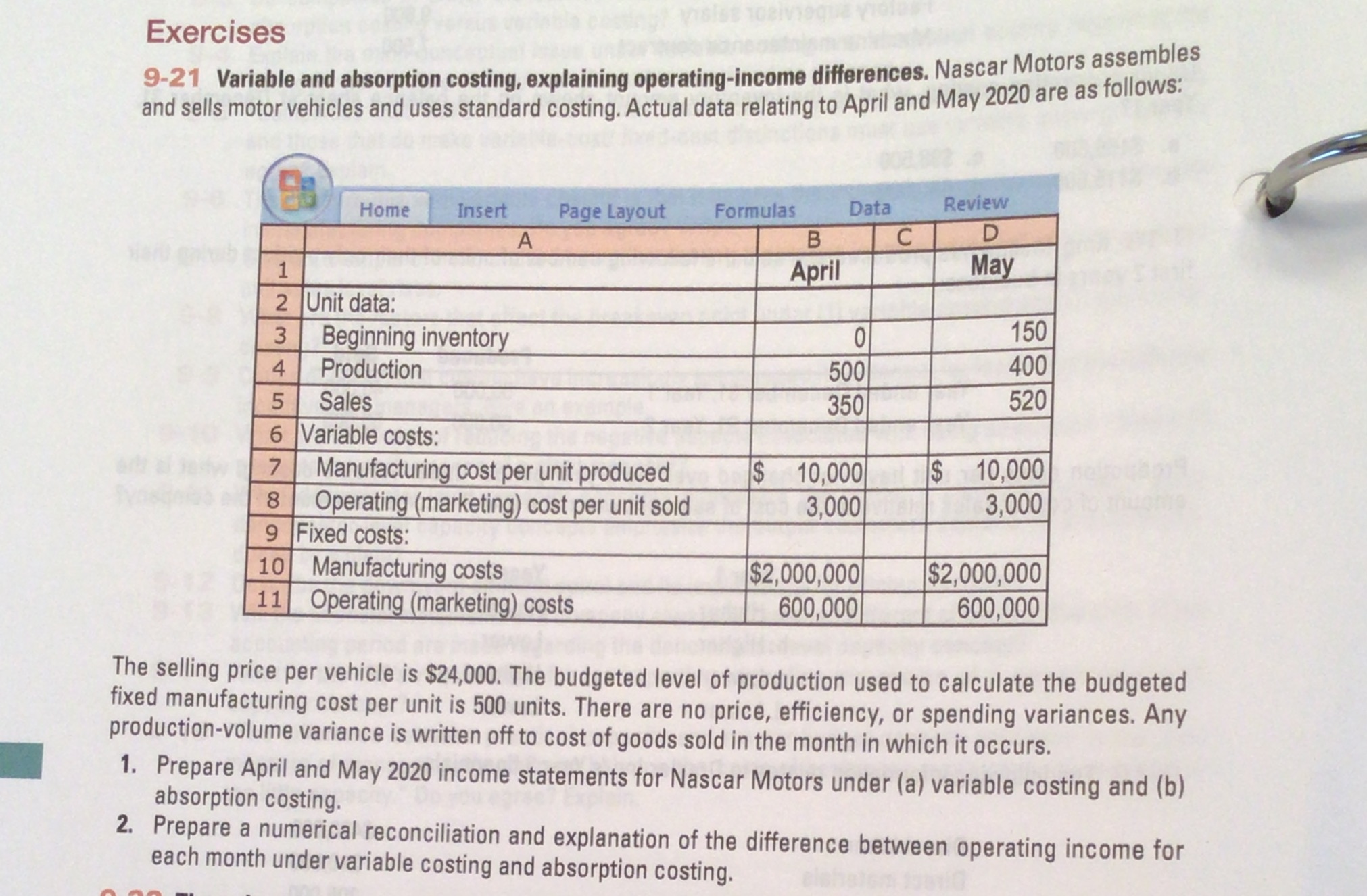

Question: CoursHeroTranscribedText: Exercises 9-21 Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to

CoursHeroTranscribedText: Exercises 9-21 Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2020 are as follows: Home Insert Page Layout Formulas Data Review A B C D 1 April May 2 Unit data: 3 Beginning inventory 0 150 4 Production 500 400 5 Sales 350 520 6 Variable costs: 7 Manufacturing cost per unit produced $ 10,000 $ 10,000 8 Operating (marketing) cost per unit sold 3,000 3,000 9 Fixed costs: 10 Manufacturing costs $2,000,000 $2,000,000 11 Operating (marketing) costs 600,000 600,000 The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. 1. Prepare April and May 2020 income statements for Nascar Motors under (a) variable costing and (b) absorption costing. 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts