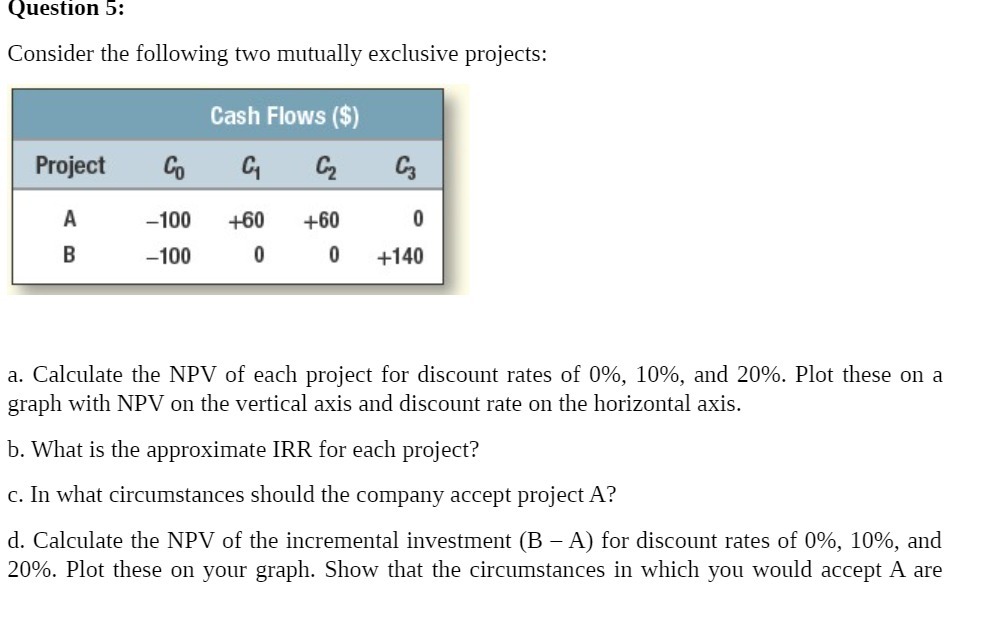

Question: CoursHeroTranscribedText: Question 5: Consider the following two mutually exclusive projects: Cash Flows (1'5) a. Calculate the NPV of each project for discount rates of 0%,

CoursHeroTranscribedText: Question 5: Consider the following two mutually exclusive projects: Cash Flows (1'5) a. Calculate the NPV of each project for discount rates of 0%, 10%, and 20%. Plot these on a graph with NPV on the vertical axis and discount rate on the horizontal axis. b. What is the approximate IRR for each project? c. In what circumstances should the company accept project A? d. Calculate the NPV of the incremental investment (B A) for discount rates of 0%, 10%, and 20%. Plot these on your graph. Show that the circumstances in which you would accept A are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts