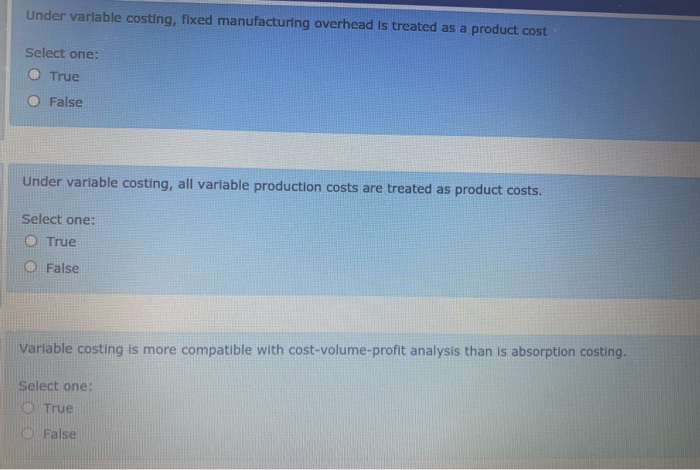

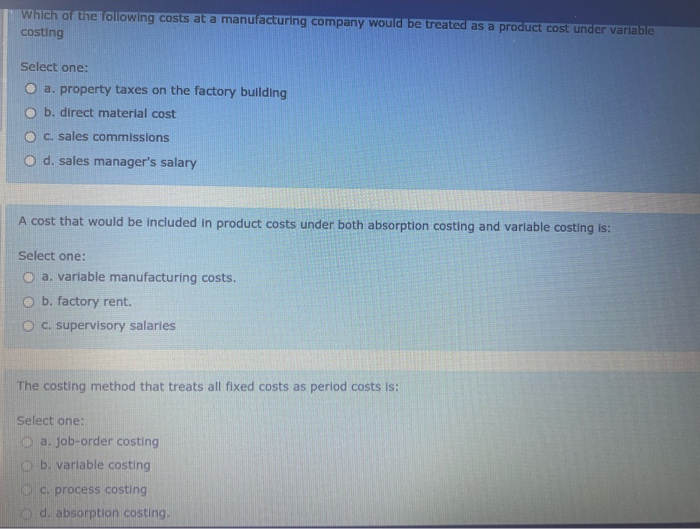

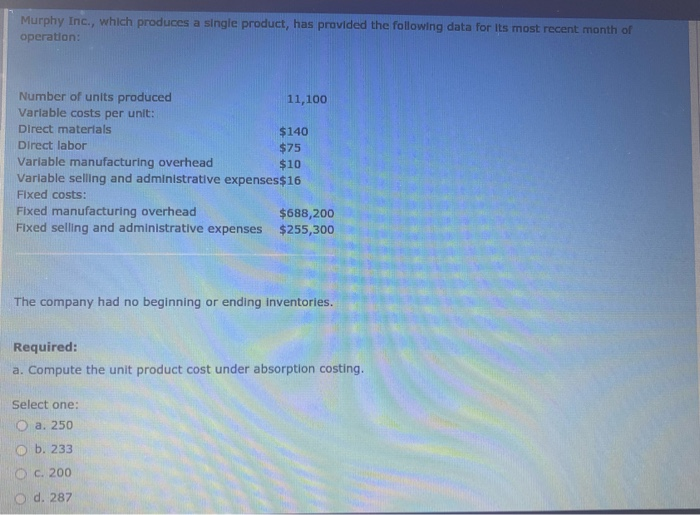

courses Which method will produce the highest values for work in process and finished goods inventories? Select one: O a. They produce the same values for these Inventories O b. Variable costing c. It depends O d. Absorption costing Variable manufacturing overhead costs are treated as product costs under both absorption and variable costing. Select one: O True False Absorption costing treats all manufacturing costs as product costs. Select one: True O False Under varlable costing, fixed manufacturing overhead is treated as a product cost Select one: True False Under variable costing, all variable production costs are treated as product costs. Select one: True False Variable costing is more compatible with cost-volume-profit analysis than is absorption costing. Select one: True False Which of the following costs at a manufacturing company would be treated as a product cost under variable costing Select one: a. property taxes on the factory building b. direct material cost c. sales commissions O d. sales manager's salary A cost that would be included in product costs under both absorption costing and variable costing is: Select one: O a. variable manufacturing costs. b. factory rent. O c. supervisory salaries The costing method that treats all fixed costs as period costs is: Select one: a. job-order costing b. variable costing c. process costing d. absorption costing Quates Corporation produces a single product and has the following cost structure: $ 27 $ 96 Number of units produced each year 3,000 Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead $ 1 Variable selling and administrative expenses$ 4 Fixed costs: Fixed manufacturing overhead $ 219,000 Fixed selling and administrative expenses $ 153,000 Required: Compute the unit product cost under absorption costing. Select one: O a. 150 b. 182 c. 270 d. 197 Murphy Inc., which produces a single product, has provided the following data for its most recent month of operation: Number of units produced 11,100 Variable costs per unit: Direct materials $140 Direct labor $75 Variable manufacturing overhead $10 Variable selling and administrative expenses $16 Fixed costs: Fixed manufacturing overhead $688,200 Fixed selling and administrative expenses $255,300 The company had no beginning or ending inventories. Required: a. Compute the unit product cost under absorption costing. Select one: a. 250 b. 233 OC. 200 d. 287

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts