Question: 5 Question 42 (2.5 points) Consider a put option that gives the long position the right to sell the underlying asset for $12.34 in

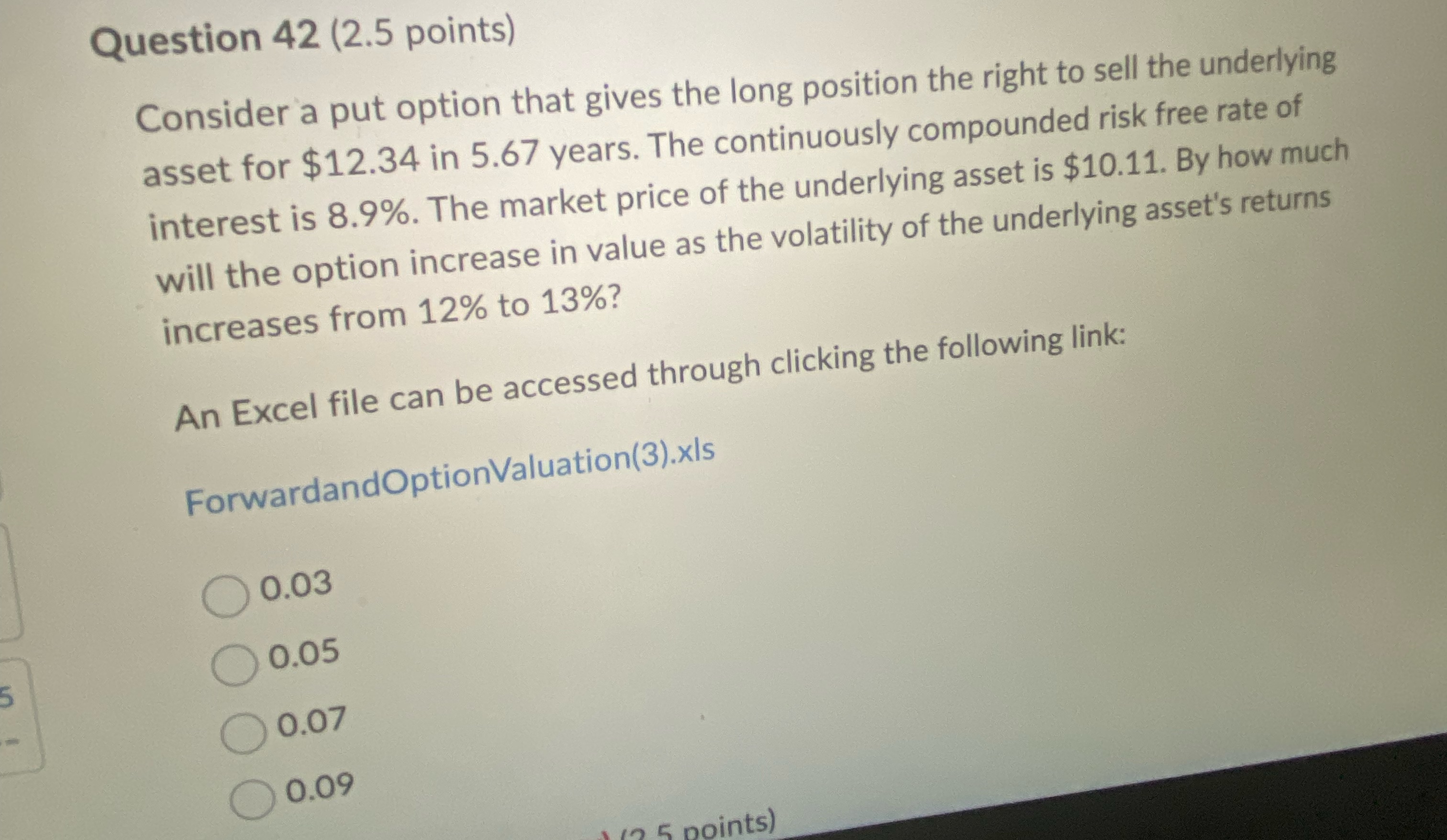

5 Question 42 (2.5 points) Consider a put option that gives the long position the right to sell the underlying asset for $12.34 in 5.67 years. The continuously compounded risk free rate of interest is 8.9%. The market price of the underlying asset is $10.11. By how much will the option increase in value as the volatility of the underlying asset's returns increases from 12% to 13%? An Excel file can be accessed through clicking the following link: ForwardandOptionValuation (3).xls O 0.03 O 0.05 O 0.07 O 0.09 ) (3 5 points)

Step by Step Solution

There are 3 Steps involved in it

Given Put option strike price 1234 Time to expiration 567 years Risk free rate 89 continuo... View full answer

Get step-by-step solutions from verified subject matter experts