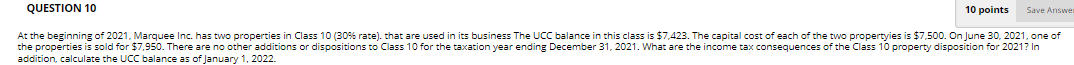

Question: CoursHeroTranscribedText: QUESTION 10 10 points Save Answer At the beginning of 2021, Marquee Inc. has two properties in Class 10 (30%% rate). that are used

CoursHeroTranscribedText: QUESTION 10 10 points Save Answer At the beginning of 2021, Marquee Inc. has two properties in Class 10 (30%% rate). that are used in its business The UCC balance in this class is $7,423. The capital cost of each of the two propertyies is $7,500. On June 30, 2021, one of the properties is sold for $7,950. There are no other additions or dispositions to Class 10 for the taxation year ending December 31, 2021. What are the income tax consequences of the Class 10 property disposition for 2021? In tion, calculate the balance as of January 1, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts