Question: COURSEWORK QUESTION - INDIVIDUAL ASSIGNMENT This assignment requires student to use select one public listed company in Malaysia from the consumer non-durables sector from Bursa

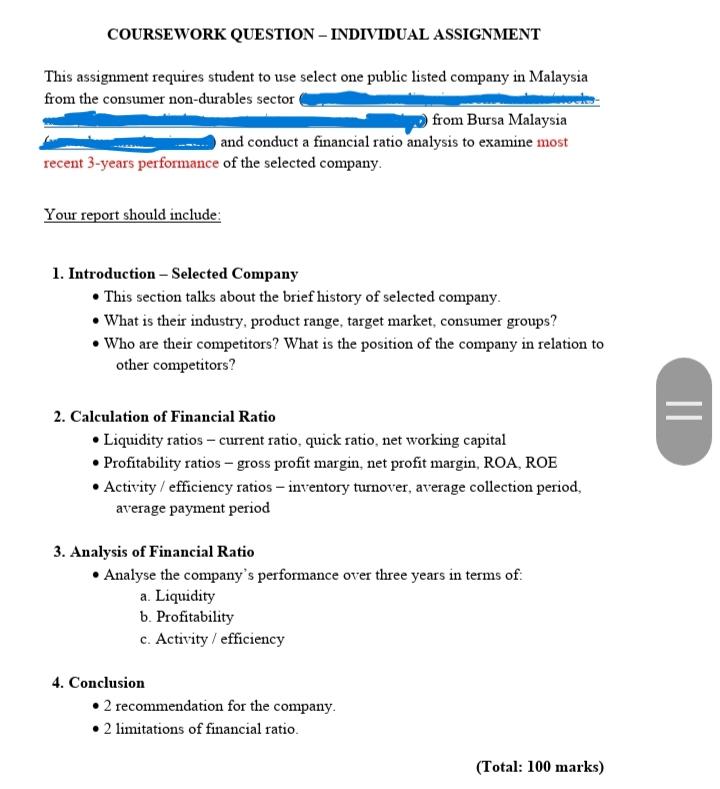

COURSEWORK QUESTION - INDIVIDUAL ASSIGNMENT This assignment requires student to use select one public listed company in Malaysia from the consumer non-durables sector from Bursa Malaysia and conduct a financial ratio analysis to examine most recent 3-years performance of the selected company. Your report should include: 1. Introduction - Selected Company This section talks about the brief history of selected company. What is their industry, product range, target market, consumer groups? Who are their competitors? What is the position of the company in relation to other competitors? 2. Calculation of Financial Ratio Liquidity ratios - current ratio, quick ratio, net working capital Profitability ratios - gross profit margin, net profit margin, ROA, ROE Activity / efficiency ratios - inventory tumover, average collection period, average payment period 3. Analysis of Financial Ratio Analyse the company's performance over three years in terms of: a Liquidity b. Profitability c. Activity/ efficiency 4. Conclusion 2 recommendation for the company. 2 limitations of financial ratio. (Total: 100 marks) COURSEWORK QUESTION - INDIVIDUAL ASSIGNMENT This assignment requires student to use select one public listed company in Malaysia from the consumer non-durables sector from Bursa Malaysia and conduct a financial ratio analysis to examine most recent 3-years performance of the selected company. Your report should include: 1. Introduction - Selected Company This section talks about the brief history of selected company. What is their industry, product range, target market, consumer groups? Who are their competitors? What is the position of the company in relation to other competitors? 2. Calculation of Financial Ratio Liquidity ratios - current ratio, quick ratio, net working capital Profitability ratios - gross profit margin, net profit margin, ROA, ROE Activity / efficiency ratios - inventory tumover, average collection period, average payment period 3. Analysis of Financial Ratio Analyse the company's performance over three years in terms of: a Liquidity b. Profitability c. Activity/ efficiency 4. Conclusion 2 recommendation for the company. 2 limitations of financial ratio. (Total: 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts